Embedded finance is redefining the essence of the financial services industry.

When practically any company can incorporate banking products into their own products and services, the financial services industry ceases to stand on its own and finance suddenly becomes ubiquitous.

Embedded finance offers a huge opportunity for non-bank merchants to get closer to their customers, open up new revenue streams and completely change how people interact with money. With embedded finance, financial services turn into customer acquisition and retention channels, opening up hundreds of opportunities for brands to reimagine their relationship with their customers.

Read straight through, or jump to the section you want to read

- What is Embedded Finance?

- Why should you be paying attention to embedded finance?

- Benefits of implementing embedded finance for companies

- The main benefit for consumers

- Top use cases

- The role of embedded finance in the future of financial services

What is embedded finance?

Traditionally, financial services such as payments and lending were the exclusive purview of banks. After all, banks are highly regulated entities, and, for the longest time, these institutions built their own custom tech stacks. Together, these realities made it practically impossible for banking services to leave the bank’s gated walls.

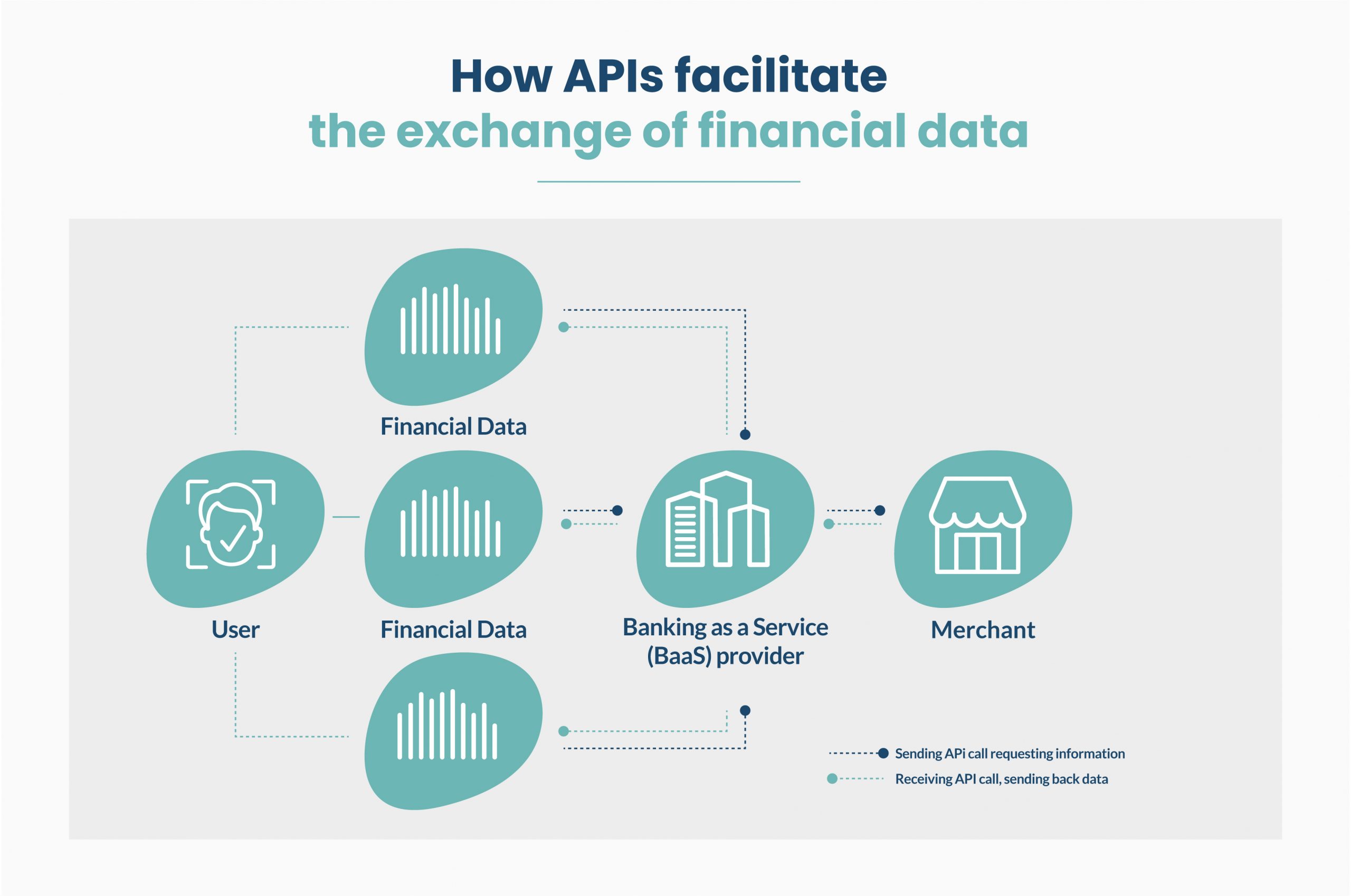

The Open Banking movement and its supporting regulations like PSD2 have effectively broken down those barriers. Today, banks, fintechs, and other regulated entities can connect non-finance companies to their platforms via APIs.

In turn, firms from practically every industry imaginable can now incorporate banking products embedded directly onto their own platforms. Here are a couple of quick examples to give you an idea of what we’re talking about.

- An e-commerce retailer adds a payment financing option at checkout.

- An “e-wallet” for a gig economy platform enables both consumers and providers to exchange money directly via the app.

- A real-estate platform offering renter’s insurance to new tenants

As you can imagine, the possibilities are practically endless.

