As of December 2020, Spanish household debt accounted for 67% of the country’s GDP.

Considering the huge effect the pandemic had on the entire world, these numbers are not all that surprising. Debt has played an essential role in helping individuals and businesses soften the blow of the crisis and take the right steps to recover.

It goes without saying that a world with large amounts of debt is also a world with large amounts of debt collection. Since debt is indispensable to recover from the crisis, debt collection as an industry has had to revitalize and focus on ensuring a smooth customer experience while being able to fully recover funds. As we’re about to see, effective debt collection is essential to helping lenders become more efficient and therefore be able to offer more loans to a wider range of customers.

This is the last part of our lending workflow series, where we look at the best ways to optimise the entire lending process. In this article, we’ll cover the main problems lenders face during collections, what the pay in workflow looks like with and without Open Banking, and the main technologies that enable a modern debt collection process.

What problems do lenders face during collections?

Not getting paid on time

It’s no secret that average payment terms in Spain are some of the longest in Europe. Due to the lack of information available, lenders usually have difficulties identifying financially vulnerable borrowers and helping them repay their debts faster.

For lenders, late payments can cause cash flow issues, increase losses and make it even harder to build accurate credit models.

Low loan repayment rate

The high friction and lack of automation in the collections process result in a low loan repayment rate for lenders. Couple that with no clear collection strategy, and lenders are left resorting to manual intervention to chase payments.

Due to the lack of automation, lenders find it difficult to identify and contact debtors, causing them to rely on single-channel communication — usually phone calls — rather than multi-channel such as email and SMS. Debtors are therefore continuously chased and put under pressure, rather than being offered a personalized payment plan that would increase their chances of repaying on time.

Lack of information

Why can’t lenders offer a personalized collection plan? The most common reason is the lack of information. It’s hard to know when the right time is to request payment when there is no real-time customer data and frequent communication breakdowns.

Lenders also do not have access to the most important metric: affordability. That’s because credit risk assessments are still based on outdated documents such as bank statements and credit scores. The complexity of public record databases also makes it hard to locate debtors across all the data.

Without being aware of a customer’s disposable income and overall financial health, it’s almost impossible for a lender to design a personalized payment plan that works for vulnerable customers.

👉 Read more: Decisioning: what it takes for lenders to make accurate credit decisions

Chargebacks on loan repayments and payment default

Another big problem facing lenders is the high fees on chargebacks and payment defaults that come with card payments. Card networks are highly adverse to chargebacks, with most disputes awarded to the customer rather than the lender. Chargeback fees can range from €20 to €85 depending on the acquiring bank, which can quickly make a dent in a lender’s bottom line.

You may like: Online fraud: Facing it with APIs

The pay in workflow with and without Open Banking

Currently, there are many obstacles facing lenders when it comes to optimizing the debt collection process. Let’s look at how Open Banking can help streamline and improve the workflow.

The traditional process

How do lenders collect repayments? Usually, the lender tokenizes the borrower’s debit or credit card data during the onboarding phase. This allows the lender to then charge the card with the corresponding amount at specific times.

Although it’s a method that is expensive due to the high card fees, it generally works well when a customer pays on time and has enough money in their bank account.

However, when a payment request bounces and the lender is unable to process a payment, the repayment process then requires human intervention. An employee will then be in charge of manually reaching out to the debtor, usually via a phone call.

The overreliance on manual processes makes it quite an inefficient legal practice, with lenders spending a large portion of their overhead manually collecting payments from debtors.

What if there was a simpler, cheaper way?

With Open Banking

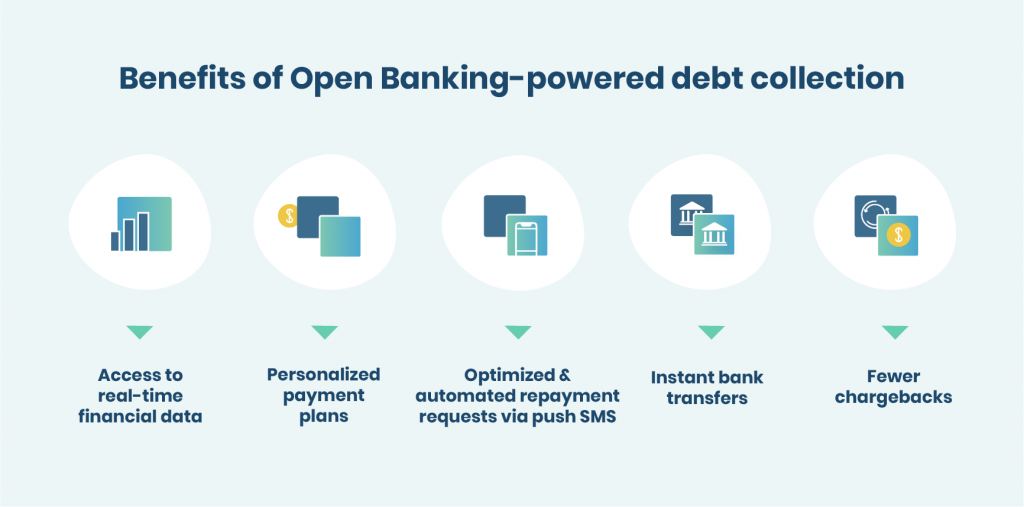

Open Banking allows a complete reinvention of the collection process.

