New electronic invoicing regulation is on the horizon for Spanish businesses.

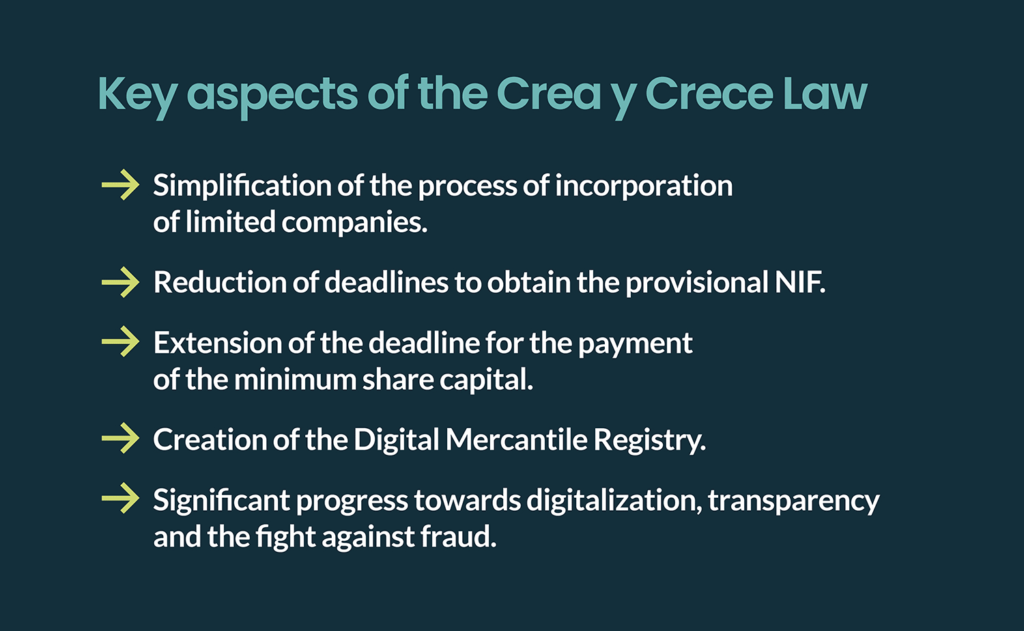

Law 18/2022 — first approved in September 2022 — outlines the new e-invoicing expectations and obligations for Spanish businesses. According to the official text, the regulation aims to “promote the use of electronic invoices” to digitize business relationships, lower transaction costs, facilitate transparency, and reduce the impacts of late payments.

Compliance for businesses will be implemented in two phases. Initially, large taxpayers, with a turnover above €8 million, are slated for compliance in the second half of 2025. Subsequently, all other taxpayers will follow suit 12 months later, with the implementation date set for 2026.

In addition, the certification requirements for e-invoicing software ‘SIF / VERI*FACTU’ are set to come into force on July 1, 2025. Starting from July 2025, any software that fails to meet the established criteria will be considered illegal. The Tax Agency retains the authority to impose fines on businesses (ERP users) of up to €50,000 merely for possessing such a non-compliant system.

With these looming deadlines in mind, let’s examine what mandatory e-invoicing in Spain entails.

Learn more: How the PSD3 regulation will impact the European financial industry

What is mandatory B2B electronic invoicing?

Electronic invoicing (e-invoicing) is the process of sending and receiving invoices digitally.

As the financial world becomes more technological, more countries and jurisdictions are looking into the benefits of e-invoicing. To address growing concerns and challenges surrounding financial management in European businesses, many countries in the region are turning to mandatory B2B electronic invoices.

A mandatory B2B electronic invoice necessitates the use of electronic invoicing systems that allow for greater efficiency through improved data sharing and automation capabilities.

In Spain specifically, the regulation of e-invoicing is overseen by the Ministry of Economic Affairs and Digital Transformation, as well as the Ministry of Finance and the Spanish Tax Agency. As of December 2023, Spain has two main pieces of legislation in place regarding e-invoicing:

– Law 18/2022: Law 18/2022 requires all B2B transactions to be exclusively supported by electronic invoices. The software used to generate, process, and validate electronic invoices must be authorized by the tax administration.

– Law 25/2013: Law 25/2013 establishes the obligation of electronic invoicing and the creation of the entry registration point. This law made B2G e-invoicing mandatory in Spain in 2015.

Under this legislation, electronic invoices must adhere to a specific structure and include certain mandatory information. To comply with these regulations, your business must ensure the authenticity of origin, the integrity of content, and the legibility of the invoice — from the point of issue to the end of the period for storage of the invoice.

