At first glance, Open Banking may appear threatening to many financial institutions. After all, proprietary financial data is one of the most valuable assets banks have: sharing it with a competitor could spell disaster.

However, Open Banking and the rules governing it, such as PSD2, mean that the data flows both ways. Banks can just as easily tap into a competitor’s APIs then build value-adding services like a neobank or more tech-savvy competitor, yet with the advantage of having a full range of financial products to sell.

Thus, for banks looking to get ahead of the competition and prove their value to customers, this movement is much more an opportunity than a menace. Here are some examples:

How Open Banking lets banks bring value to their customers

Easier access to information

Account aggregation is the first pillar of the Open Banking movement. The idea is clear-cut: bank account data is better when it can flow freely to whoever wants it (with the user’s permission, of course.). From the bank customer’s perspective, this concept can fundamentally simplify the tedious task of tracking their different bank accounts.

A bank can connect a customer with all of its bank accounts, whether internal or external. With information aggregated within an app or dashboard, the user can instantly access a 360° view of their entire financial position.

Gives holistic insights for better financial well-being

Account aggregation goes far beyond just balance information. Using a categorization algorithm and other indicators, banks can provide budget insights and financial coaching. Banks are the authority on money for most consumers. By helping their customers understand their finances and make better decisions, retail financial institutions add real value to their customers from an advisory standpoint. This also leads to increased customer engagement and loyalty.

