While it didn’t get much press in the general public, the EU’s second payment services directive, commonly referred to as PSD2, was one of the most groundbreaking financial regulations of the past decade.

Inspired by the Open Banking movement’s tremendous possibilities, the European Union updated their first payment services directive to liberate banking data from banks.

Today, any bank or authorized third party can access account information, initiate payments, and securely authenticate users. While only a couple of years old, PSD2 is undoubtedly reshaping the European banking landscape for decades to come. Although all aspects of the directive should concern banks, understanding and utilizing account aggregation should be their top priority.

About Account Aggregation

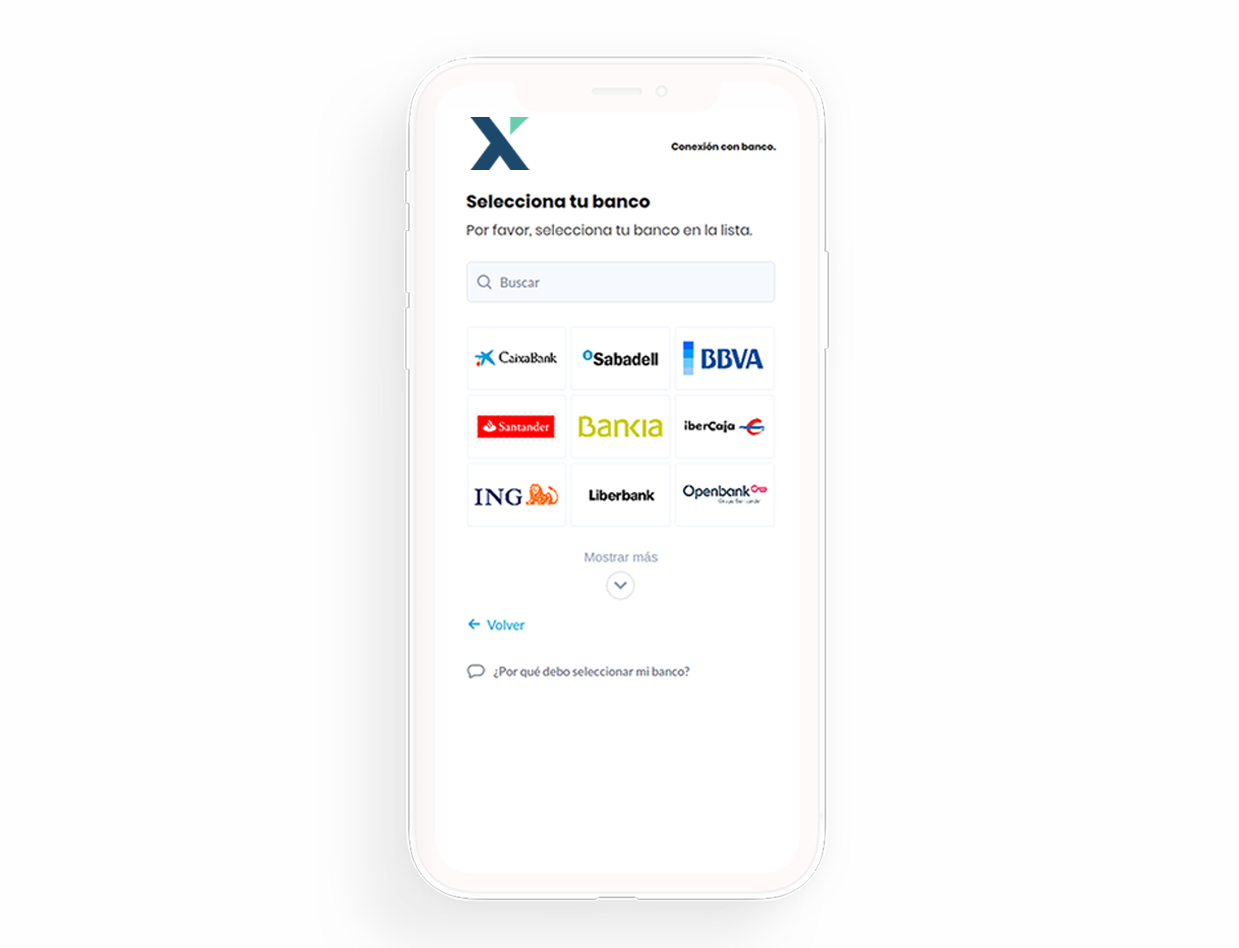

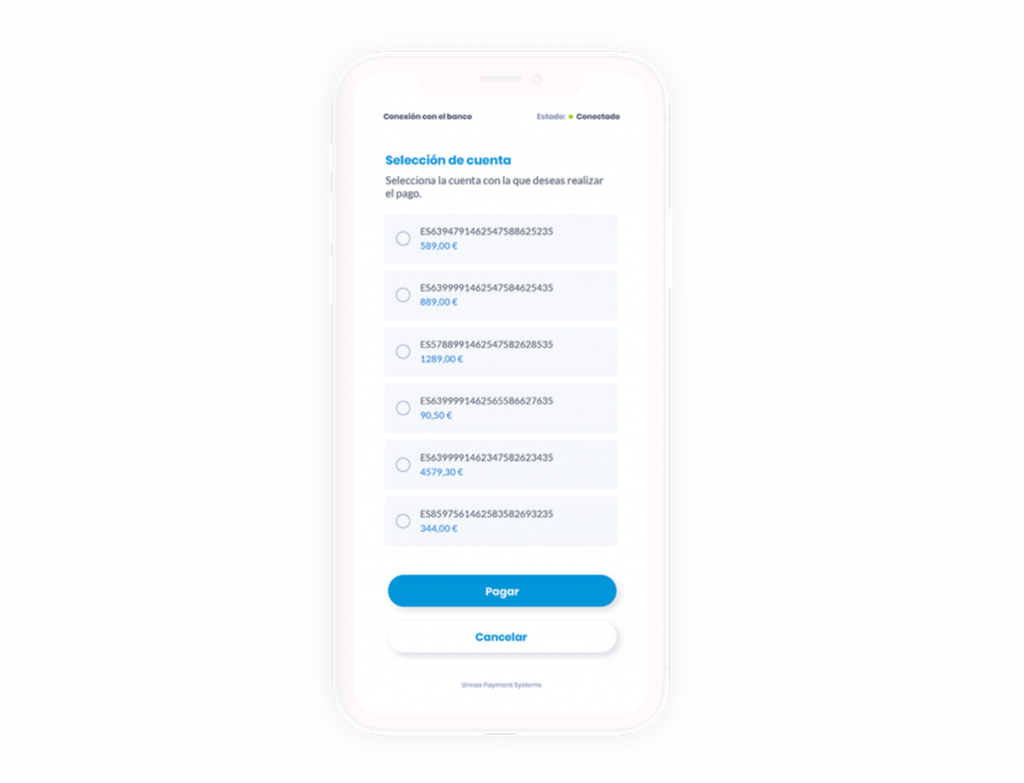

Account aggregation is exactly what it sounds like: compiling different bank accounts into one centralized feed. Under PSD2 and Open Banking, banks must share their customers’ data via a standardized API format with authorized third parties.

With the bank’s customer’s consent, they can access this information on an outside platform. The information is in “read-only” mode, meaning that the user or accessing party can only see the data, and not change it. Once a bank taps into an account aggregation API, transformative possibilities begin to emerge.

Why Banks should prioritize account aggregation

Of the three main features built into PSD2, account aggregation offers the easiest win for banks. For starters, aggregation is a read-only feature. Banks are merely accessing a user’s financial data without making any permanent changes to it. Compared to initiating payments or making authentication requests, implementing aggregation is straight forward and relatively low-risk.

That said, there are still some issues banks should keep in mind when aggregating accounts, particularly around privacy and data protection. However, these concerns are easily manageable using a regulated provider. From there, implementing Open Banking at the retail level becomes nearly effortless.

Account Aggregation in Action

Here are a few opportunities banks can take advantage of with account aggregation.

Building a better UX and turbocharging the banking app

User experience and design are some of the quickest wins banks can make. Here, the institution can aggregate its customer’s global bank accounts into their app, giving each user a singular channel to check balances.

With a bit of development, the product team could take the user’s raw data to provide real-time spending insights. Combining this feature through a well-throughout app will give customers more reason to engage with the bank, creating more sales opportunities in the process.

Deep learning for more powerful marketing and insights

