Is your method for validating customer bank accounts due for an upgrade?

The account ownership validation process has come a long way from its roots in manual verification and paper-based processes. New technologies and regulations have made it easier to share account holder information between organizations, simplifying operations overall.

Today, instantaneous account ownership verification is a vital element and benefit of PSD2. Through this capability, businesses gain instant access to financial data, enabling the automation or near-automation of processes linked to financial data.

Additionally, though not without its limitations, Open Banking helped pave the path forward, giving organizations wider access to customers’ financial data.

Yet, despite the many advantages the first wave of Open Banking-based technology has brought to the account validation process, it still requires 1-to-1 request processing and direct customer interactions. Such interactions require the customer to provide consent and manually read and retrieve data from their bank accounts, complicating the process along the way.

To address these challenges, Unnax’s account ownership verification solution leverages APIs to create a more seamless validation process.

Let’s dive into the specifics of bank account verification and the advantages of API-based verification.

What is bank account verification?

Account verification (also known as account validation) is the process of validating the authenticity of a bank account and ensuring a customer is the true owner of said bank account in various financial settings, such as lending or insurance.

Verifying customer identity is an important step in customer due diligence (CDD) processes, as it enables businesses to confirm that a customer has provided accurate information about their ownership of a specified bank account. Account verification is also vital for preventing fraud attempts by validating account ownership information received from clients.

Manual verification vs. PSD2 vs API-based account verification

Many verification processes today still rely on traditional methods of verification that require greater manual effort. Such processes are operationally challenging organizations by reducing overall productivity, efficiency, and cost-effectiveness.

PSD2 verifications offered a more modern alternative to manual verification.

Through Open Banking, customers can consent to an organization connecting with financial institutions to collect the information necessary to verify the customer’s identity. However, while Open Banking makes verification faster and more secure, it remains a clunky process.

As financial technologies advance, APIs have emerged as a new avenue for optimizing account verification. APIs enable seamless account ownership validation without direct user interactions. For example, Unnax’s API-based account verification solution can enable batch validations and directly integrate with various back-office systems (ERP, CRM, TMS, etc.).

API-based account verification represents a practical evolution of both the PSD2 and manual verification processes, emphasizing efficiency, simplicity, and API-driven innovation.

Why is bank account verification important?

Aside from ensuring security and compliance with CDD, KYC, and KYB processes, account verification is vital for any organization dealing with financial account data. Namely, account verification can be crucial for increasing operational efficiency.

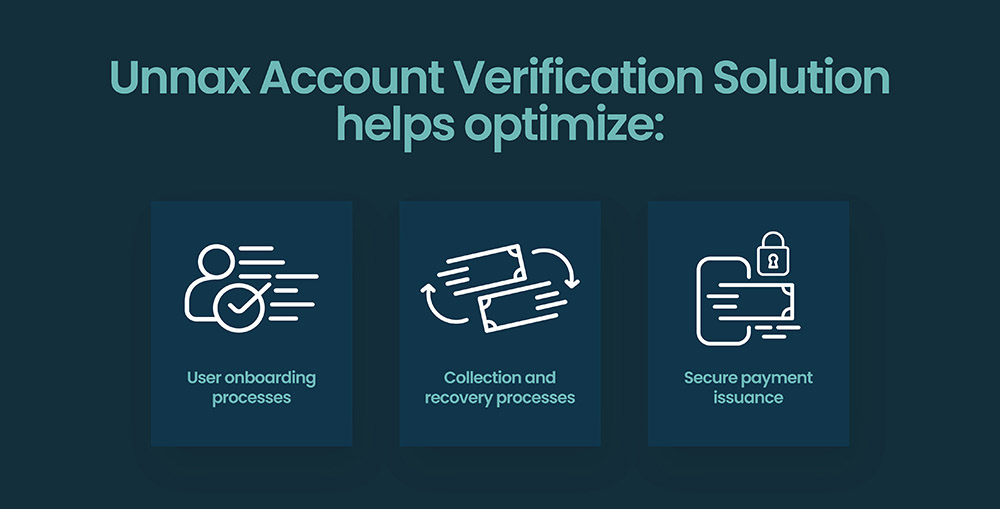

In addition to compliance, account verification also helps to optimize:

- User onboarding processes: By leveraging account ownership verification solutions, you can optimize user onboarding by automating customer validation, as well as expedite the onboarding process overall.

- Collection and recovery processes: Account ownership verification streamlines collection and recovery processes by ensuring accurate identification of account holders, reducing manual errors, and enhancing efficiency of recovery efforts.

