‘Open Banking’ is seismically shifting the industry. Financial data is being liberated and placed into the hands of innovators. For consumers, these are welcome changes. As Accenture’s MD for global payments, Sulabh Agarwal writes, “Open Banking is providing consumers with the ability to manage their finances openly and move their data with complete transparency.”

The movement is impacting all aspects of the financial services industry, from the way innovators can securely read user’s banking data to the way they process it. While account aggregation is powering the former, payment initiation is transforming the latter.

In short, payment initiation reimagines the entire payment process, using APIs and interfaces to bypass archaic and costly infrastructure. The creative possibilities are limitless in this ever-popular space as payments can now begin and end completely outside of any banking interface. However, despite the positive upside innovation will bring, the liberation of payment processing is a serious threat to traditional banks. Their challenge is to adapt quickly or risk falling into irrelevance.

Why banks shouldn’t ignore payment initiation

Traditional banks are beset by multiple pressures. Consumers continue to flock to digital-only neobanks that provide users with modern alternatives (and superior UX) to staid institutions. Additionally, non-financial tech giants are eagerly entering the payments space, driven by a mission to keep users on their platform, reduce transaction fees, and harvest valuable data.

Payment initiation gives banks a powerful tool to combat these threats, which, when used properly, enables more effective and secure operations.

First, banks providing payment initiation will generate more transaction data. This information gives the company valuable insights for the product, marketing, and operations department to use, enabling more accurate targeting and customization of their products. Banks can subsequently transform this information into actionable insights, allowing them to better target users with insurance, credit, and other financial products.

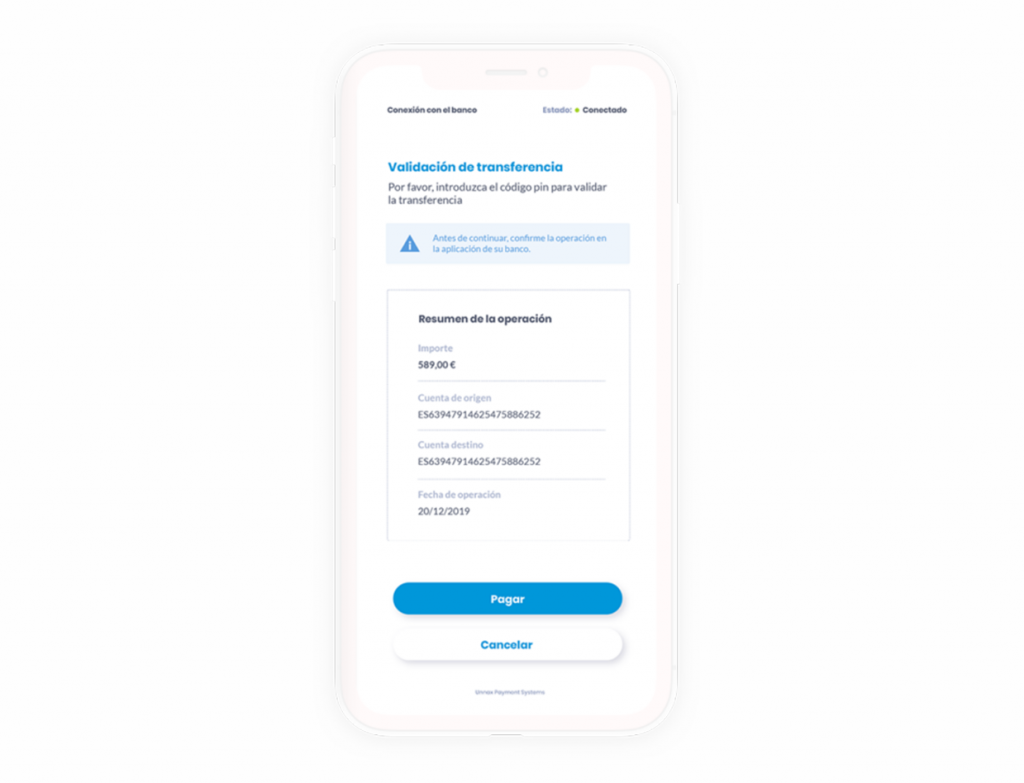

Second, payment initiation uses strong customer authentication (SCA), a requisite of the PSD2. Under this system, each user must validate transactions using two of something they know, possess, or are a part of them (like a fingerprint or retina). In turn, payments become more secure, which reduces fraud, protects users’ data, and builds trust.

Most importantly, incorporating easy and intuitive payments with Open Banking can drastically improve the user experience. Consumers are demanding more personalization from their banking interactions. By providing them with more and better ways to pay, banks can easily satisfy these demands while protecting or even growing their market share.

