Every report and article on payments say that 2020 was a great year for eCommerce and online transactions. But will this be the case in 2021?

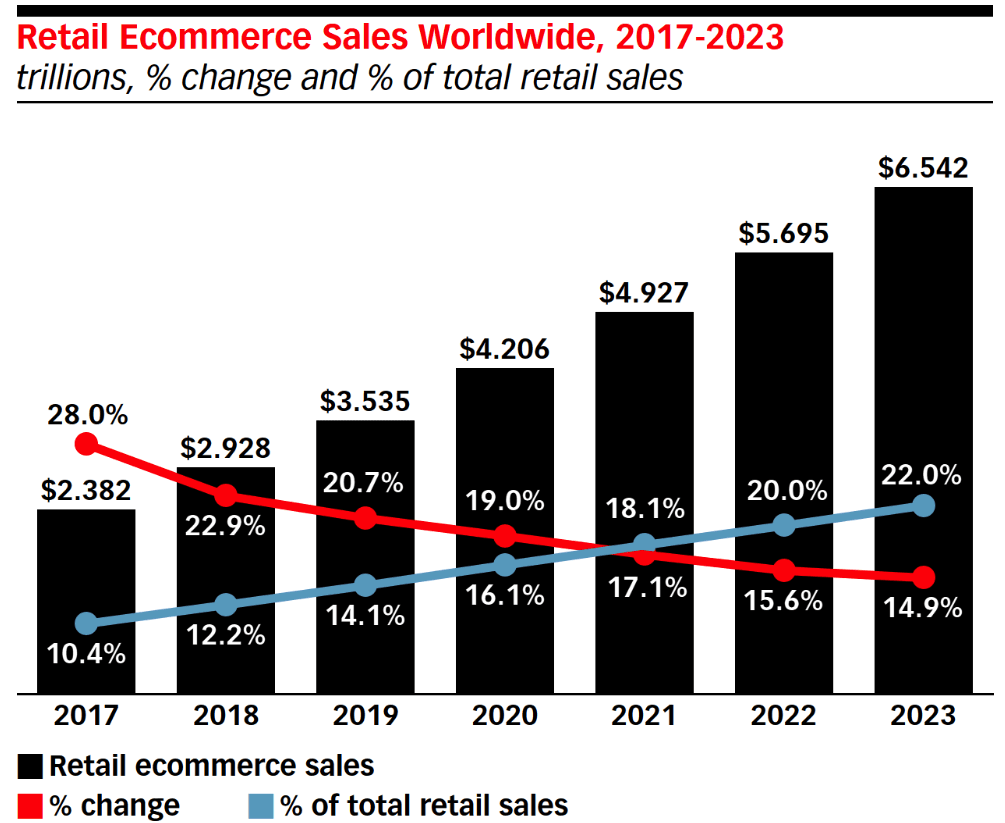

In 2020, the pandemic forced consumers to move their shopping habits online, causing eCommerce to rise to 16% of all retail sales worldwide. This huge increase in sales is definitely good news for the eCommerce industry, but it doesn’t come without potential obstacles.

An increase in electronic and eCommerce transactions also signifies higher interchange fees. In many countries, credit and debit cards are still the most popular payment method, which means merchants often end up paying hefty fees for online purchases. If a higher volume of eCommerce sales are not translating into higher profits, then it’s time to look at alternatives.

Latest payment initiatives pose new challenges for merchants

In 2021, these already hefty fees will cut even deeper into eCommerces’ balance sheet.

In the US, Visa and Mastercard are increasing merchant credit card fees later this year. Visa is also changing how it calculates fees for restaurants, which means those that use online ordering systems will face rising costs.

Meanwhile, Mastercard is raising merchant fees for reward credit cards in small grocery stores, going as high as 2% for customer credit card purchases. With online shopping on the rise and credit cards dominating in-person purchases, merchants will need to put up with even higher interchange fees.

In Europe, after a 15-month delay, PSD2’s Strong Customer Authentication (SCA) requirement has finally come into full force across the whole European Economic Area on 1 January 2021 to decrease the amount of online payment fraud. With 3DS2, the main protocol used to make online payments more secure and comply with the new regulation, every 5th payment will need to be authenticated, regardless of value. Consumers will also need to authenticate if they spend more than €100 within 24 hours.

The SCA requirement will prompt a flurry of confused consumers, and will certainly cause an increase in declined transactions and cart abandonment rates. An Amazon study shows that the 3DS2 authentication rate in Spain could be as low as 21%. According to a Spanish report, this could cause 59% of sales to fail, and a loss of 20.2 billion euros.

Customers who get their transactions declined will opt to use alternative payment methods. If an eCommerce does not offer another option on the checkout page, then they’ve lost a sale and the consumer will go elsewhere.

Open Banking comes to the rescue for eCommerce

The good news is that there is a solution that can help eCommerce companies circumvent these new initiatives while also boosting revenue: direct bank transfer.

👉 You may like: Everything you need to know about Payment Initiation

Although paying by direct transfer is not as popular in Spain as it is in other countries, the new 3DS2 protocol is likely to encourage buyers to switch to new payment methods.

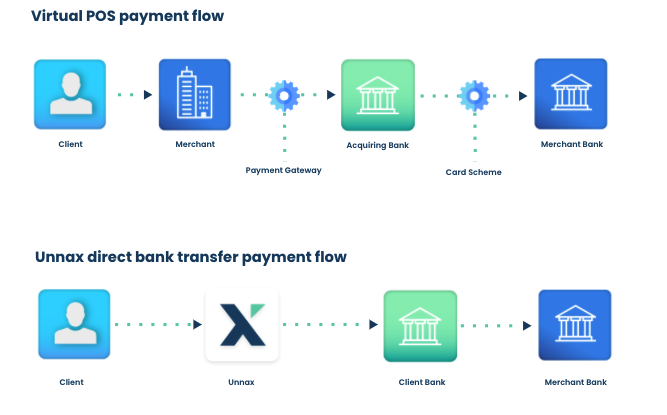

Comparison: Card payment vs direct bank transfer payment

Direct bank transfers are powered by the Open Banking movement, which enables payment initiation services regulated by PSD2. The PSD2 initiative was introduced to break up the monopoly of the banking industry and forces banks to make their financial data shareable through APIs. This allows licensed third parties such as Unnax, to initiate payments from one account to another.

With this new initiative, consumers can make bank transfers directly from their bank account. Although this usually would be a very manual process, with Open Banking the payment initiation process can be automated from start to finish.

Through the usage of APIs, the customer experience is intuitive, faster, and a lot cheaper for merchants, which is why we are seeing a trend of paying by bank transfer rather than debit and credit card throughout Europe. By partnering with a licensed payment services provider, merchants allow consumers to pay with a myriad of fast and secure payment methods, reducing the negative impacts of higher interchange fees and the 3DS2 regulation.

Direct bank transfers are faster, offer a greater customer experience, and most importantly are a lot cheaper. With Open Banking payment initiation, merchants can eliminate both interchange and transaction fees.

The result? Bank transfers cost 30% less on average than traditional card payments. By initiating the credit transfer directly from the customers’ account to the credit merchant account, merchants can bypass expensive middlemen and use SEPA payments, which are a lot faster and more transparent.

A United Nations report predicts that online transactions will remain high even after the pandemic eases. Although it’s great news for eCommerce companies, it means that finding ways to decrease transaction costs should bump its way up to high priority. The good news is that with payment initiation services powered by Open Banking, merchants have a chance to upgrade their payment infrastructure, circumvent high transaction fees and fully benefit from the wave of online shopping.