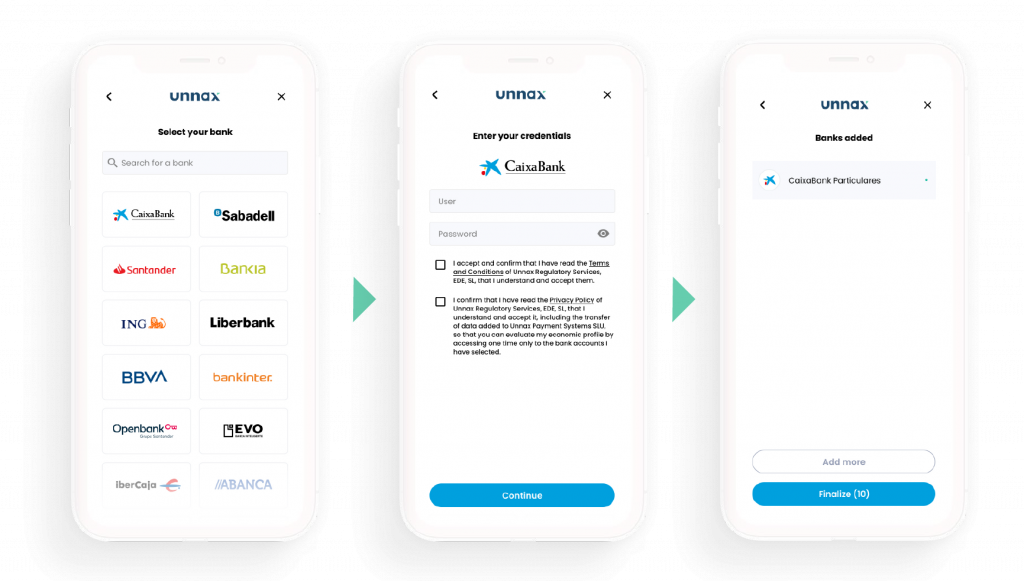

During the onboarding process, the borrower allows the lender to connect (with consent) directly to their bank account via a payment API. This allows the lender to use real-time information to assess creditworthiness and therefore offer a more accurate loan agreement.

When debt collection begins, the lender is already connected to the borrower’s bank account and can therefore automatically transfer funds using payment initiation. By enabling recurring bank aggregation, lenders can find out whether the customer has enough funds in their account, and then trigger a payment withdrawal based on the information processed.

👉 Learn more: Everything you need to know about Account Aggregation

There are several benefits to implementing this method: first of all, lenders can offer a personalized payment plan to financially vulnerable borrowers based on the financial transactions happening in their bank account (e.g. asking for repayment the same day they receive their salary or pension).

Second of all, Open Banking enables account to account transfers which completely bypass card networks. That means instant transfers that are cleared in real-time, contrary to the 24 – 48 hours required for traditional card payments. They are also 30% cheaper than traditional card payments, and since it’s an active payment method, there are no transaction size limits, no expiration dates, and very few chargebacks — a big win for lenders.

Third of all, communication is a lot more responsive between the borrower and lender. For example, with Unnax’s Click & Pay system, lenders can send a push SMS to the customer with a link that allows them to pay back instantly, rather than having to go through lengthy phone calls.

Open Banking does not completely remove debit cards from the mix. It simply allows debtors to pay via multiple payment methods, whether it’s with a card or via bank transfer. Giving customers the choice to pick between payment methods helps increase conversions and repayment rates.

Overall, Open Banking helps lenders save time, money and helps increase security as well as develop stronger relationships with customers.

Technologies to get a better collection process

Let’s look a little more closely at the specific technologies that help Open Banking streamline the debt collection process.

Recurring bank aggregation

Bank aggregation is what allows lenders to have continuous access to a customers’ financial state, personalize a repayment plan accordingly, and therefore make collections at the right time.

With recurring bank aggregation, lenders have access to real-time, reliable data that can be used to perform much more accurate credit analysis. They can then set up recurring payments — with the customer’s consent — for repayments and therefore reduce the penalties for payments that bounce.

With bank aggregation, lenders can also offer much more personalized messaging through the right channels to help increase repayment rates.

Payment initiation

Payment initiation is one of the main pillars of the Open Banking movement and is enabled by PSD2 (the Second Payment Services Directive). It’s what enables licensed third parties to push payments on behalf of merchants and financial institutions via an API.

The main advantages of payment initiation are:

- Settlement is real-time and a lot faster than card payments

- Chargebacks are restricted since there are fewer intermediaries

- Transfers are 30% cheaper than card payments

- There aren’t any expiration dates or restrictions on transactions

Payment initiation also offers an excellent user experience to the customer: once they open the screen, they just need to input their bank login details, and payment is completed automatically. Since it’s an active payment, it drastically reduces payment fraud, making it a lot safer for lenders.

👉 Read more: Everything you need to know about payment initiation

Click & Pay

Click & Pay is a payment method we designed at Unnax that helps increase conversions: with a Click & Pay widget, we can generate a payment link which is then sent in bulk to users via SMS and email and can be tracked for conversions. The user receives an SMS regarding their loan repayment and just needs to click on the link to connect to their bank account and repay their debt.

With this payment method, lenders can now offer borrowers three different user experiences for payment: PIS (payment initiation service), virtual POS (point of sale), and Click & Pay. In an age where customers want the freedom to choose their preferred payment method, giving them several options helps lenders increase repayment and conversion rates.

With Open Banking, lenders have an opportunity to adapt to the new debt-heavy environment and make debt collection less of a drain on resources and more of an opportunity to offer better services. Connecting directly to a customer’s bank account allows lenders to assess a customer’s affordability more accurately and provide a payment plan that ensures repayment. The result? A stronger relationship with borrowers, higher repayment rates, more predictable cash flow, and lower operational costs due to automation.