Open Banking has been called the financial revolution of the decade.

And yet, most people would stare at you blankly if you mentioned “Open Banking”. In fact, some would be concerned — isn’t banking supposed to be private?

Open Banking is our bread and butter at Unnax, so to remedy this we decided to put together an in-depth explainer of what Open Banking means and how it will affect the world of finance as more companies and financial institutions engage with PSD2 across Europe. If you have questions on Open Banking, hopefully, this piece will answer them.

- What is Open Banking?

- Principles or objectives

- How does it work?

- AISPs and PISPs

- The approval and implementation of PSD2

- Directives around the world

- Open Banking beyond Europe

- The benefits of Open Banking for the user

- Users’ security above all

- Use cases and industries

- Applications and products

- Open banking vs Open finance

- The future of Open Banking

¿What is Open Banking?

The concept of Open Banking comes from the idea of “open innovation”, a term promoted by Henry Chesbrough in 2005 which has strong links with the changes in the attitude towards data ownership, which crystallized into the GDPR and the Open Data movement.

The Open Data movement refers to the idea that certain types of data should be available for everyone, without copyright restrictions, patents, or other control mechanisms.

Open Banking is an extension of this idea. The premise is that personal banking data should be more accessible so that companies and individuals can leverage it in different ways to provide better services and offer more benefits to customers.

To adapt to this new reality, promote competition on the market, and promote Open Banking, the European Union passed a new directive on financial payments in 2015, PSD2, updating the legislation from 2009.

Principles or objectives

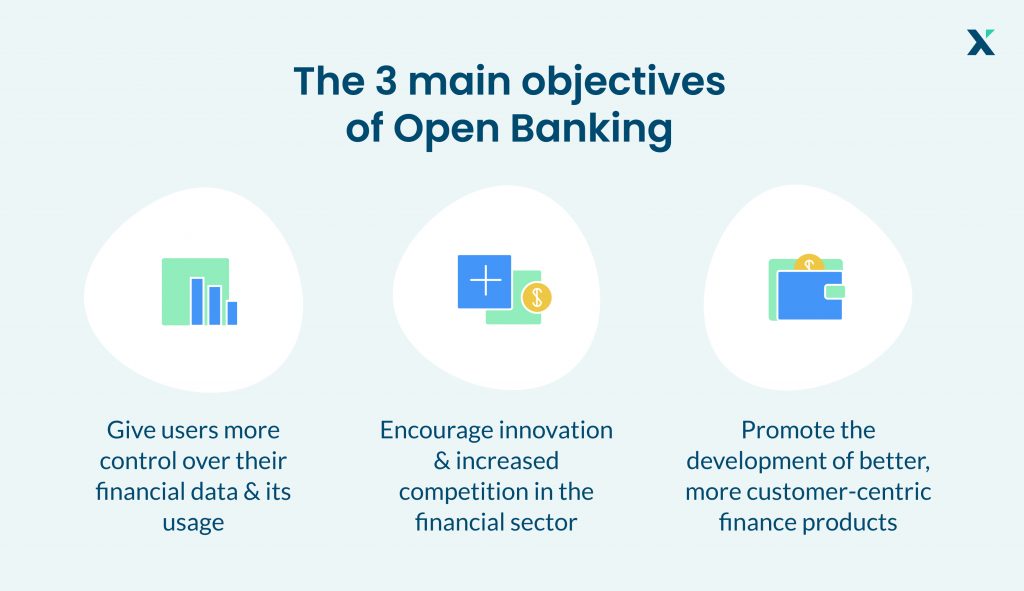

What are the main principles or objectives of Open Banking and PSD2?

Here are some of them:

Enable the customer to be in control

For most of history, financial customer data has sat in the hands of banks and financial institutions. This meant that customers kept most of their information in only one location and were unable to move it. Before the time of digital, this wasn’t such an issue.

But in today’s world of shareable information and data, customers are used to customer-centric applications, integrated accounts, and omnichannel experiences.

Open Banking is the first step towards digitizing financial data and enabling the customer to be in control of their data. With Open Banking, financial data can now be integrated with third-party applications and help build much more customer-centric financial products.

Encourage more competition amongst financial institutions or companies

Some banks and financial institutions have become complacent in the past few years. With new regulations and little competition, banks have stuck with their legacy systems, hierarchical structure, and out-of-date customer approach.

