Personal financial data is an asset of great value for companies, as it allows them to better understand the client and develop more personalized services in line with their demands.

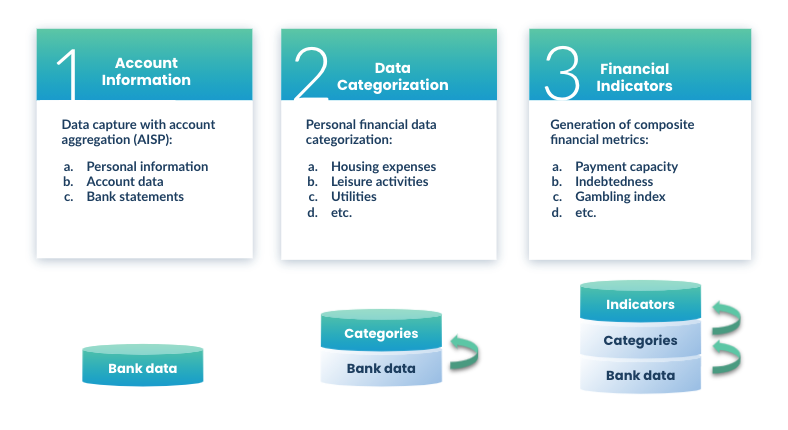

However, raw data is not enough to build innovative financial services. It must be processed in such a way that it’s intelligible, so the insights that are valuable to each use case can surface easily.

What are Unnax’s financial indicators?

The goal of any company that provides financial services is to know its customers better and minimize risk as much as possible.

Unnax’s Financial Indicators are a series of metrics that illustrate a customer’s financial health and behavior. They are designed to help companies limit risk in their operations by making better decisions.

Unnax offers two types of Financial Indicators, onboarding Indicators and dynamic Indicators.

Onboarding indicators

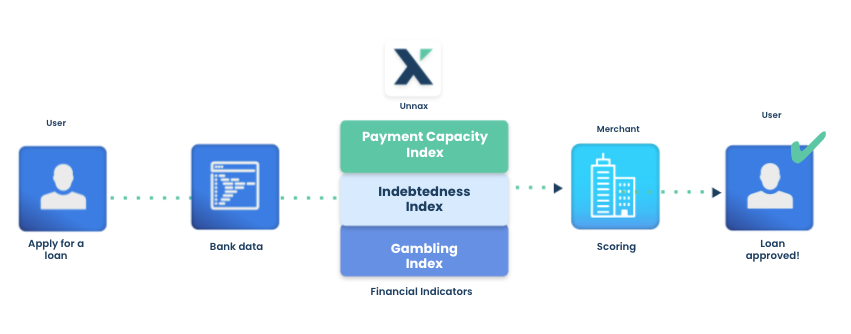

Onboarding indicators are designed to aid a financial services provider during the first contact with a prospective customer, by helping them analyze the user’s financial situation so they can make a decision on whether to provide them with a loan or other services.

In the past, the workflow for lending companies ended with the bank aggregation, that is, the reading of the information of the last 3 or 6 months of banking activity. We know that from this reading, the lender can obtain very valuable information that can have a great impact on decision-making.

But this data must be processed to be able to generate customer intelligence from it.

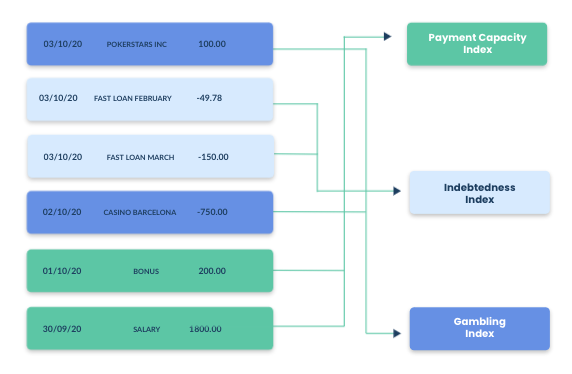

With financial indicators, lenders can obtain metrics that allow them to identify whether a customer is in good financial health. For example, you could calculate what the client’s debt ratio is, that is, how many loans she has and what percentage of her income goes to paying them back, or what their net income and cash flow looks like month to month. With this information, the merchant determines whether or not a person can take on an additional loan.

