Hyperconnectivity has become imperative for ERPs. In light of the roll-out of new EU e-invoicing regulations in countries like Spain, players that embrace and implement hyperconnectivity first can strategically position themselves to reap the operational benefits before new regulatory rules come into full force.

The necessity of hyperconnectivity for modern ERPs

Benefits for ERPs

Hyperconnectivity enables seamless integration and real-time communication between an ERP’s various systems, platforms, and devices.

From a business leadership perspective, ERPs must consider the importance of early adoption of hyperconnectivity. For instance, competitors will soon provide integrated payment services on their platforms. So waiting until existing customers start complaining about the lack of such a feature will only drive an ERP’s clients away. Conversely, taking the lead with an early roll-out of a hyper-connected system can aid in both retaining existing clients and drawing in customers from competitors.

This is exactly what happened with the roll out of account aggregation solutions by ERP platforms in recent times. Three years ago, a few bold ERPs introduced this feature to clients who were willing to pay an extra-fee for it. A year later other ERPs followed because they were losing customers to the first-movers, and eventually, account aggregation became a commodity.

On another note, when data flows fluidly between various tools and financial operations, an ERP can ensure all necessary financial data is readily available and accurately reported. Connecting and streamlining data in this way also simplifies compliance with upcoming regulations, such as the new e-invoicing regulation in Spain.

Benefits for ERP customers

On a deeper level, from an ERP customer perspective, hyperconnectivity enables critical advantages, such as increased operational efficiency and reduced manual intervention and errors. It also allows companies to respond quickly to their financial positions and make more informed decisions. The ability to connect to a cohesive payment ecosystem gives businesses the ability to take full advantage of all essential operational benefits.

“The more integrated an ERP or invoicing system is with a payment and collection ecosystem, the better it is — not only for legal compliance but also for enhancing the company’s efficiency and real-time information. The faster I can make payments and detect received payments in my account, the closer I am to the banking ecosystem that impacts my company, allowing me to make decisions more quickly and effectively.” — Francisco Nuñez, Product Manager at Wolters Kluwer

You’ll like: How Wolters Kluwer Increased Productivity and Efficiency by 60%

The challenges of rolling out hyperconnectivity

ERPs have evolved, making hyperconnectivity a necessary operational component for addressing specific problems like siloed data or inadequate communication between different business functions (i.e. treasury and accounts payable).

Without it, ERPs risk duplicating internal efforts and generating unnecessary inefficiencies due to a lack of organization-wide collaboration.

However, hyperconnectivity can also introduce a new level of operational complexity.

Interacting with multiple systems requires careful planning and a strong IT infrastructure to manage the increased flow of data, often creating a barrier for companies during implementation processes.

Many ERPs have yet to embrace hyperconnectivity because it’s not only a seemingly intimidating process due to concerns around initial investment, data security and integration, but they also lack an overall awareness of the long-term benefits. In the short term, hyperconnectivity can help ERPs win new clients from competitors, while in the long term, it can play an immensely vital role in optimizing an ERP’s operations and the flow of data within the organization.

As the importance of a hyper-connected system grows more clear, we are likely to see wider adoption as more companies adjust their perspective and discover that hyperconnectivity does not have to be so costly or difficult to integrate.

How Unnax enhances ERP functionality and reduces complexity

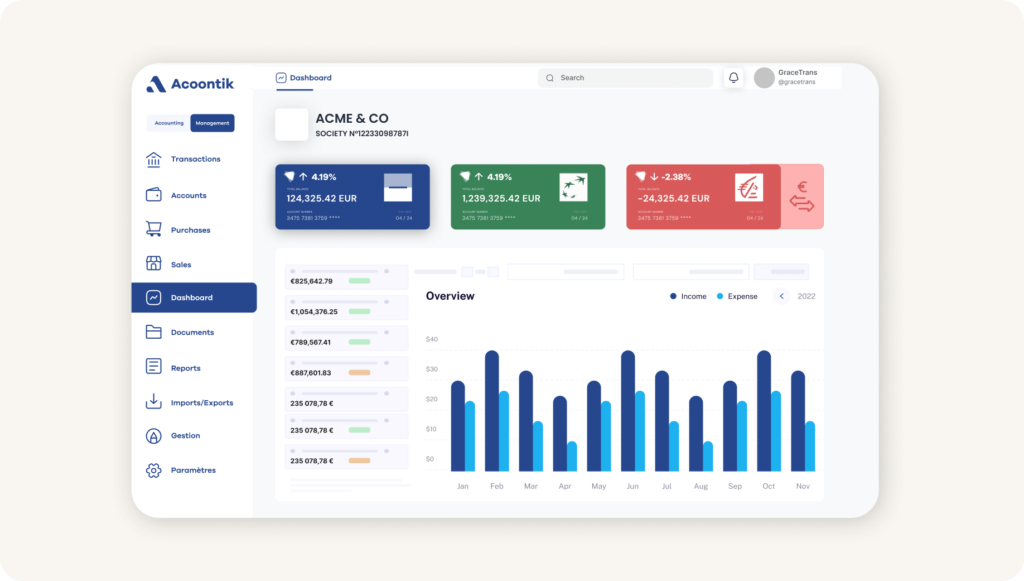

Implementing hyperconnectivity across an ERP system requires modern solutions. Unnax provides essential technological support to automate processes in both back-end operations and client-facing services. Our offerings include IBAN accounts, payment, and aggregation solutions designed to manage payments and automate reconciliation through our seamless API integration.

With Unnax, ERPs can:

- Simplify payment processing

- Achieve fully automatic reconciliation

- Obtain real-time cash flow visibility

Our account aggregation solution consolidates bank data in real-time, directly within the ERP, eliminating the need for frequent connections to bank accounts. This centralized approach provides full visibility in one place, enhancing efficiency.

Unnax dismantles data silos and transforms B2B operations by unifying essential functions. Our Embedded Finance solutions further enrich B2B experiences, enabling highly efficient transactions and integrated payment solutions.

We work closely with ERP clients to tailor our technology to their needs. Even if a feature isn’t part of our current roadmap, we adapt and develop new functionalities, always localizing our solutions to fit specific markets.

Hyperconnectivity doesn’t have to be complicated. With Unnax, it can become a true strategic advantage for ERPs.

Written by Estefania Martinez, Head of Sales at Unnax – Spain.

Speak with our team today to get started.