Cashback programs have grown immensely in popularity across Europe, with Spain emerging as a key market. According to ResearchAnMarkets, cashback spending in Spain is projected to reach US$8.73B by 2029, growing at an estimated 12.4% annually.

As brands and financial providers strive to improve customer retention and boost transaction volumes, open banking solutions have become essential for streamlining processes, optimizing user experience, and maximizing ROI.

In Spain, however, cashback programs face a distinct challenge: while some have embraced automation, others still rely on manual processes such as scanning or photographing receipts, manual validation, and reward allocation. This can slow down operations, hinder scalability, and impact user satisfaction. As a result, partner brands may experience delays in processing and a less personalized approach.

Recently, we sat down with Unnax Chief Commercial Officer Nicolas Ribeaut to discuss the Spanish cashback sector and the opportunities presented by Open Banking solutions.

Why are cashback programs such an interesting market for Open Banking?

Traditionally in Spain, many cashback programs have relied on manual processes to assign rewards. For those still operating this way, the lack of automation presents a barrier to scalability and seamless customer experiences.

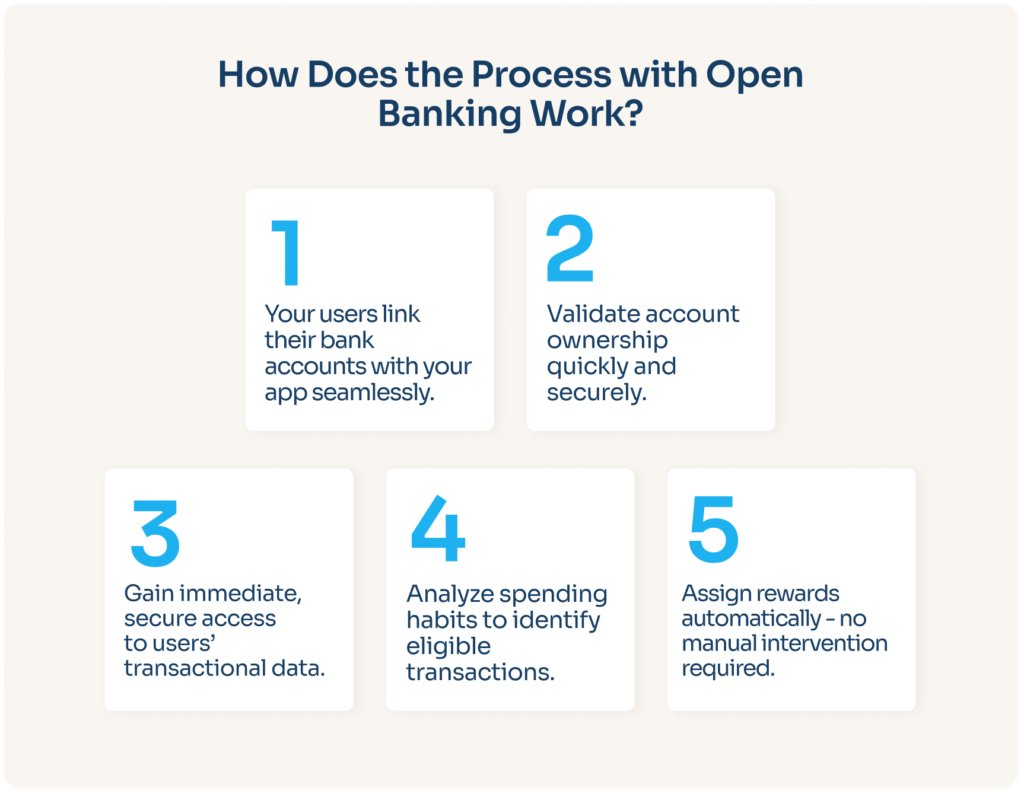

Open Banking changes the game by providing instant, secure access to transactional data from users’ bank accounts.

This automated approach not only streamlines operations but also opens up new opportunities for both B2B and B2C models. With PSD2 compelling banks to share data, Open Banking now enables cashback firms to innovate beyond outdated methods, delivering faster reward allocations, personalized offers, and advanced services like BNPL and virtual card payments.

Read more: Simplifying Bank Reconciliation With Virtual IBANs

What Challenges Do Cashback Programs Face in Spain?

Spanish cashback programs are currently grappling with significant hurdles.

The most pressing issue for those yet to fully automate their operations is the continued reliance on manual processes, which slows down the reward allocation cycle and hinders scalability. Additionally, limited 360° visibility into customer transactions complicates efforts to personalize offers and boost engagement.

User acquisition remains costly, making high sign-up conversion and retention rates critical yet challenging to achieve. Furthermore, the fragmented approach to data management makes it difficult to maintain regulatory compliance and effectively prevent fraud.

These operational inefficiencies not only reduce user satisfaction but also leave partner brands dissatisfied, underscoring the urgent need for automated, data-driven solutions like those offered through Open Banking.

You’ll like to read: The Use Cases for Account Ownership Verification Across Industries

Why is Unnax an excellent fit for cashback programs?

As a licensed and fully compliant Open Banking provider, Unnax, as part of the Powens group, works with more than 300 clients in Europe, including leaders in the cashback sector such as Joko and Macadam, helping them tackle the above challenges and more.

Automated Reward Allocation:

With Unnax, cashback companies can automate the assignment of rewards, eliminating the need for manual receipt scanning and validation.

Enhanced User Experience:

Our API-first platform ensures a smooth integration process, enabling quick account connections and secure access to transactional data.

Real-Time Data Analysis:

Unnax allows companies to analyze consumption habits in real time, enabling personalized offers and improving customer loyalty.

Optimized Consent Management:

We help clients manage the 180-day consent renewal process by sending proactive alerts via email, SMS, or other channels.

Reliable and Compliant:

We adhere to PSD2 requirements, providing secure, stable, and compliant data solutions.

Wide European Coverage:

Along with Spain, we offer extensive coverage across France, Italy, Portugal, Belgium, the Netherlands, Luxembourg, and Germany, supporting nearly 2,000 tested connectors and handling up to five million connections daily.

Experience cashback at Unnax

At Unnax, our Account Aggregation solution enables cashback companies to automatically detect eligible transactions across a wide range of partner merchants.

Meanwhile, our Account Check solution simplifies the process of verifying users’ IBAN and bank account ownership. We also perform daily synchronizations to ensure transactional data is always up to date and consent renewals are managed efficiently.

Contact Unnax today to get started and revolutionize your cashback program with automated, data-driven solutions.