Unnax’s Financial Indicators aggregate all this data and present it in averages of the last 30, 60 and 90 days to illustrate trends, illustrating what is happening with the client’s finances.

This tool makes the analysis and decision-making process of the company easier, because it helps surface the most important data points in the customer’s finances.

Use cases for Unnax’s financial indicators

Lenders

Credit institutions need to obtain accurate and real-time information about their potential clients in order to make better decisions and minimize loan risk. The compilation of this information by alternative means to Open Banking is tedious since it requires an exhaustive analysis of the client with slower and less precise techniques.

On the other hand, customers are looking for a simple, fast and clear process, with the least possible friction. If the experience offered is uncomfortable, there is a risk of losing the customer.

Given this, financial indicators are ideal for lenders to easily obtain insights on the financial behavior of their clients and thus identify low-risk clients, in addition to creating specific offers that increase conversion.

PFM and BFM

Financial indicators can augment the functionality of personal and business financial management applications by contributing insights on the user’s finances, such as indebtedness, risk-related spending, and others.

By default, many of these applications already provide insights aimed at improving financial management, but the data provided by indicators can add additional depth to their analytical capabilities.

👉 Read more: Everything you need to know about Account Aggregation

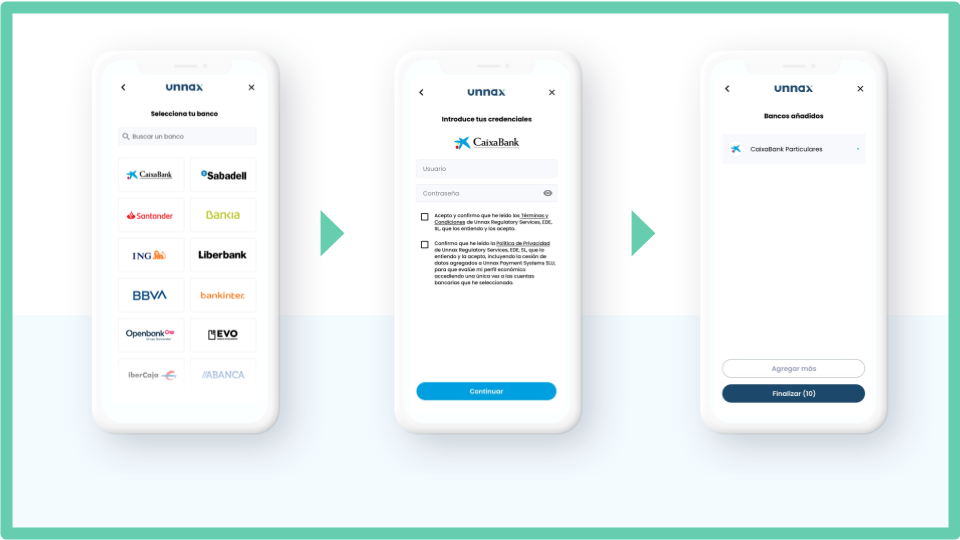

Giving value to data with bank aggregation

Bank aggregation is a technology that allows merchants to connect with a customer’s bank account and extract their data so that they can be used in different analysis and decision-making processes.

At Unnax we have developed a flow for financial businesses with three unique intelligence layers (information on accounts, categorization and financial indicators) to augment their analytical capabilities and improve their decision-making processes.

“Credit is our biggest use case, we have a lot of experience in this vertical and we know in detail what lenders are looking for, together with the technology we have developed, we have a perfect tool to complement and fully cover the customer journey of lending use cases” – Benjamin Cotte – Head of Product

Understand your customers’ finances and make better decisions with advanced financial indicators here.