Examples of how banks can adopt payment initiation to get more customers

When it comes to implementing payment initiation-based products banks have a multitude of different use cases they can quickly adopt. Here are some of the more popular ones:

Improving personal financial management

Personal financial management tools (PFMs) use account aggregation to help users better understand and manage their finances. By incorporating payment initiation into a PFM, banks will enable users to automate cross-account payments quickly. In turn, users can ensure that bills get paid early without the cumbersome task of managing liquidity.

Making saving simpler

Banks can combine payment initiation and e-wallets to automate savings. An e-wallet acts as a segregated virtual account. With payment initiation, banks can let users set savings goals then automatically move money into different e-wallets, often by rounding purchases. Here, users can put cash aside without thinking about it, increasing their deposits, and building wealth. Combining automatic transfers into e-wallets with a PFM can deliver immediate benefits and add value to customers.

Reducing payment friction and costs

Payment initiation is fundamentally changing the way consumers make payments. Previously, if a person wanted to make a payment, they would need to open their banking app or log in to a dashboard. From there, they would have to enter the beneficiary account, then validate it on the platform.

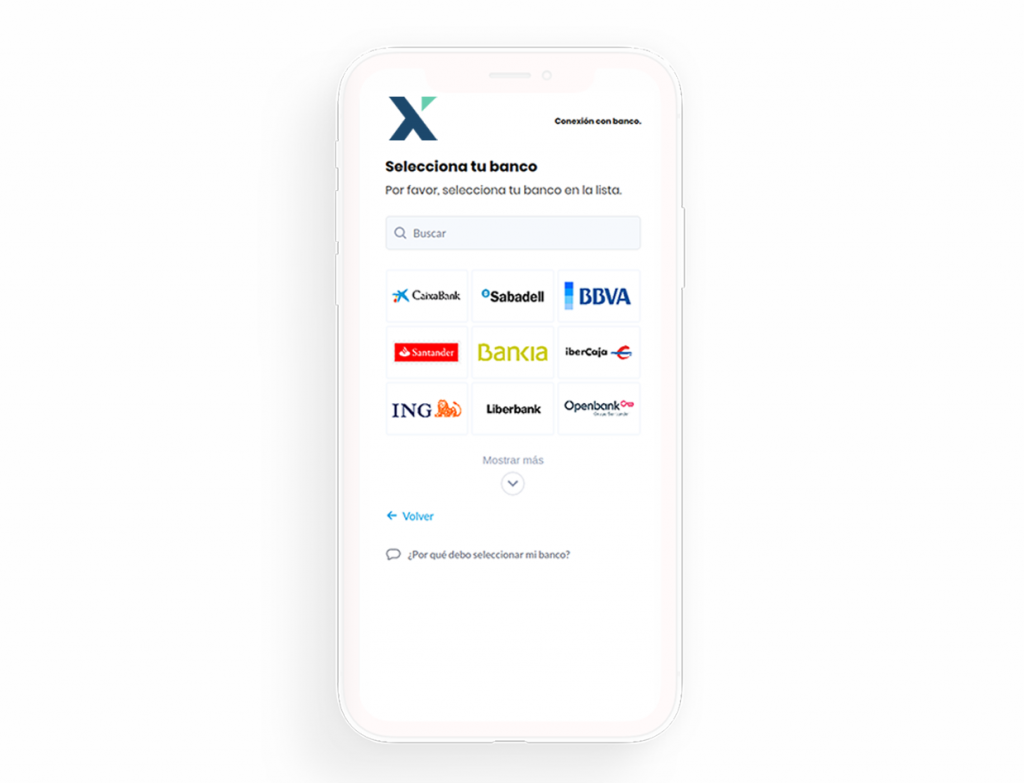

Now, consumers can pay through various mediums without having to turn to their banking app. Instead, they can initiate transfers via their phone or even directly on a merchant’s website, with SCA protecting the user from fraud. Additionally, all parties save on fees since banks connect via APIs and not expensive clearing networks.

Payment Initiation is the future of payments

The global payment industry is embarking on a revolution. Thanks to the Open Banking movement and legislations like PSD2, the way consumers, merchants, and banks make transactions will now be markedly different. Instead of fearing this change, banks should embrace it head-on.

Of course, putting together the required tech and connecting to a wide range of institutions is a formidable task. Banks could easily spend countless hours piecing together various APIs and back-ends before even starting on the more important front-end. By working with a specialized provider of Open Banking services, banks can focus on developing UX and not worrying about complicated infrastructure.

With a great interface, a personalized payment experience, and a dedication to tech, banks can secure the best outcomes for their business and avoid being left behind.