One of the main objectives of the PSD2 directive is to encourage more innovation in the financial space. By making customer data shareable with Open Banking, third parties can innovate and offer better consumer products, forcing banks to improve their own products as well, in order to keep customers engaged on their platform.

Improve customer products

Following on from the previous point, Open Banking will encourage a lot more innovation in the financial space.

Apart from the fact that banks will be innovating, it means that customers will be able to use new, vastly improved products. These range from personal finance management apps that help consumers manage their money better, to loan applications that offer results in minutes and release funds in under 24 hours.

¿How does it work?

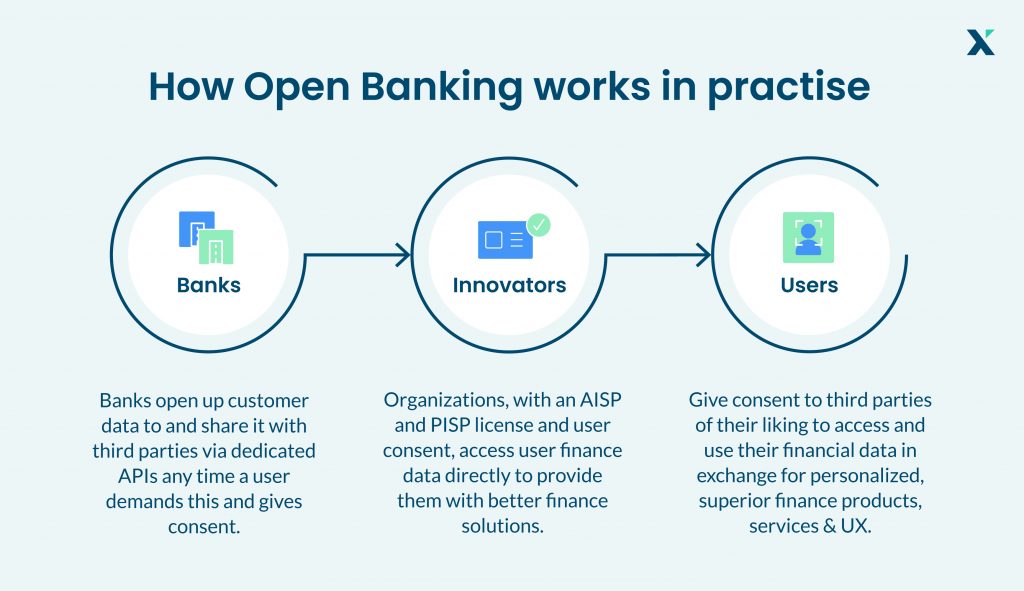

¿Who are the different players in the Open Banking space and what role do they play?

What the banks do

Following the implementation of PSD2, banks are now obliged to make their customer data shareable. That means that their customers’ data should be accessible via an API, which a licensed third party can then have access to.

Banks are currently working on their APIs, although some are moving faster than others. In the UK, the 9 large banks are all Open Banking compliant.

How you get registered

If you want direct access to your customers’ financial data, then you will need to get an AISP or PISP license. These can take up to a year to acquire and require rigorous regulation and compliance management.

Another easier, and better option is to instead partner with a financial company that already has all the licenses in place. Unnax, for example, has an AISP, PISP, and an EMI license — the only company in Spain to have all three. By partnering with us, you can connect with your customers’ data without having to acquire a license.

What the customer sees

What happens on the customer side? This depends on the action they are taking.

If they are pushing a payment via Open Banking, then they can make the transaction with an account to account payment instead of using their credit card. They would just need to pick their bank account from the list and complete payment in a few taps. These types of payments are especially suited to sectors with large ticket sizes such as travel, which many cards will block because of their built-in limits.

If it’s just account reading, then Open Banking allows them to view all their different bank balances on one screen. As a PFM or financial advisor, this can come in very handy.