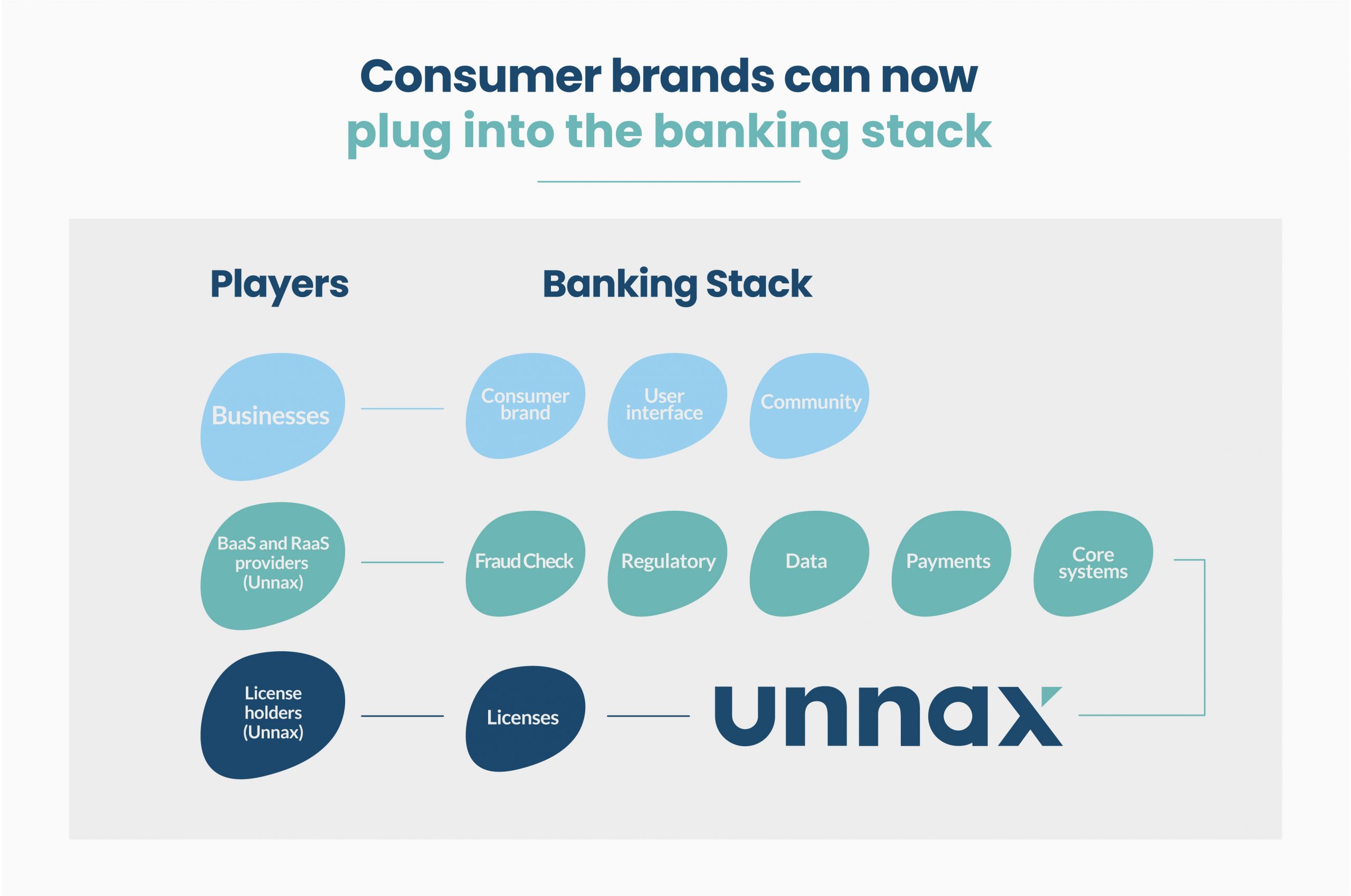

From a regulatory perspective, these companies have little to worry about. Instead, the regulated entity — be it a bank or a fintech — deals with these tedious yet crucial details.

These include maintaining the appropriate licenses, staying compliant with relevant legislation, safely holding client deposits and operations.

From a user’s perspective, embedding financial services into a platform follows the standard operating procedures for working with APIs. Once the product manager defines what they want to build, developers only need to code the relevant snippets in harmony with the UX designer’s vision.

Why should you be paying attention to embedded finance?

Embedded finance will undoubtedly be one of the hottest trends in both the financial services world and the economy in general over the next coming years. Famed Silicon Valley VCs Andreessen Horowitz recently noted that embedded finance could “potentially 5x the revenue per customer.”

Therefore, understanding how it works not only makes for insightful reading but becomes a ‘must’ for any product manager or innovator looking to significantly expand their product offering, enhance the user experience, and grow their bottom line.

By embedding financial services, both banks and the companies deploying them can learn valuable information about their users, making lending and insurance-writing more efficient while enabling providers to offer more targeted services.

The more data there is, the more efficiently this process works. This means that in the future we are likely to see a redefinition of how merchants interact with customers: offering personalized banking (e.g. discounts) as well as more accurate loans.