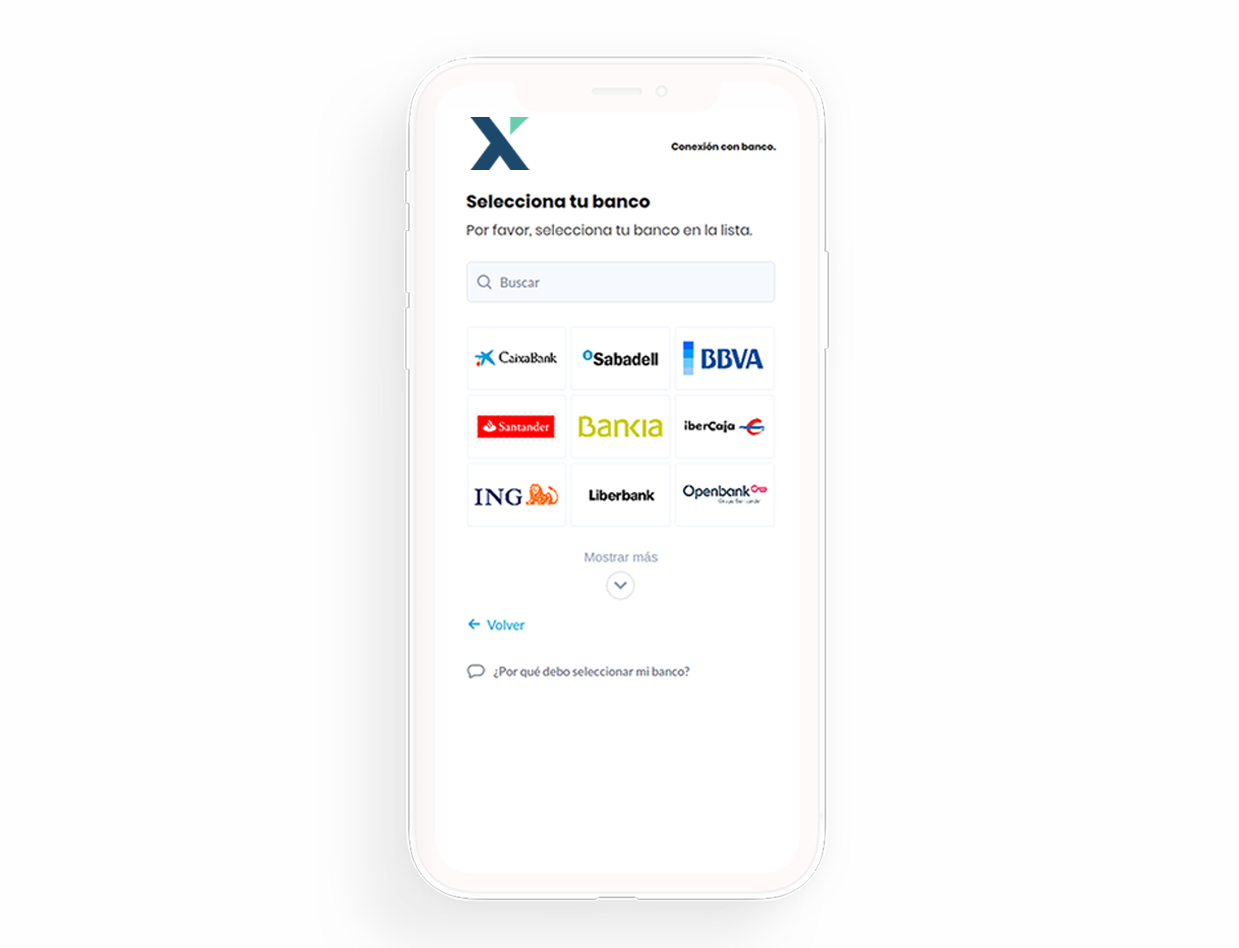

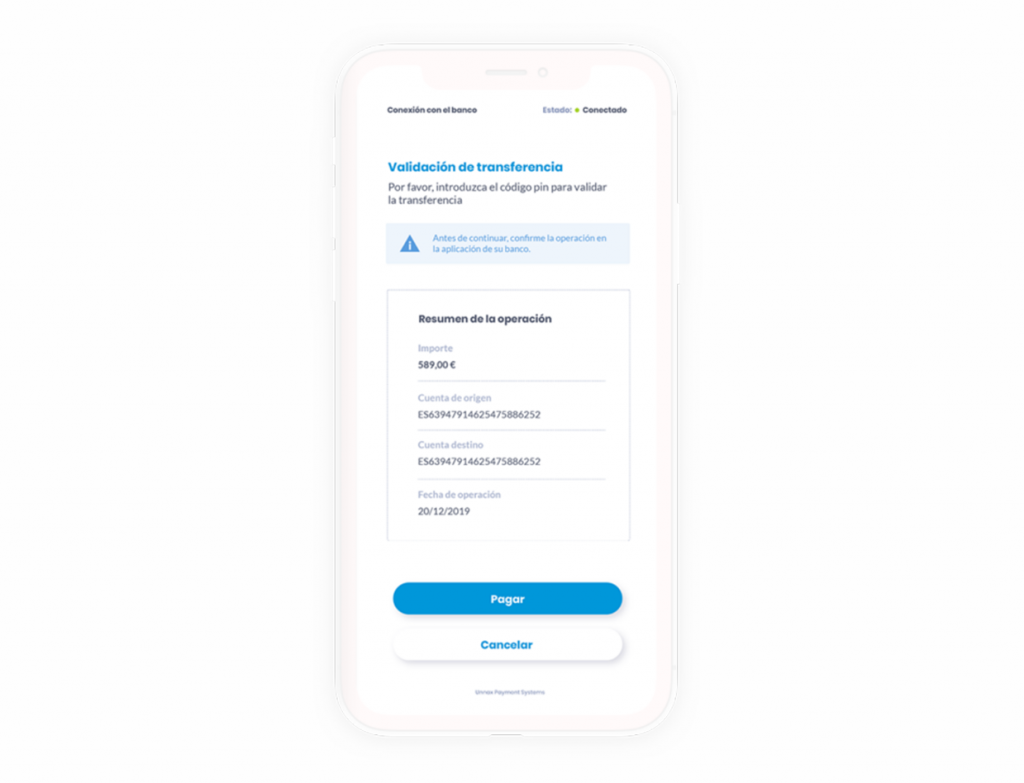

Creates faster and frictionless payments

Open Banking is also transforming the payment process by making it frictionless and faster. Since every institution connects via an API, a bank can quickly transfer money within an app, or with fewer barriers on websites. Now, users can make secure payments without having to enter the cryptic account and routing codes.

Allows them to find the right products for the right needs…

Banks love to build new financial products. Yet, giving consumers too much choice will overwhelm them. This has the potential to limit sales while simultaneously wasting marketing budgets. By using account aggregation and advanced indicators, banks can build more accurate buyer personas to know their customers truly. With this information, they can offer more targeted products and valuable services fit for each specific customer.

… and avoid ones that could harm them financially

Better credit scoring and product matching by a lender means lowering the risk of arrears, underperformance, or default. For banks, the result is clear as these measures protect the balance sheet. For customers, the benefits are enormous.