Let’s dive a bit deeper into AISP and PISPs:

AISPs and PISPs

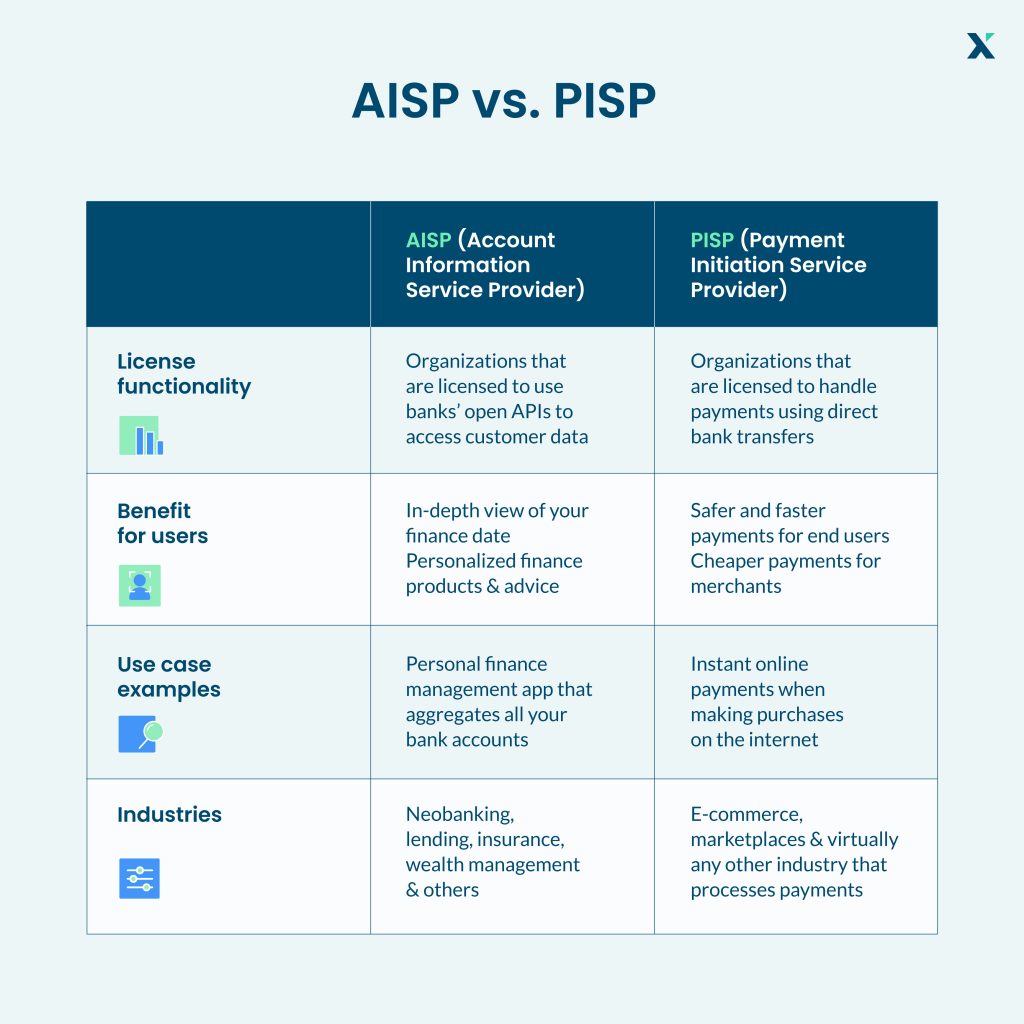

Probably the most important part of Open Banking is the two forms that third-party providers (TPPs) can take on under PSD2. These are AISPs and PISPs, which stand for Account Information Service Providers and Payment Initiation Service Providers, and are the two legally recognized figures that can provide certain services under the PSD2 framework.

As the name suggests, AISPs are organizations that are licensed to use banks’ open APIs to access customers’ banking data to provide different kinds of services. A common example is the well-known PFM mobile apps — personal financial managers.

These applications help people manage their finances better by reading their bank accounts, analyzing the data, and offering a more in-depth view of a person’s finances and personalized advice based on their individual needs.

PISPs are organizations that handle payments using direct bank transfers. They use the customer’s online banking credentials to issue a payment on their behalf directly from their own bank account with no middle step. This is a much simpler process than the traditional method where a customer submits their personal and payment data to a payment processor. The payment processor then submits a payment request to the customer’s bank for a payment to be issued, and the bank approves or rejects the request.

As such, the PISP-backed payment process has the advantage of being safer, faster, and less demanding of the customer. Instead of having to input all their personal information or facilitate their credit card details, this payment system allows customers to make a payment with only a user name and a password.

