The EU’s Consumer Credit Directive 2 (CCD2) has its sights set on digital microlending.

As the second iteration of the EU’s CCD regulation, CCD2 revises credit agreements for consumers and legally clarifies rules regarding digital credit products.

Per the Spanish Presidency Council of the European Union, the new directive aims to achieve three goals:

- Simplification of existing legislation

- Increase in consumer protections

- Creation of a level playing field for online financial services

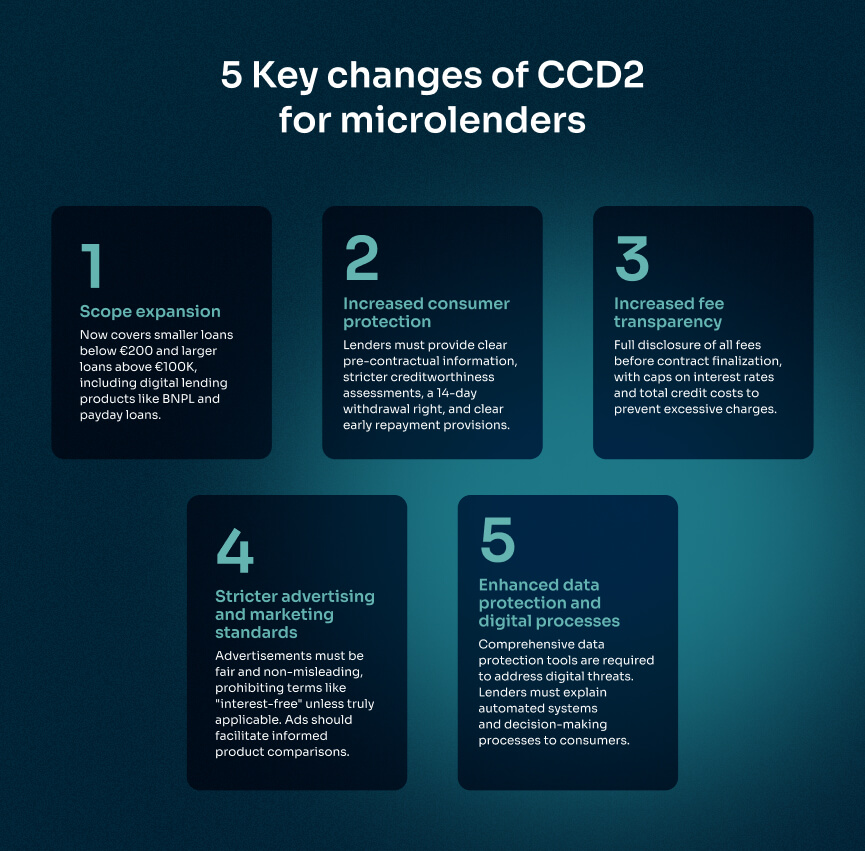

Establishing CCD2 compliance requires lenders to understand the regulation’s key changes.

CCD2’s shifts its focus to microlenders and digital products

Lenders of all kinds now face many of the same regulatory expectations as traditional credit institutions in Spain. While some personal small loan providers historically flew under the radar, regulators are now increasing their focus on the digital lending space, bringing microlending operations to the forefront.

CCD2 introduces several changes to compliance requirements to address:

1. Scope expansion

An increase of oversight for micro and digital lenders is one of the most significant changes.

CCD2 expands the directive’s regulatory scope to include both smaller loans (below €200) and larger loans (above €100K). Additionally, it increases coverage of online and digital lending products to include alternative loans, such as Buy Now, Pay Later (BNPL).

The expansion of loan-type coverage ensures that online and digital lenders adhere to the same standards as traditional lenders.

2. Increased consumer protection

CCD2 aims to increase consumer protection in digital lending environments. Specifically, lenders must comply with the following changes:

-

Pre-contractual information

Lenders must provide clear, comprehensive, and standardized pre-contractual information to consumers that plainly explains the terms of the credit agreement.

-

Assessment of creditworthiness

Stricter creditworthiness assessment standards require lenders to use sufficient and relevant data to evaluate a consumer’s ability to repay the loan.

-

Right to withdrawal

Consumers gain the right to withdraw from a credit agreement within 14 days without giving any reason.

-

Early repayment

Clear provisions for the consumer’s right to early repayment must be outlined, including the method of calculating the compensation due to the lender.

👉 Must reads: Responsible lending: How digital innovation is reshaping the lending space

3. Increased fee transparency

Across the board, CCD2 provides greater clarity around interest rates, fees, and charges associated with loans. The new regulation requires lenders to clearly communicate all fees to consumers before finalizing contractual agreements.

CCD2 also introduces caps on interest rates and the total cost of credit in some circumstances to protect consumers from excessive charges.

4. Stricter advertising and marketing standards

CCD2 imposes stricter advertising and marketing rules to ensure all advertisements for consumer credit are fair and not misleading. The information included within advertisements must allow consumers to make informed comparisons of the advertised product to other lending products.

In addition to clearer advertising standards, CCD2 prohibits using certain misleading terms, such as “interest-free” and “free of charge.” Such terms may only be used when a lender can genuinely offer products matching their advertised cost of credit.

5. Enhanced data protection and digital processes

CCD2 mandates that all lenders use comprehensive data protection tools to address both traditional and digital threats, especially within the context of digital lending.

The regulation further requires lenders to provide consumers with clear information regarding the mechanisms of specific technologies. For example, when using automated systems for credit assessments, lenders must inform customers of the logic involved and the significance of the decision-making process.

👉 You’ll like: How Loaney Improved Processes and Increased Loans 4x with Unnax

Unnax’s account aggregation helps Spanish lenders comply with CCD2

With the roll-out of new CCD2 underway, ensuring compliance with the new creditworthiness assessment requirements stands out as one of the most significant challenges for lenders to overcome.

To help with overcoming that exact challenge, Unnax’s account aggregation solution provides lenders and microlenders in Spain with the technological capabilities to perform comprehensive and automated solvency analyses that comply with the new obligations outlined in CCD2. Microlenders in Spain can consolidate financial data from multiple accounts to gain comprehensive overviews of customer finances.

Bank account aggregation is essential in the creditworthiness assessment because it will allow you to immediately and accurately access a credit applicant’s financial information, without interrupting the application process.

This is key because legislation requires that creditworthiness evaluations be based on relevant and accurate data about the consumer’s income, expenses and other financial criteria. The ability to consolidate this data in real time ensures that you can make quick and informed decisions, meeting the accuracy standards imposed by CCD2, while providing a seamless and frictionless experience for your users.

The Unnax platform simplifies and enhances CCD2-compliant creditworthiness assessments by providing:

- In-depth data that goes beyond PSD2 data

- Real-time data aggregation, with results in 15 seconds or less

- Near total coverage (98%) of the Spanish banking market

- 2-Step Verification for obtaining more than three months of statements and up to a year’s worth of transactional data

- Tokenized connections to support both one-off and recurrent readings

- Certificates of aggregation to prevent fraud and disputes

With Unnax, you can complete thorough and accurate customer creditworthiness assessments using sufficient and relevant data. Unnax provides the real-time access you need to vital customer data, enabling speedy decision-making processes and reducing non-performing loans.

The importance of CCD2 compliance cannot be understated, especially for microlenders facing these regulatory challenges for the first time.

As a certified Electronic Money Institution (EMI) registered with the Bank of Spain, Unnax has in-depth regulatory knowledge of Spanish lending markets. Microlenders in Spain can rely on Unnax to access advanced financial capabilities that simplify creditworthiness assessments and compliance with CCD2.

Speak with Unnax today to get started.