2021 is finally here. Despite the pandemic-induced disruption that defined 2020, the Open Banking movement was already rewriting retail finance’s operating rules.

Driven by the newly-enacted PSD2, banks, lenders, consumers, and retailers across Europe got their taste of continent-wide Open Banking in action.

Now, as we enter into the second year of the landmark directive, we wanted to quickly take stock of where we are while looking at what’s next for Open Banking in 2021, both in Europe and beyond.

👉 You may like: ¿What is Open Banking?

The evolving regulatory landscape

Laws, directives, and regulations are driving the Open Banking movement across Europe and one. Here what we’re watching for next year.

PSD2

In the fall of 2019, PSD2 went live, officially liberating financial data from European banks. Despite the fanfare, the rollout wasn’t without its bumps.

As guardians of valuable financial data, many banks released the bare minimum APIs, hoping to stay out of regulatory trouble but keeping their market share.

Then, when the pandemic hit, consumer spending habits suddenly went digital. With it, new use cases for Open Banking emerged.

Now, with changing consumer trends, will the EU look to either improve or tweak the directive? Or will they force banks that complied “in name only” to up their offer or even enforce greater compliance?

Strong Customer Authentication

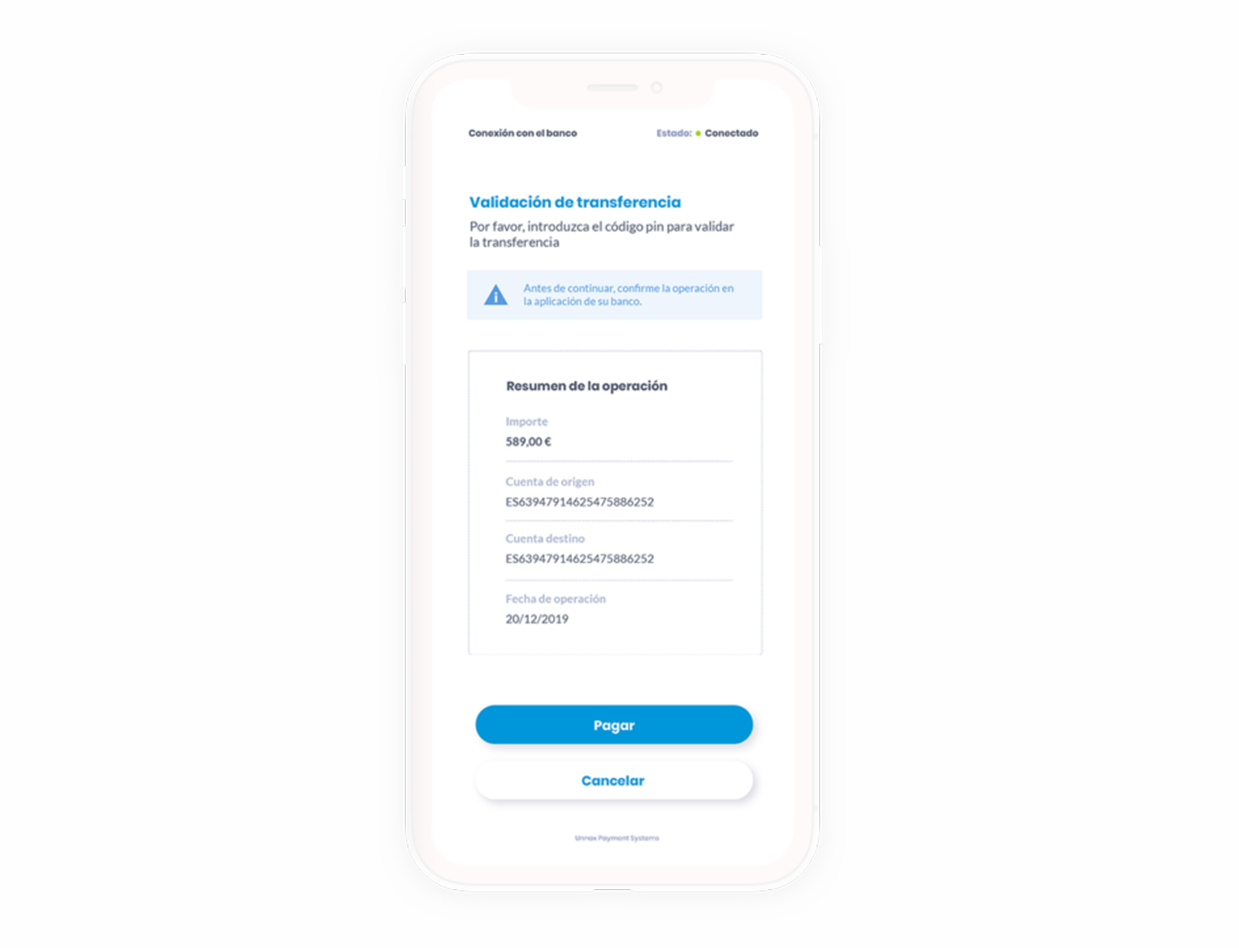

Strong customer authentication (SCA) PSD2’s security lynchpin. In short, customers using an Open Banking-powered product must validate their identity with two of the following three things:

- Knowledge (like a pin code)

- Possession (such as a smartphone with an app)

- Inheritance (i.e., a fingerprint)

Implementing SCA is proving to be a headache for many providers and certain sectors developing digital sales channels.

The troubles notwithstanding, on January 1st, 2021, SCA will come into force for all online transactions involving a payment card in the EU (with a mid-March deadline for UK-based firms).

As of this writing, the majority of banks across Europe aren’t ready for SCA. How they and the regulators react to this new reality will dominate industry news as we start the new year.

3DS2

Visa and MasterCard’s 3DS2 payment authentication platform went live in March of 2020. This protocol is SCA-compliant out of the box, which many payment providers will welcome.

However, 3DS2 verification can harm user experience, leading to high shopping cart abandonment rates. Will merchants accept this risk as a cost of doing business, or will they adopt other payment methods that securely bypass SCA?

Outside of Europe

