The EU’s Consumer Credit Directive 2 (CCD2) imposes several new regulatory requirements and expands the directive’s regulatory scope to include online and digital microlenders.

One major change introduced in CCD2 revolves around creditworthiness assessments.

For microlenders in Spain, understanding how to perform creditworthiness assessments according to the new consumer credit law standards is essential for achieving and maintaining compliance.

What’s new with CCD2: Creditworthiness assessments

CCD2 mandates that all lenders (microlenders included) must perform a creditworthiness analysis of potential borrowers using sufficient and relevant data. The data used must precisely evaluate the customer’s repayment ability, ensuring lenders do not distribute funds irresponsibly.

Per the official CCD2 regulation:

“In an expanding credit market, in particular, it is important that creditors do not engage in irresponsible lending or give out credit without prior assessment of creditworthiness. Member States should carry out the necessary supervision to avoid such behavior of creditors and should determine the necessary means to sanction such behavior.”

Creditworthiness assessment requirements in detail

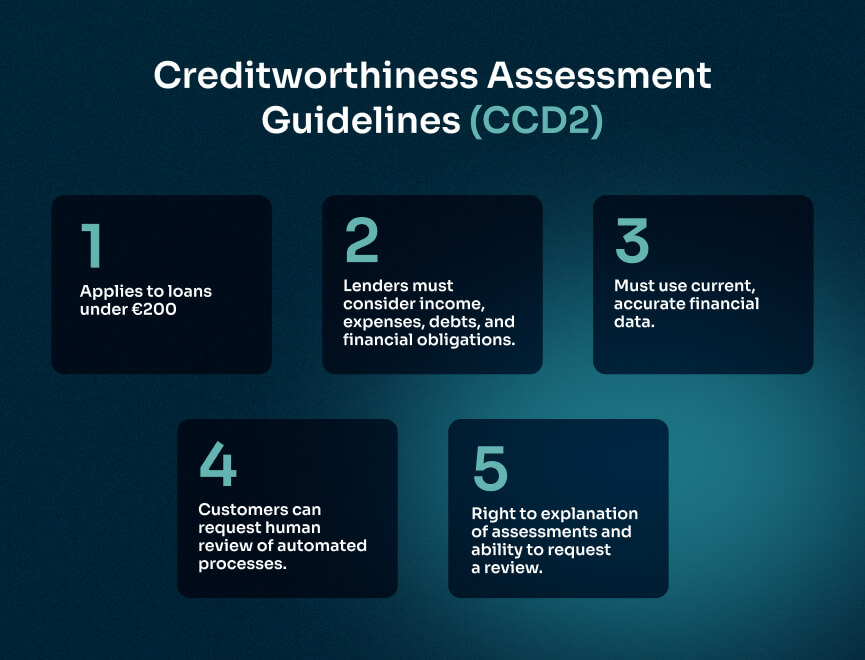

The specific details and requirements CCD2 outlines regarding creditworthiness assessments include:

- Creditworthiness assessments must now also be performed for loans of less than €200.

- Lenders must establish a holistic view of each customer’s financial health, accounting for factors like income, expenses, existing debts, and other financial obligations. They should also consider the consumer’s income, expenses, and other financial and economic circumstances.

- Creditworthiness assessments must use up-to-date information and data that accurately reflects a customer’s current financial situation.

- Customers gain the right to request human intervention from creditors in any automated processes involving customers’ personal data.

Customers can request and obtain a reasonable explanation of their creditworthiness assessment, after which they can express their opinions and request a review of the assessment and lending decision by the creditor.

👉 You may like: How Loaney Improved Processes and Increased Loans 4x with Unnax

Consumer Credit Directive Spain: The challenge of creditworthiness checks

Spain has a booming microlending market, making CCD2’s widened regulatory scope particularly impactful within this region. Creditworthiness checks can be a significant task for any lender, but especially microlenders without established IT departments.

The challenge of creditworthiness checks for microlenders lies in the imperative of immediacy that such assessments can delay. Current legislation asks for accurate information with the possibility of presenting tangible documentation if requested, further elongating the completion of an assessment.

Breaking this challenge down from a technical standpoint, CCD2 presents microlenders in Spain with three major hurdles regarding creditworthiness assessments:

-

Data collection:

Microlenders need the technological capabilities to collect customer data from multiple different sources (i.e. checking accounts, savings accounts, existing debt, etc.), as well as an integrated digital environment to store and assess this data accurately.

-

Cybersecurity:

When handling personal customer information, microlenders must ensure all digital platforms and products collecting or using customer data are secured against cyber threats.

-

Assessment efficiency:

To keep the lending process operating smoothly, profitably, and with a high UX, microlenders need the ability to complete creditworthiness assessments instantly, while still maintaining a fair and accurate assessment process for customers.

Open Banking can substantially reduce the burden of creditworthiness checks for microlenders by providing the streamlined data necessary for a secure assessment process. With technology partners like Unnax, microlenders can tackle the challenges of the new regulatory requirements with greater ease and efficiency.

👉 Read more: Mastering Payment Collection Methods With Unnax’s Solutions

How Unnax’s account aggregation simplifies creditworthiness assessments

Unnax’s account aggregation solution enables microlenders in Spain to easily perform creditworthiness assessments in real-time. Our platform provides accurate, up-to-date, and categorized financial data that simplifies your credit decisions.

With Unnax, you can complete comprehensive and automated solvency analyses that help you not only perform creditworthiness assessments in real-time but also help meet the requirements of CCD2.

Perks of Unnax’s account aggregation solution for microlenders in Spain include:

- Access to both PSD2 and non-PSD2 data to provide you with valuable and in-depth insights

- Real-time data aggregation, with results in under 15 seconds that power speedy assessments

- 98% bank coverage in the Spanish market, including both personal and business accounts

- Tokenized connections for recurrent reading

- Certificate of aggregation to prevent fraud and disputes

Unnax gives you a detailed overview of each customer’s financial profile and spending patterns, aiding you in creating accurate customer personas and segments.

Using Unnax’s account aggregation solution, you can streamline decision-making processes and ensure all creditworthiness assessments are both compliant and accurate.

Chat with Unnax today to get started