These services aren’t confined to the future — they’re already available on the market through services such as Unnax’s Account Aggregation and Payment Initiation APIs. Businesses aiming to upgrade their offerings with Open Banking technology can already do so with tools like these.

The approval and implementation of PSD2

In October 2015, the European Parliament passed the European Payment Services Directive, otherwise known as PSD2. This new regulation was passed with the goal of creating a single payments market, in line with the European Union’s goal of standardizing laws and regulations across Europe, and promoting innovation, competition, and greater efficiency in the online payments space. The law came into force for the 27 EU countries on 13 January 2018, with a transition period that ended in September 2019.

In 2020 and 2021, more European banks have been implementing APIs, with a big rise in third-party providers. In the UK, there are already 300 third-party providers involved in Open Banking.

Why is the UK so advanced when it comes to Open Banking? Let’s take a look.

Directives around the world

The United Kingdom, the leader in Open Banking

The United Kingdom is one of the European countries that is promoting Open Banking the most. In fact, one year after PSD2 was passed in 2015; the Competition and Markets Authority (CMA) issued a ruling that required nine of the largest banks in the UK (HSBC, Barclays, RBS, Santander, Bank of Ireland, Allied Irish Bank, Danske Bank, Lloyds, and Nationwide) to allow companies to access data from their transactions.

Under the scope of the UK Competition and Markets Authority (CMA), these banks created the Open Banking Implementation Entity (OBIE) to promote the opening up of financial data in the United Kingdom.

As such, British banks have been among the first to create open APIs that allow TPPs to access banking data. Meanwhile, the UK has also been a pioneer in issuing AISP and PISP accreditations to interested companies so that they can begin to operate under this new paradigm.

The British model in promoting Open Banking has been an inspiration for others, and many EU and non-EU states are now seeking to replicate it.

In 2021, more than 2.5 million UK customers now use Open Banking enabled products, and third-party API call volume increased from 66.8 million in 2018 to nearly 6 billion in 2020.

Open Banking beyond Europe

Australia

Australia is one of the countries that have taken the most inspiration from the British experience in implementing Open Banking. In this respect, the Australian Government issued a report with 50 suggestions related to the implementation of Open Banking. It set the first phase for large banks to open up their data in July 2019.

In July 2020, the first phase of Open Banking was launched in Australia and is called Consumer Data Right (CDR) with 71% of industry respondents planning to use it. Most believe it will take 3 to 5 years before most Australians are using Open Banking.

Canada

The Canadian Government has already sent out a report assessing how Open Banking should be introduced, which at the time of writing, has riled the main banking association. However, in recent months, it seems that the larger banks are starting to come round to the idea.

In 2021, Open Banking is not yet implemented in Canada but the government is still reviewing the safest way to roll it out.

Japan

The attitude of the Japanese Government regarding Open Banking is notable because of its discretion. However, PSD2 coming into force in Europe has led to the Amended Japanese Banking Act to request that banking institutions create APIs to collaborate with FinTech firms in the coming years.

Japan is 80% cash-based, which has made it difficult for the population to benefit from Open Banking. In 2020, 80 of the largest banks agreed to open up their APIs.

New Zealand

Open Banking has reached New Zealand through the Payments NZ association, and a test run in which all of the main banks in the country took part. This is an experience that draws inspiration from the UK initiative.

On a global scale, nine years ago an initiative was created to promote open-source code in order to develop the APIs necessary to implement Open Banking.

In 2020, the Payments NZ association announced the latest version of an API sandbox. With Covid, the rollout of Open Banking has slowed down but the regulation is still underway.