It’s a win-win-win for everyone involved: banks benefit by white labeling their services, consumer benefit because purchasing is a lot more seamless and convenient, and merchants benefit because conversions increase and costs are often a lot cheaper.

Benefits of implementing embedded finance for companies

1. More control over the payment process

Embedded finance eliminates the need for banks, effectively allowing any company to become a financial services company.

One of the main benefits of being a financial services company is the ability to control the payment customer journey. Instead of redirecting customers to third-party pages, companies can now ensure the entire process happens under one “digital roof”. Not only does this translate into a better payment experience, but companies are in a better position to understand the payment habits of their customers.

2. Added value to customers

With embedded finance, companies can completely rethink their relationship with the customer. By being in control of the payment journey, merchants can offer Alternative Payment Methods (APM) and localized solutions that might be better suited to their target customer. For example, if they are targeting younger generations, offering Buy Now Pay Later (BNPL) will help increase conversions.

3. Lower costs

One other huge benefit for companies is that by embedding the payment process, merchants can remove several middlemen such as card networks or expensive payment providers, making it a lot cheaper to process payments.

4. Higher revenue

On the other side of the balance sheet, companies can also turn embedded finance into an additional revenue stream. By providing credit to customers, merchants can effectively earn revenue in the form of interest payments. The clearest example is BNPL solutions that offer credit at the Point of Sale.

