Does your recurring payment system need an upgrade?

This was the situation our client, Esmiluz Energía, found themselves in. As a young company, they didn’t have enough support from their banking system to collect invoices from all their customers. They had to go to six different banks to process all their direct debit remittances. Now, thanks to Unnax’s technology, they’re able to manage more than €150K remittances in a single month.

This is just one example of how recurring payments offer many benefits to businesses across industries. The key to a successful recurring payment strategy is having the right technology in place to enable automation and streamline payment processes.

Let’s examine recurring payments and how Unnax’s fully automated solution can help.

What are recurring payments?

Recurring payments are a payment model where funds are automatically deducted from a customer’s account at scheduled intervals to cover subscription fees for products or services.

By offering recurring payments, financial businesses can streamline transactions and automate payment processes for efficiency, providing convenience for both the business and its customers. Managing recurring payments effectively is crucial for optimizing cash flow management, ensuring financial stability, and maintaining a clear understanding of ongoing financial commitments.

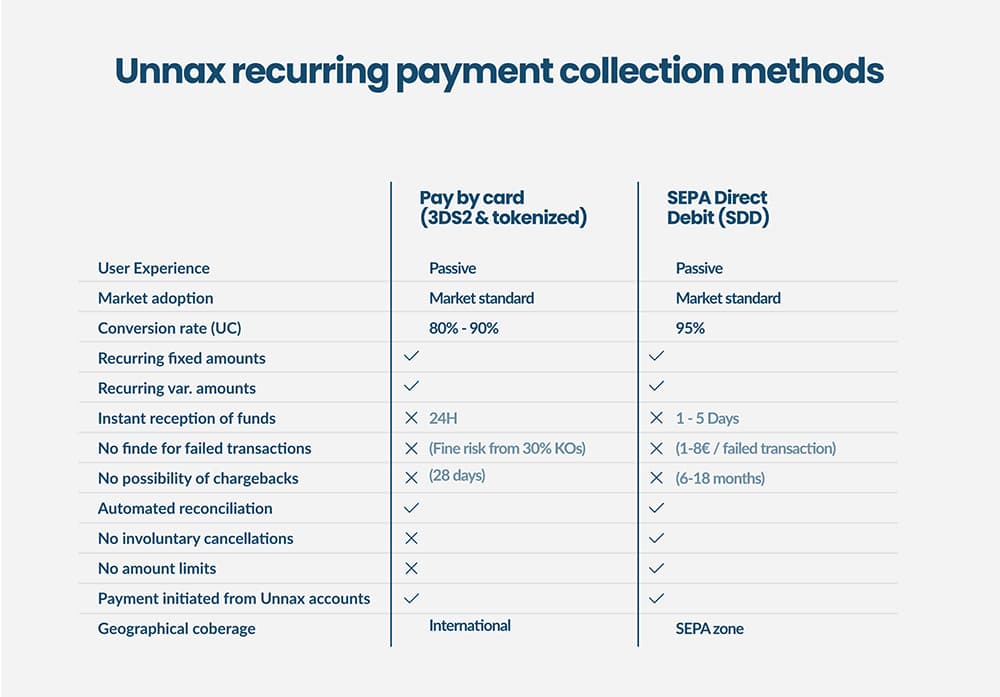

To process recurring payments, you can use a variety of payment collection methods, including Virtual POS, SEPA Direct Debit, and A2A PSD2 transfers.