The benefits of B2B electronic invoices

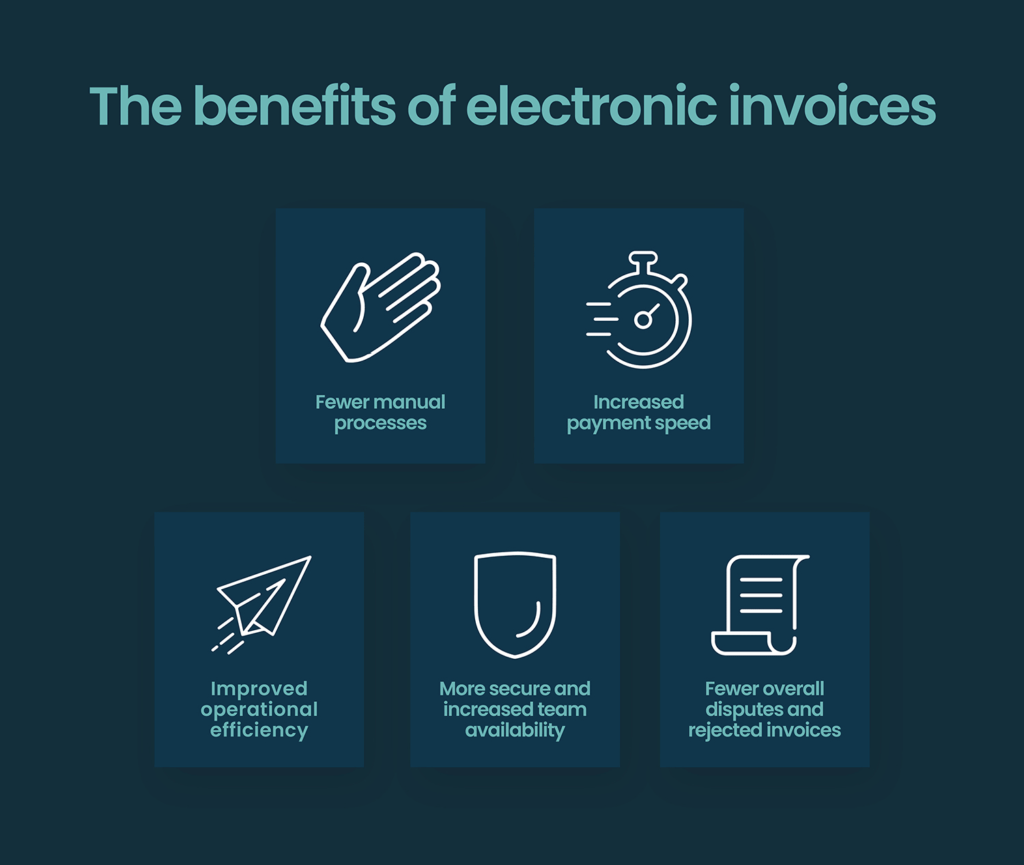

Electronic invoicing comes with many excellent benefits for B2B use cases, particularly in terms of boosting overall business resilience and productivity.

Let’s take a look at three key advantages of B2B electronic invoices:

– Fewer manual processes: Electronic invoices are sent directly between the sender and the receiver’s IT systems, eliminating the need for manual processes for the receipt and validation of an invoice. Additionally, reduced manual processes also make electronic invoicing more secure.

– Increased payment speed: A fully automated invoicing system makes it easier to approve and pay off invoice balances. As a result, your business can focus on increasing productivity without manually hassling with cash flow management and account reconciliation processes.

– Improved operational efficiency: Electronic invoices ultimately give your business greater resilience by enabling fewer overall disputes and rejected invoices. In turn, invoice payments can be gathered quickly, allowing your team to focus on business innovation.

In addition to the more general benefits of electronic invoices, new e-invoicing regulations in Spain aim to reduce administrative burdens, optimize financial management, improve tax control, and enable a more efficient exchange of information between businesses.

Who is required to issue electronic invoices?

In Spain, the mandatory electronic invoicing regulation applies to all businesses engaging in B2B transactions and invoicing. Those exempt from the legal requirements of Law 18/2022 include:

– B2B transactions in which neither party has a primary economic activity headquarters or a permanent establishment within Spain.

– Travel agencies, transport services, and retail activities.

– Businesses using simplified invoices that are issued in accordance with Article 4 of Royal Decree 1619/2012.

We think you’d like: How Wolters Kluwer Increased Productivity and Efficiency by 60%

How ERPs can prepare for electronic invoicing

Providers of electronic invoicing software must ensure the certification of their electronic invoicing systems.

Specifically, the entity or individual responsible for developing the computer system must certify its compliance with regulations and specifications through a responsible declaration, as approved in its development through ministerial order.

These programs must guarantee the integrity, preservation, accessibility, readability, traceability, and unalterability of billing records. The crucial component of the system is its secure capability to generate and store billing records.

Electronic invoicing software must particularly ensure:

– The integrity and unalterability of billing records, with the system detecting and issuing a warning if modifications occur after generation and recording.

– The traceability of billing records, requiring linkage for traceability verification through their creation sequence.

– Compliance with regulations, including a secure procedure for downloading, dumping, and archiving billing records, which should be exportable to external storage in a readable electronic format.

For providers of Enterprise Resource Planning (ERP) software, electronic invoicing represents both a challenge and an opportunity to establish a competitive advantage. ERPs should be ready to introduce new features allowing users to issue and receive electronic invoices, preferably on a unified platform.

Through the implementation of the right electronic invoicing solution, ERPs can generate significant additional revenue, enhance customer retention, and foster loyalty with a seamless user experience.

Rely on Unnax to prepare for mandatory B2B electronic invoicing

A significant change for businesses and professionals will be the obligation to track the various stages of invoices, with a particular focus on payment validation, through the electronic invoicing system.

These added “bureaucratic procedures” might pose challenges for businesses unless integrated with payment solutions to automate these new reporting obligations.

ERPs can seize the opportunity to empower their clients to automate payment and reporting operations through a unified platform. To sum up, ERPs can expect:

– Diversification of their service offerings, resulting in increased revenue.

– Enhanced user experience for their clients, leading to greater loyalty.

Unnax solutions, such as IBAN accounts and payment methods, emerge as the ideal solution to streamline payment transactions, ensure compliance, and provide instant bank reconciliation.

This service allows ERP end-users to have an IBAN account (after a successful onboarding process), offering various functionalities, including the automatic settlement of electronically issued or uploaded invoices in the ERP.

The process is quick, simple, and entirely automated, guaranteeing efficient reconciliation of payments for these invoices in the ERP-linked account.

Contact Unnax today to discover how we can help you prepare for B2B e-invoicing in Spain.