The main benefit for consumers

The main benefit of embedded finance for the consumer is convenience – and that’s no trivial thing. In today’s day and age, people are willing to allocate a large percentage of their income to paying for convenience; just look at Amazon Prime, fast food, and Ikea. Today, it’s the companies that prioritize convenience that have the competitive advantage.

With embedded finance, convenience reaches another level. That’s because the concept of “payment” almost disappears. Instead of consumers taking out their debit card and going to a separate payment screen to fill in their details (for the hundredth time), they now just need to click the merchant’s “Buy Now” button to purchase their item. It saves them time, energy and helps build trust with the merchant. Thanks to Open Banking and PSD2, this will soon become the norm rather than the exception.

One of the best ways to illustrate the power of embedded finance is in insurance. Most consumers nowadays need to purchase their car from one company, and then get their insurance somewhere else. This takes time and energy that the consumer would rather spend doing literally anything else. With embedded finance, insurance can already be included: when you buy your car, car insurance can be easily contracted at the same time and page. When you sign your rental lease, rent and contents insurance are already included. Embedded finance allows consumers to spend less time on boring administrative tasks, and more time doing what they enjoy.

Top use cases

We’re now going to look at six different industries and how embedded financial services (sometimes called “invisible banking”) are opening new doors while simultaneously creating brand new revenue possibilities.

1. E-commerce platforms

From a business perspective, e-commerce has been one of the biggest beneficiaries of the pandemic economy. In addition to more consumers shopping online, entrepreneurs and other merchants seized the moment to expand into this space. As a result, platforms wanting to help their clients succeed are embracing embedded financial services.

Shopify, the e-commerce platform, created a financial arm to help merchants secure credit. Since getting an accurate loan is difficult for many merchants, the Canadian firm leveraged its internal data to better forecast a merchant’s future sales.

With that information, the company can offer better-suited loans to lenders in need of financing. Additionally, Shopify offers shoppers a “buy now, pay later” financing option at check-out, bringing invisible banking to both sides of their business.

Other examples of embedded finance in E-Commerce include e-wallets and instant payments for merchants, bypassing slow and costly traditional banking channels.

2. Healthcare

Healthcare has always been a central pillar of our economy. In the aftermath of the pandemic and with a rapidly-aging population, this vital industry will become even more critical in our lives. Health insurance will play a crucial role in financing treatments in the years to come.

By embedding various financial services, healthcare providers can leverage their data sets to match patients with better-fitting coverage. In turn, costs for providers, insurers, and consumers alike will drop as the industry becomes more economically efficient.

3. Automotive

The automotive industry is no stranger to financial services. After all, financing and leasing are amongst the key drivers in the industry, to the point that some manufacturers have their own banks and even APIs. That said, there is still plenty of room for growth.

Financing and insurance are some of the main profit drivers for car dealerships. These companies can offer a broader range of funding and insurance options to car buyers and better avoid arrears and costly repossessions through embedded financial services. Here, dealerships can act more independently, improving both user experience and reputation.

4. B2B

Embedded financial services aren’t solely for companies with consumers as the end-user. The corporate treasury plays a central role in the success of any business. Many enterprise resource planners already accept banking functions like account aggregation and payment initiation via API calls.

With embedded financial services, treasuries can leverage their own set of financial data to find better-matching financing options quickly. Other possibilities include smart FX hedging and execution as well as intelligent expense management and accounting.

5. The gig economy

Platforms enabling people to freelance have been on the rise for the better half of a decade. From ride-sharing to personal shopping to meal delivery, embedded financial services can play a crucial role.

For example, service workers such as shoppers or delivery people receive their earnings directly from the platform. These workers can immediately access their earnings without passing through a financial intermediary with a combination of an e-wallet and a branded debit card.

Gig-economy giant Uber is taking embedded financial services even further. Their “Uber Money” product provides its drivers with credit cards, overdraft financing, and cashback rewards on certain purchases.