Beyond the financial risk borrowers take on, falling behind on a loan can negatively impact their mental health. Open Banking’s ability to gain powerful insights about a customer’s real financial picture will help them find the right products while promoting financial and mental well-being.

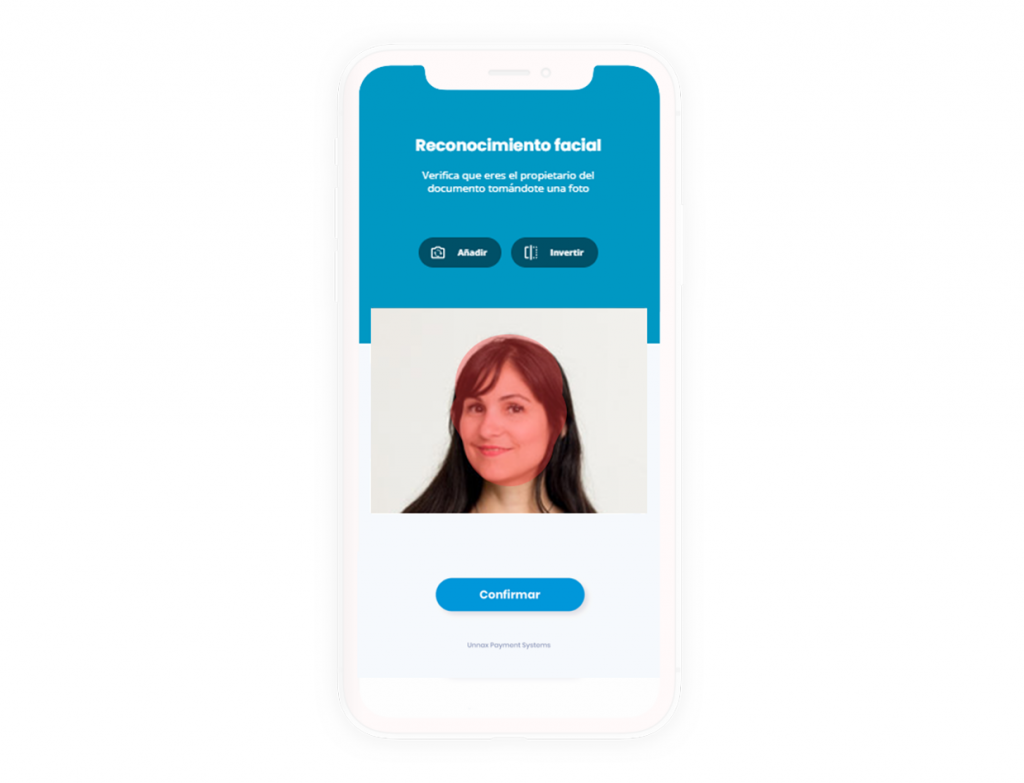

Enables swifter onboarding

ID verification is a tedious process that can quickly result in the consumer’s abandonment of a product. Open Banking’s account aggregation feature allows banks to verify a user’s identity checking against different sources rapidly. For prospective customers, faster turnaround times leave better first impressions while building valuable trust in the process.

Makes the User Experience truly personal

In the coming decade, customer experience will be a primary consideration for retail banks, which comes as no surprise, considering how tech constantly makes our interactions more personalized.

Through account aggregation to payments, financial institutions can ensure that their users feel valued each time they log onto their dashboard or open their app. With each personalized message or suggestion, customers will feel appreciated, building the groundwork for a long-term, lucrative relationship.

Why retail bankings should look to Open Banking to add value

Getting this formula right has the potential to be a key differentiator in the years to come. It’s no secret that bank branches are closing as consumers prefer to do their banking online. Without the human touch, banks will need all the help they can to build trust, keep users on their platform, and attract new ones.

Of course, traditional banks don’t have to go it alone. Partnering with a Fintech company who has a digital-first approach to financial services can help banks quickly build cutting-edge UX demanded by the public. In this sense, the two can offer the best of both worlds: a wide range of financial products coupled with an interface that users engage with.

Ultimately, regardless of whether a bank forms a partnership or innovates internally, the key is to get on board with Open Banking and adjust to a new playing field as soon as possible. This is the only way to provide value-adding services that keep customers coming back without ceding market share to competitors in the future.