Open Banking isn’t confined to the EU. As one of its leading pioneers, the UK will continue to push the movement, particularly when it officially leaves the EU.

Other nations, including India, Canada, and a host of Latin American countries, are rolling out similar regulations to PSD2. Finally, with the Biden administration taking office in January, the United States could see a more regulated Open Banking approach.

Payments

Open Banking’s payment initiation function benefited the most from 2020’s disruption. With the formidable shift to online shopping, merchants and consumers both put heavy demands on payment providers.

Thanks to payment initiation, online shoppers can now pay directly from their bank account at checkout. Here, merchants avoid expensive card networks and the abandonment risks associated with 3DS2 authentication. Instead, payments clear securely between financial institutions using APIs and an Open Banking provider.

Direct bank transfers are one of the biggest use-cases for payment initiation. In the future, it will be up to both merchants and users to realize its value as a viable alternative to card payments.

Banking-as-a-Service becoming more mainstream

Many companies want to offer banking products to their customers. Most of them lack a banking license to do so. Enter Banking-as-a-Service (BaaS).

BaaS enables non-financial companies to offer banking services through a regulated third party using Open Banking-style APIs. Here, companies in the gig economy, e-commerce, travel, and beyond offer services such as lending, e-wallets, and payments to their users embedded directly into their platforms.

In addition to generating valuable financial data from users, BaaS will help companies further build their brand, create communities, and, most importantly, enhance their overall user experience. While still novel, the rise of BaaS into the mainstream could be the biggest surprise story in the coming year.

The exciting road ahead for Open Banking

Since the Open Banking movement started, financial services have continued to become more open and innovative. After the first full year of PSD2, it’s clear that, despite the progress made, there’s still plenty of work to do. Even within the EU, there are wide discrepancies in implementation.

Conversely, these shortcomings offer an unprecedented amount of opportunity for financial innovation. For companies looking to take advantage of the moment, it’s imperative to work with an Open Banking provider fully-licensed to offer a wide range of financial services. In doing so, innovation not only becomes possible but also nearly effortless. Ignoring Open Banking’s transformative potential could prove disastrous in 2021.