The financial services industry is no stranger to trending technologies, with the last few years dominated by concepts like Embedded Finance or Open Banking. Now that the sector has grown more accustomed to the idea of an integrated, open finance system, the “next big thing” we see emerging is encapsulated payments.

What are encapsulated payments, and how do they work?

Encapsulated payments are, in many ways, the natural evolution of embedded payments.

Embedded payments focus on building native payment experiences into existing platforms, websites, and applications. Encapsulated payments wrap embedded financial products with data, making it possible to enable extra functionalities like automatic reconciliation or streamlined authorization.

As for how encapsulated payments work, the technological process combines embedded payment technology with Open Finance interoperability, connecting financial data from multiple sources to a platform or app’s embedded financial services.

You may like: The Differences Between Open Banking, Open Finance, BaaS & Embedded Finance

The benefits of encapsulated payments

While it may sound more technologically complex on a surface level, a primary benefit of encapsulated payments is the ability to bring greater simplicity to financial transactions.

Encapsulated payment technology gives businesses the freedom to contextualize transactions within specific scenarios. For instance, by attaching data to the payment, companies can provide increased transparency and enable automation – such as reconciling invoices automatically. This process not only reduces manual interventions for payees but also enhances the user experience by creating a smoother, end-to-end payment flow.

This automation addresses a significant pain point for businesses. According to Gartner, companies spend 40% of their time managing manual payment processes and reconciliation tasks, which can cost up to €200K annually in operational inefficiencies. Encapsulated payments eliminate these inefficiencies, enabling organizations to save time, cut costs, and reallocate resources to more strategic activities.

Additionally, encapsulated payments are a gateway to expanding financial services into lower-tech environments. By embedding payments into straightforward platforms and leveraging open financial data, businesses can engage industries or regions that have traditionally lacked access to sophisticated financial services. This inclusion opens up new market opportunities while addressing long-standing gaps in financial accessibility.

Moreover, encapsulated payments ensure seamless connectivity to financial data across multiple services, platforms, and applications, all through a unified interface. For both businesses and consumers, this translates to greater financial flexibility and control, free from the constraints of single-provider ecosystems.

Applying encapsulated technology in real-world scenarios

Encapsulated technologies offer practical benefits across various industries.

Take ERPs and accounting software as an example.

Encapsulated payments can transform these platforms by embedding financial services directly into the software.

For example, an ERP or accounting software could automatically reconcile payments against issued invoices or process payroll seamlessly within the platform. By reducing manual intervention, businesses can improve operational efficiency, reduce errors, and save time.

This automation helps businesses eliminate bottlenecks in financial operations, improve cash flow management, and significantly reduce errors—all without requiring users to leave the platform. The seamless integration of payment data into these systems also ensures transparency and better reporting, enhancing decision-making capabilities for companies.

You may like: How Wolters Kluwer increased Productivity by 60%

Another industry seeing major benefits is property management.

Encapsulated payments can revolutionize property management by integrating all financial transactions directly into property management platforms.

For example, property managers could collect rent, pay maintenance services, and handle other transactions all within a single, streamlined interface. Open Finance features enable tenants and property owners to link their bank accounts effortlessly, making transactions more seamless and transparent. This approach simplifies daily operations and enhances trust between all parties involved.

In practice, encapsulated technologies present numerous use cases for businesses to take advantage of.

You may like: How Unibo leverage Unnax Account to Achieve 15x Growth

Key challenges and limitations to consider ahead of implementation

Adopting encapsulated payments early offers significant advantages, but businesses need to plan carefully to maximize success.

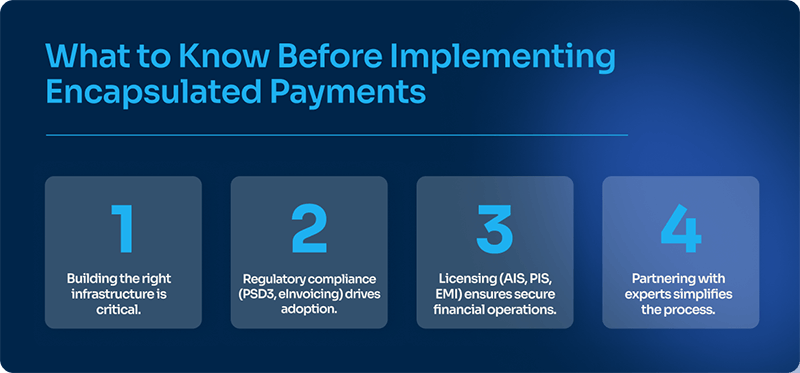

One key consideration is ensuring the infrastructure is robust enough to support both embedded payments and Open Finance solutions. Additionally, businesses must evaluate whether to develop these capabilities internally or partner with a technology provider specializing in financial integrations.

Regulatory compliance is another essential factor. To implement encapsulated payments, companies may need to obtain the appropriate licenses, such as AIS (Account Information Service) or PIS (Payment Initiation Service) licenses, or even an EMI (Electronic Money Institution) license. These licenses are foundational for embedding compliant financial services.

Beyond licensing, regulations like PSD3 and mandatory eInvoicing frameworks in the EU are significant drivers of innovation. While these mandates introduce new requirements for invoicing and billing software, they also present opportunities for businesses to digitize and optimize financial workflows using encapsulated payment technology.

You may like: Everything about Mandatory B2B e-invoicing in Spain

Unnax provides the necessary foundation for adopting encapsulated payments

At Unnax, we are ahead of the curve.

Our platform integrates Embedded Banking with Open Finance solutions to provide users with a hyper-connected environment capable of implementing new technologies quickly. As encapsulated payments grow in prevalence and popularity, Unnax can provide the compliant technical infrastructure you need to build highly tailored payment experiences right away.

Contact Unnax today to get started.