If you’re a merchant accepting payments, it’s likely that you’re either already taking recurring payments or you’re planning on doing so.

There are many ways to accept recurring payments: Open Banking, SEPA Direct Debit, or with card payments. Each method is different, and each has several pros and cons and is useful for different use cases.

In this post, we’ll look at the definition of each recurring payment method, compare the three, and analyze some of the top use cases.

Recurring payments with Open Banking

Executing recurring payments via Open Banking allows merchants to take recurring payments via direct bank transfer.

Usually, direct bank transfers are manual and cumbersome for consumers. But with Open Banking, a licensed third party pushes the payment — not the customer. The main benefits of taking repeated payments via bank transfer are that it’s a lot cheaper for merchants, settlement times are shorter and there are no chargebacks.

With Open Banking recurring payments, customers are set up with ongoing consent with the merchant, which means the payment only needs to be authenticated once and then offers direct access to the customer.

👉Learn more about Open Banking

SEPA Direct Debit

If Open Banking payments are “pushed” by the customer, SEPA Direct Debit are the opposite: they are pulled by the merchant.

SEPA direct debit is a European system that allows merchants to collect recurring euro payments from 34 countries. Once the customer signs a “mandate”, the merchant then initiates the payment at every interval.

SEPA Direct Debit is bank to bank, with no card networks involved. All transactions must be in euros, and customers can request a refund up to 13 months after the payment.

In order to set up a SEPA Direct Debit, companies need to first ask customer to complete a mandate to authorise the payments. Mandates need to include legal wording and mandatory customer information, and can be completed online or on paper. Once the customer has completed the mandate, it then needs to be submitted to a bank. The Direct Debit is then active once the first payment is confirmed.

Credit card payments

Recurring credit card payments are the most well-known payment type, where the customer allows the merchant to take a repeated payment via their card. These payments continue until the customer cancels or when the repayment schedule finalizes.

Although the payments are fast and convenient, they go through various intermediaries, which is expensive for merchants. Chargebacks are also a big issue, as card networks charge high fees for processing them. Not only that, but card payments have some of the highest fraud rates since they are hard to track and fraudsters are rarely pursued. Churn is also higher than usual due to expiry dates and the fact that cards can be lost or stolen.

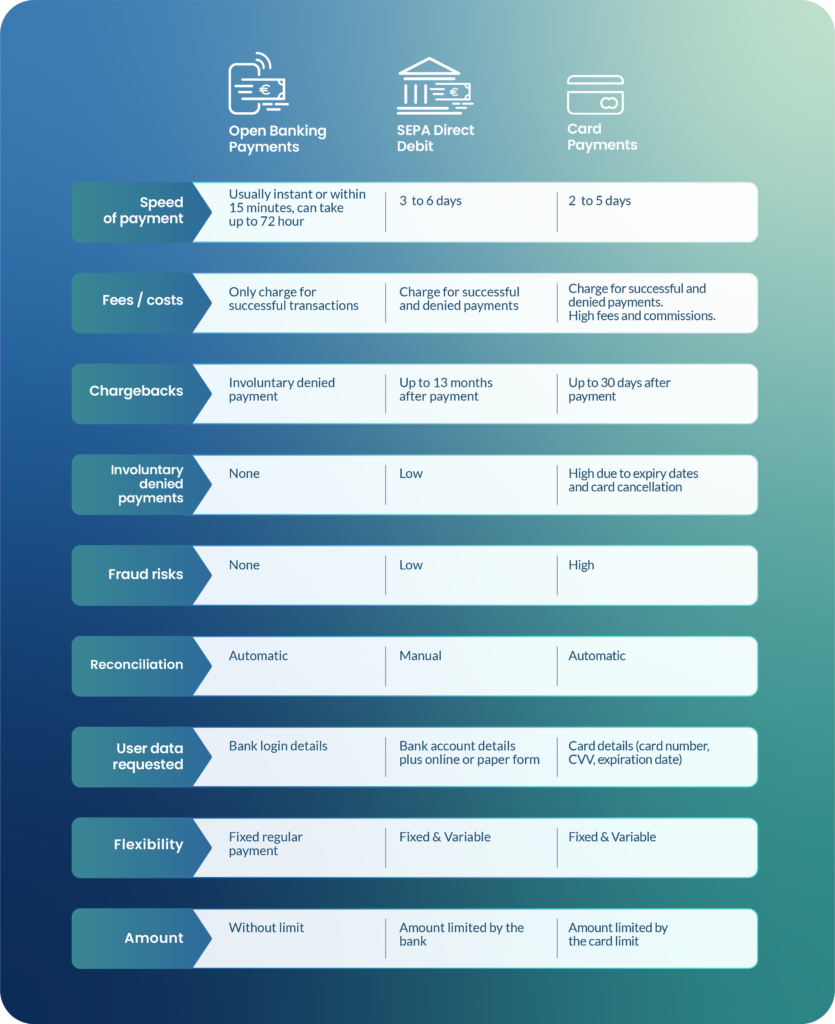

Let’s look at the benefits and comparison between these three recurring payment types in more detail:

Comparison between recurring payment methods:

Which option is best for you?

Card payments

Card payments are expensive and less secure, but they are convenient. That means they are especially good for transactions that need to be cleared immediately and must be paid quickly. This is often the case for e-commerce services and online shopping.

However, card payments can get very expensive for recurring payments as fees need to be paid at every interval. They aren’t the ideal payment method for merchants that want to lessen denied payments or when the amount to be paid is high and they want to reduce the cost per transaction.

SEPA direct debit

Direct debits are great if you have a long-term relationship with your customer and if you want greater confidence that they will pay their bills every month on time.

Since it’s a set and forget payment method, merchants don’t have to chase late payments. Having said that, reconciliation is difficult and complicated. They are also variable, which means the quantity can be adjusted every time.

However, direct debits are limited to the euro currency and can take a while to settle, making it harder for merchants to manage cash flow. The mandate that requires signing and paperwork is also very admin-heavy and isn’t the most straightforward for the customer.

The top use cases for SEPA direct debit are typical subscription-based merchants such as SaaS companies, gyms, and subscription companies that operate in the euro area and have a long customer lifetime value.

Open Banking payments

Open Banking payments are a relatively new payment type that is an improvement on both card payments and SEPA direct debit. They offer more security than cards and instant settlement, with a lower price and less admin than direct debits and cards.

With Open Banking, customers complete payment by logging in via their bank. Once the customer accepts the recurring payment, a licensed third party will push it at regular intervals.

Since it’s more secure and settlement is usually instant, Open Banking recurring payments are especially useful for higher value recurring payments, such as for insurance and loans. In general, fixed Open Banking recurring payments are an ideal payment method for merchants that are charging or invoicing high fixed amounts on a recurring basis, such as SaaS, insurance, and lending companies.

👉Read more: Everything you need to know about payment initiation

Since only fixed Open Banking payments are available at the moment, this payment method isn’t suitable for a merchant that might be charging variable costs every interval. However, variable recurring payments (VRP), will be soon available and merchants will be able to use them.

Most merchants will currently be taking payments with cards or with SEPA direct debit — but Open Banking recurring payments offer an opportunity that the other payment types don’t: lower fees, more security, and much faster settlement. We hope this article makes it clearer which payment method works best for your specific business.