Welcome to the

Unnax blog

Welcome to the

Unnax blog

Virtual IBANs empower businesses to efficiently manage payment routing and reconciliation while adapting to specific needs. Unlike traditional accounts, Virtual IBANs are designed solely for collecting payments and act…

The financial services industry is no stranger to trending technologies, with the last few years dominated by concepts like Embedded Finance or Open Banking. Now that the sector has…

Hyperconnectivity has become imperative for ERPs. In light of the roll-out of new EU e-invoicing regulations in countries like Spain, players that embrace and implement hyperconnectivity first can strategically…

The fall air may be cooling, but we’re heating up for our next release of new products and features across the entire Powens Group. Check out our latest innovations…

The EU’s Consumer Credit Directive 2 (CCD2) imposes several new regulatory requirements and expands the directive’s regulatory scope to include online and digital microlenders. One major change introduced in…

Alquiler Seguro boosts the profitability of the Spanish property renting market by acting as an intermediary between landlords and their tenants. Over the past 13 years, Alquiler Seguro…

When powering financial solutions for your clients, can you offer a seamless bank reconciliation? Bank reconciliation is often a complex process prone to human error. Simplifying this process requires…

The EU’s Consumer Credit Directive 2 (CCD2) has its sights set on digital microlending. As the second iteration of the EU’s CCD regulation, CCD2 revises credit agreements for consumers…

As embedded banking products have become widespread, businesses in many industries must rethink their account validation processes. The rise of financial technologies has introduced APIs as a powerful tool…

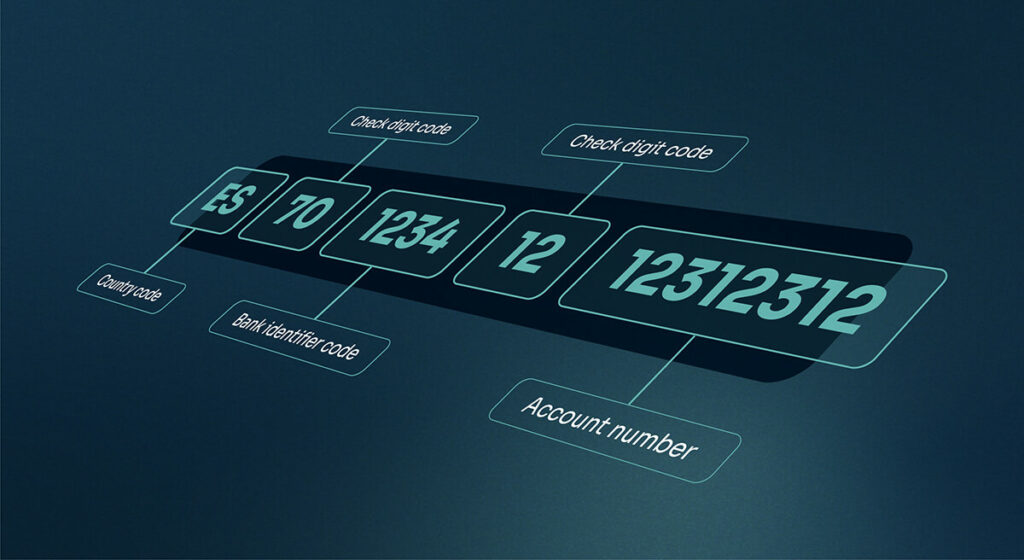

First introduced by the European Committee for Banking Standards (ECBS) in 1997, IBANs have helped to standardize bank account identification processes across Europe. Today, non-financial companies now have the…