- Secure payment issuance: With account verification, you can enhance payment issuance security by validating and confirming the authenticity of account details, minimizing the risk of fraud, and ensuring reliability in payment processing.

Overall, account verification plays a pivotal role not only in security and compliance but also in establishing an efficient and personalized environment that benefits both businesses and customers.

Who should use account ownership verification? 5 key use cases

Account ownership verification plays a tremendous role in increasing efficiency of various financial processes. By enabling automation, account verification can alleviate the pains of tedious manual processes and eliminate the threat of manual errors.

Although account ownership verification can benefit all businesses dealing with financial data, the process can be especially advantageous for the following industries:

Credit

For credit and lending businesses, account verification is fundamental for assessing a customer’s financial responsibility, status, and reliability. Account verification enables more accurate risk assessments and can often be instrumental in reducing the risk of fraud and default. In turn, financial institutions can make more informed decisions on loan approvals and terms.

Insurance

Risk assessments and fraud prevention are particularly vital in the insurance sector. Account verification helps to accurately assess potential customers, collect insurance premiums more securely, reduce manual errors in accounting processes, and determine a more precise level of risk. Achieving this higher level of risk assessment accuracy helps to prevent fraudulent claims and streamline the claims process, reducing the likelihood of both fraud and errors.

Marketplaces

In a marketplace setting where merchants and customers interact directly, reliable account verification is paramount. Marketplaces must ensure security on two fronts — the buyers and the sellers. Account verification gives marketplaces the tools necessary to ensure all users are verified and accountable for their financial actions.

Gambling/Gaming

The gambling and gaming industries have traditionally been labeled as high-risk, making it essential for businesses in this realm to prove their trustworthiness. Account verification is critical for adhering to relevant gambling regulations and ensuring that all payments made by the company are sent to the owner of the destination accounts, achieved by automating the validation of user accounts.

Unnax’s Account Ownership Verification Solution

For organizations in Spain, Unnax can optimize your approach to account verification. Unnax offers upgrades for both PSD2 and manual verification methods, helping you bring your verification process into the modern era.

Unnax’s API-based Account Ownership Verification solution provides all the capabilities necessary to streamline your account verification process.

The Unnax solution works exclusively with payment operations initiated from our accounts. However, Unnax can validate ownership of any account, regardless of the bank, so long as the provided account has a Spanish IBAN.

Tailored to the SEPA region, the features of this solution include:

Spanish IBANs

With Unnax’s account verification solution, you can validate the ownership of 75+ million accounts with Spanish IBANs, including both individuals and businesses.

Real-time availability

Unnax’s solution is available 24/7 with responses in seconds.

100% digital

This solution is entirely digital, and the API can connect directly to your back office to automate responses and receive responses in JSON format.

Batch queries

Unnax enables your business to make individual or batch requests depending on your specific needs.

No customer interactions

Unlike PSD2-based account verification, Unnax’s solution eliminates the need for customer interaction — all you need is the customer’s IBAN and identification number (DNI/NIE/NIF/CIF).

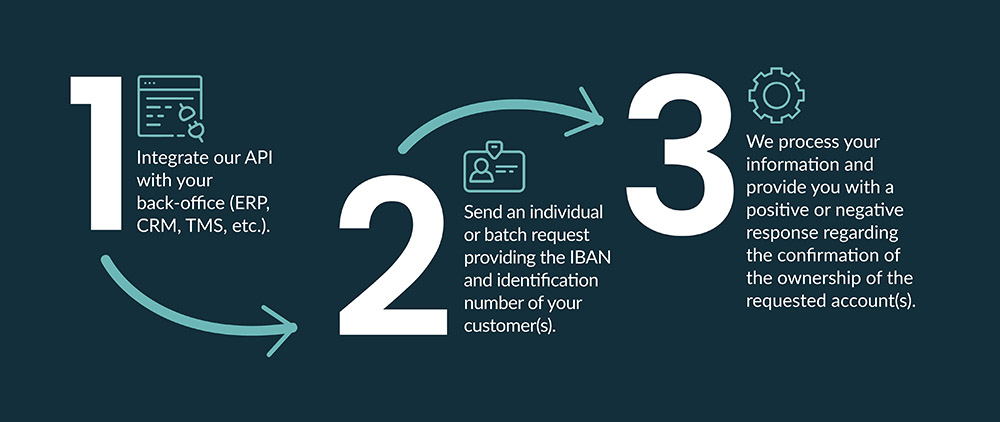

The image below shows how account ownership verification with Unnax and via API works in practice:

Contact Unnax today to create your account and get started.