When tourism returns, we’ll potentially see another boom in short-term apartment rentals, with people letting rooms and houses. Here, embedded finance can help manage risks through on-platform insurance for travelers and hosts alike.

6. Real estate

Real estate is continuously under disruption. With the traditional agent-tenant-landlord model ripe for reinvention, embedded finance can help new platforms better serve their customers.

Picture an online service that enables renters and landlords to close deals directly, cutting out the rent-seeking agents. Here, embedded financial services can solve numerous pain-points, including escrow accounts for deposits and renter’s insurance to protect both parties.

Likewise, construction and remodeling firms can help property owners quickly find appropriate financing for their renovation projects.

The role of embedded finance in the future of financial services

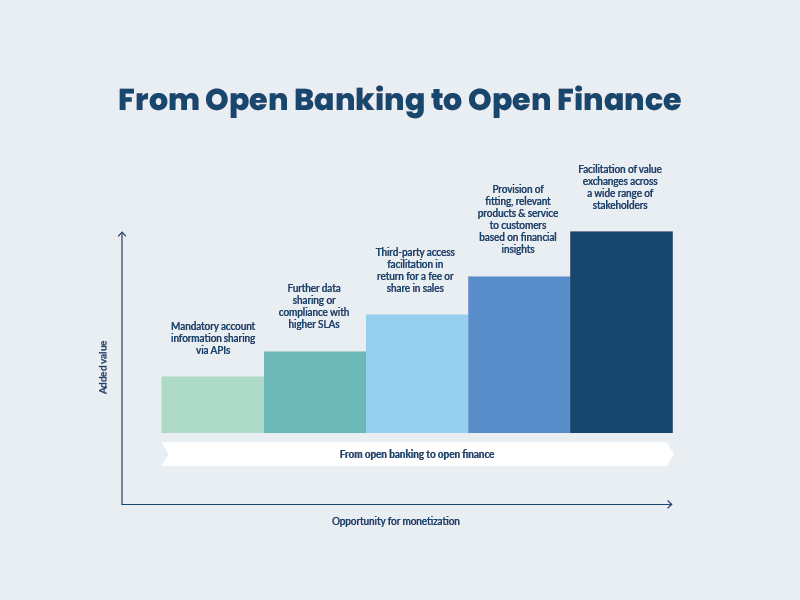

The finance ecosystem is changing: consumers now prioritize convenience and banks are currently re-evaluating their business models due to near-zero interest rates. Fintech companies and financial organizations are filling the gap by becoming more customer-centric and monetizing through fees and subscriptions. This means there are now more players in the finance ecosystem than ever before, each with different target markets and business models.

But the new finance ecosystem is not about building separate companies: it’s about partnerships. And that’s where Banking as a Service (BaaS) providers will play a huge role in developing new products. In 2021, financial institutions and fintech companies understand that people are not interested in banking – they want goods and services. Banks are slowly becoming the underlying infrastructure, while fintech companies are taking care of the customers.

In this way, the financial ecosystem will go from silos to acting as a platform. The 2008 crisis exposed the weaknesses of the financial system: siloes are unsustainable and risky. But now with embedded finance, we are moving towards a platform model. The financial world will look more like the internet, where everything is more modular and customizable. This allows new business models to flourish, unlocking greater value for the customer.

With BaaS, banks, fintechs, and financial organizations can work together to provide consumers with personalized goods and services. The ecosystem is moving towards an age where banks will stop being so visible (sometimes called “invisible banking”). Everything will remain in one ecosystem, with finance embedded in our lives and businesses.

Needless to say, embedded finance plays an essential role in developing the future of financial services. Thanks to European regulations such as PSD2, financial institutions (FI) are moving towards an API economy where companies partner up and offer integrated solutions, rather than work separately. As embedded finance becomes a core part of the digital marketplace, companies and FIs that reject the platform model risk turning into boring financial plumbing, while those who do embrace it will benefit from incredibly high customer lifetime value numbers.