👉 Find out more: Open Banking Beyond Europe

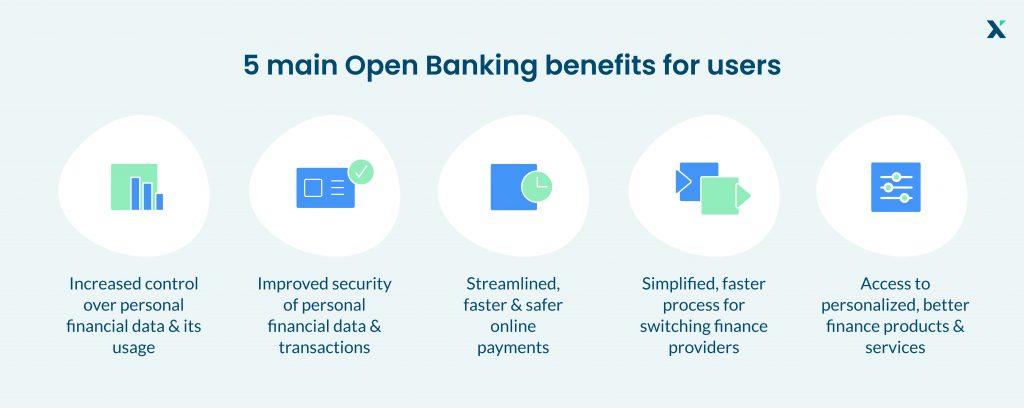

The benefits of Open Banking for the user

In practice, Open Banking disintermediates payment services and banking data access. Instead of payments being processed by a payment services provider, Open Banking enables payments to go directly from consumer to business in real-time, and the same is true of obtention of banking data. This gives people greater control over their money and their personal data and allows companies to create better user experiences.

On the business side, increased access to banking data has the potential to make many business processes easier. With money movements and banking data obtention being API-controlled, it’s possible to completely automate many processes, increasing their speed and reliability and reducing costs.

PSD2 removes many of the entry barriers that were keeping companies out of this market, so it will create an exponential effect in the development of new products and services serving both businesses and private consumers.

Users’ security above all

Despite the benefits offered by Open Banking, there is still a certain lack of trust among users regarding open data.

One of the changes PSD2 introduces to make the online payments space safer for users is the requirement that TPPs comply with the same security standards as traditional payment service providers. That means that companies that don’t obtain the proper accreditation from the competent regulatory body won’t be allowed to operate in the online payments space at all.

What’s more, the new security requirements included in the PSD2 text mean that all payment service providers must increase security around online payments by implementing what is known as Strong Customer Authentication, or SCA.

SCA consists of an authentication method under which users must provide two of three different authentication factors. These are something that they know, such as a password or PIN code; something that they own, such as a phone; and something that they are, such as a fingerprint or a biometric sign. To be able to use the new payment and banking data services that Open Banking enables, users will have to provide a combination of two of these.

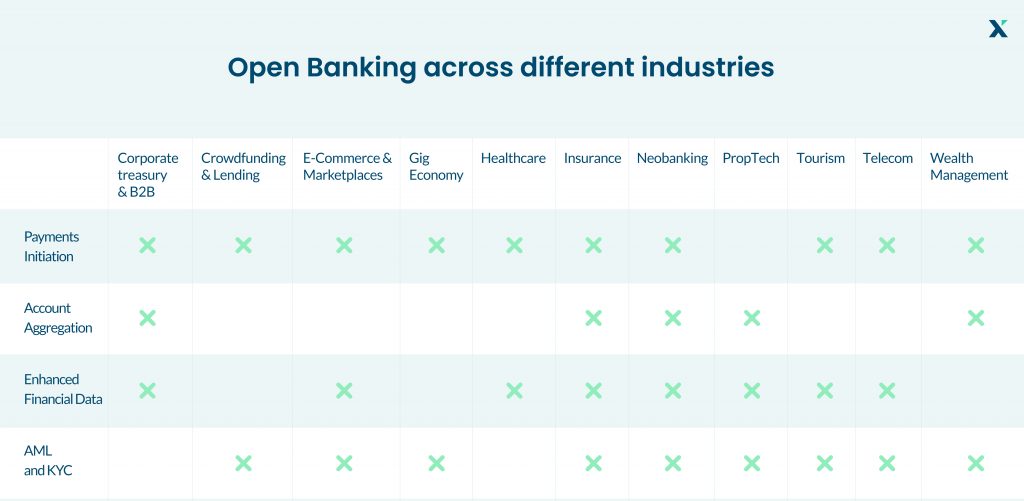

Use cases and industries

As the table above shows, there are many use cases for Open Banking, and many are already being implemented and used by consumers around the world. Here are three of thems:

Card payment and processing

When Covid happened in 2020, consumers quickly shifted online to do their shopping. This meant that card payments and digital payments quickly increased. Although at first glance this may seem like a good thing, the main issue with digital payments is the high fees that merchants have to pay to card networks like Visa and Mastercard.