The two types of recurring payments: fixed & variable

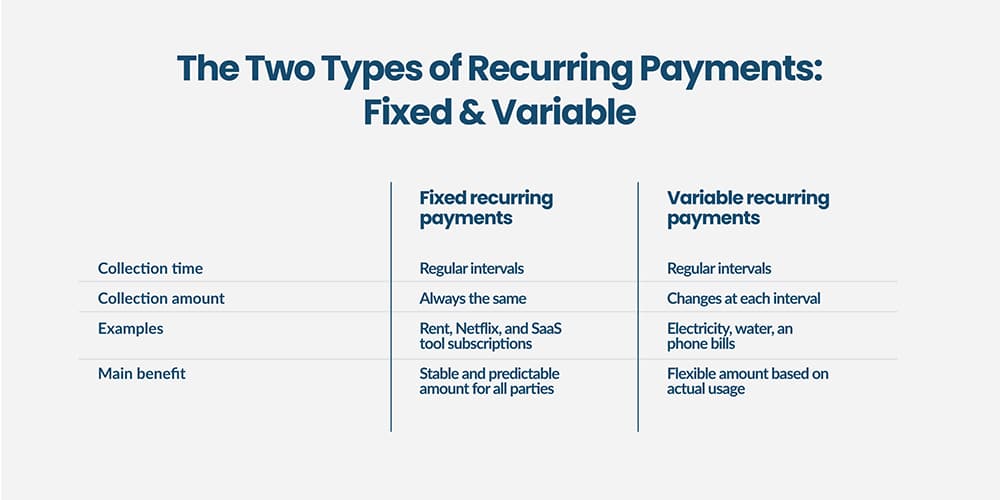

Fixed and variable payments are the two main types of recurring payments for businesses to consider.

Fixed recurring payments occur at regular intervals and a consistent cost that does not fluctuate. This is the most common type, widely used by many subscription services.

Meanwhile, variable recurring payments still occur at regular intervals but charge varying amounts. The simplest example of a variable recurring payment is a utility bill, which is charged at the same time every month but varies in the billing amount based on a customer’s usage.

Fixed payments provide a level of predictability, allowing businesses to plan their budgets with more certainty regarding cash flow. Variable payments, on the other hand, may require a more flexible approach, as the exact amount can change based on external factors.

Which industries should leverage recurring payments?

Recurring benefits play a crucial role in the scalability and efficiency of various industries. Most notably, the utilities, insurance, and rental sectors stand to gain significant benefits from recurring payments.

Take a look at how recurring payments optimize each sector’s payment process:

- Utilities: Recurring payments provide a steady and predictable cash flow for the utilities industry, ensuring consistency in overall operational stability. For consumers, it ensures continuous access to essential services without the hassle of manual payments.

- Insurance: In the insurance industry, recurring premium payments facilitate a consistent revenue stream for insurers. Automatic recurring payments allow insurance companies to manage risks more effectively while simultaneously reducing the risk of policy lapses and non-payment.

- Rentals: For rental companies, recurring payments contribute to financial stability. This model ensures a regular income stream, allowing rental companies to manage property maintenance, offer better services, and plan for expansions.

In all three industries, recurring benefits enhance financial planning, operational efficiency, and customer satisfaction by providing a reliable and automated payment structure.

How Unnax simplifies recurring payments

Unnax collects payments via API that directly integrates with a business’s ERP, back office, or accounting tools to facilitate seamless reconciliations and process automation. Plus, Unnax, contrary to other stakeholders, offers stable conditions without reducing your debit line or asking for exceptional guarantees.

Additionally, Unnax’s recurring payment solution enables real-time notifications about the payment status of your transactions.

Collecting recurring direct debit payments with Unnax

Through a partnership with Unnax, you can easily set up SEPA Direct Debits as one of your recurring payment methods.

Unnax’s SEPA Direct Debits — offered as both direct debit core and B2B — provide many advantages to help bolster your organization’s flexibility and resilience, including:

- Automated collections: Unnax enables 100% automation within the payment process

- Operational peace of mind: Unnax’s collections process requires a one-time interaction with the client to obtain a signature of mandate — from there, everything is automated

- Heightened efficiency: With Unnax, you can save time on managing collections and avoid manual errors thanks to our end-to-end automation and streamlining

- Improved scalability: Unnax helps scale your business with ease by enabling payment collection throughout the SEPA region from a single bank account

As mentioned, Unnax’s SEPA Direct Debit recurring payment solution is helping our clients expand their businesses with greater simplicity — such as Esmiluz Energía, who now manage more than €150K remittances in a single month thanks to Unnax’s technology.