Account aggregation allows banks to gain a treasure-trove of insights on their customers. Using algorithms, it’s possible to categorize each client by their transactions. These indicators then paint a more precise picture of each user. From here, a world of new possibilities opens up for the bank.

For one, the bank can deliver an unparalleled personalized user experience. Second, banks can categorize each customer into better-refined user personas, making targeted product marketing much more cost effective. Together this data-driven intelligence enables banks to make smarter, faster decisions.

Quick verification to avoid issuing an NPL

Lending is one of the key bread-winners for retail banks. However, issuing the wrong debt to the wrong person could create a non-performing loan. As any bank knows, NPLs are a part of the business. Still, with unparalleled economic uncertainty, the number of bad loans on the books could increase, adding more distress to fragile balance sheets.

Account aggregation allows banks to get a real-time global overview of a potential borrower’s financial health. Banks can then incorporate this information into their decision-making process, helping them match borrowers with better terms, or avoiding a bad loan altogether.

Beat the neobanks at their own game

The combination of the Open Banking movement and advances in tech and design-centric thinking over the past decade ushered in neobanks. The startup challengers have successfully built user-centric banking apps that scale quickly and give consumers, particularly the young ones, a sorely-needed personalized experience.

Despite their popularity, though, their product offerings remain relatively thin compared to the traditional banks they are disrupting. Indeed, these startups focus on the most basic banking functions, providing (pre-paid) debit cards and other light products to convert users quickly.

Armed with an already hefty arsenal of profit-generating products, traditional banks can leverage account aggregation to give their challengers a serious run for their money.

By using a design-driven approach, banks can build an engaging banking app, aggregating their clients’ global bank accounts. Then, armed with a refined buyer profile extracted from categorization insights, the bank can offer the user insurance, loans, and other in-house products, which their challengers don’t have.

Account aggregation: the pathway to future relevance for banks

On the surface, Open Banking looks more like a threat than an opportunity to traditional financial institutions. Yet, banks can leverage PSD2, account aggregation, and categorization to expand their product offering and maintain or even grow market share. Traditional banks would be wise to take advantage of account aggregation’s transformative capabilities now before they find themselves playing catch-up for the unforeseeable future.