With new regulations such as 3DS2 and the recent increase in Visa and Mastercard fees, merchants are now looking towards alternatives for online payment processing.

Open Banking helps solve a huge pain point for merchants by enabling online payment processing that is 92% cheaper than card payments. With Open Banking, customers can pay with their bank accounts — but instead of the highly manual and time-consuming process of a direct bank transfer, it’s an integrated payment instead.

As a merchant, this means no chargebacks, much cheaper digital payments, and deposits that take place the next working day.

Lending

With e-commerce and online shopping getting more competitive and crowded, many brands are seeking to stand out by building an even stronger relationship with the customer. One way to do this is by offering financial products such as personalized lending.

With Open Banking, non-financial companies can offer loans to their customers and build a more comprehensive service while also opening up a new revenue stream. Open Banking allows companies and financial institutions to aggregate customer data through an API, rather than asking customers to download and re-upload Excel files and PDFs.

A streamlined system makes it a lot easier, faster and safer to provide loans to both businesses and individuals.

Identity verification

With the Strong Customer Authentication directive coming into force later this year, we’re already experiencing a wave of regulations that aim to help decrease online fraud and identity theft. This is especially true considering how Card Not Present (CNP) fraud has seen a large increase in the past year or so due to people completing more purchases online.

With Open Banking, companies and financial institutions can verify a customer’s identity a lot more easily and quickly. By using APIs, they can confirm a customer’s identity by integrating directly with a legalized institution such as a bank.

Applications and products

How do these use cases and industries translate into real-life products? Here are two examples.

Personal finance management

With Open Banking, third parties can help consumers manage their money more efficiently. With debt on the rise and people still recovering from the crisis, more people are aware of the need to manage money well than ever.

By aggregating customers’ bank accounts onto one app, third parties can put all their information onto one dashboard and provide useful financial tools, such as budgeting, forecasting, and saving tips. This helps customers get a better understanding of where their money is going and make better decisions.

Product comparison websites

Current product comparison websites are not very personalized to a user’s needs. They list hundreds of results and the user usually needs to scroll through and input their details several times over.

By sharing financial data with the website, the site can offer a list of results that are better suited to a user’s needs as well as allow people to search and apply for products more securely.

Open banking vs Open finance

Open Banking is the name of the movement that kickstarted these new regulations that encourage the implementation of open financial APIs. There is the next step after Open Banking, and it’s called Open Finance.

What are the main differences between the two? Open Banking focuses mainly on banking: so savings accounts, checking accounts, transactions, and payments. Open Finance aims to take this one step further, by opening up the entire world of financial data. This would include pensions, insurance, consumer credit, mortgages, and a lot more.

By making a person’s entire financial life more open and accessible, consumers and businesses would have even more control over their data and have access to even more financial products.

This could mean creating a financial dashboard where a user can see everything: investments, pensions, savings, and checking on one screen. It would make credit decisions a lot more accurate and would make it even easier to get financial advice. It would also involve automatic switching and renewals, better product recommendations, and even better customer protection.

Open Finance is not perfect yet — there are still some concerns on whether it’s a good idea to have a user’s financial details all in one location. But it is the objective of most financial authorities to level the playing field and make finances more open – and that’s definitely a good thing.

The future of Open Banking

Open Banking is here and it’s set to transform how we can pay for goods and services and manage our finances. Open Banking creates an important opportunity and offers great potential for turning the financial services environment on its head.

According to data from PWC in a study alongside the Open Data Institute, the revenue opportunities created by Open Banking by 2022 could reach €8.5 billion. In terms of adoption, 71% of SMEs expect to use an Open Banking service, and 64% of adults think that they will be making the most of an Open Banking service by that year.

The tech consultancy firm, Gartner, goes even further in its predictions and assures in a recent report that by 2030, many of today’s top banks will have shrunk considerably and FinTech firms will become the leaders in a market shaped by Open Banking. In conclusion, collaborations between FinTech companies and banks are also expected to increase in the near future.

As a result of this, financial services will be of higher quality, fees will be lower for consumers, and enable everyday people to have access to the finance they need. We hope you now understand why Open Banking is so revolutionary.

You may like: What’s In Store For Open Banking In 2021?