PSD2

Our role: Your PSD2 Partner

Unnax is licensed Electronic Money Institution, regulated by the Bank of Spain and authorized to provide Account Information Services (AIS) and Payment Initiation Services (PIS), as well as e-money services.

From multinational banks to real estate companies, ERPs, and lenders, our technology has helped hundreds of businesses develop better products and services leveraging customer financial data and intelligent payment architectures.

with no burden for your business

Data ownership

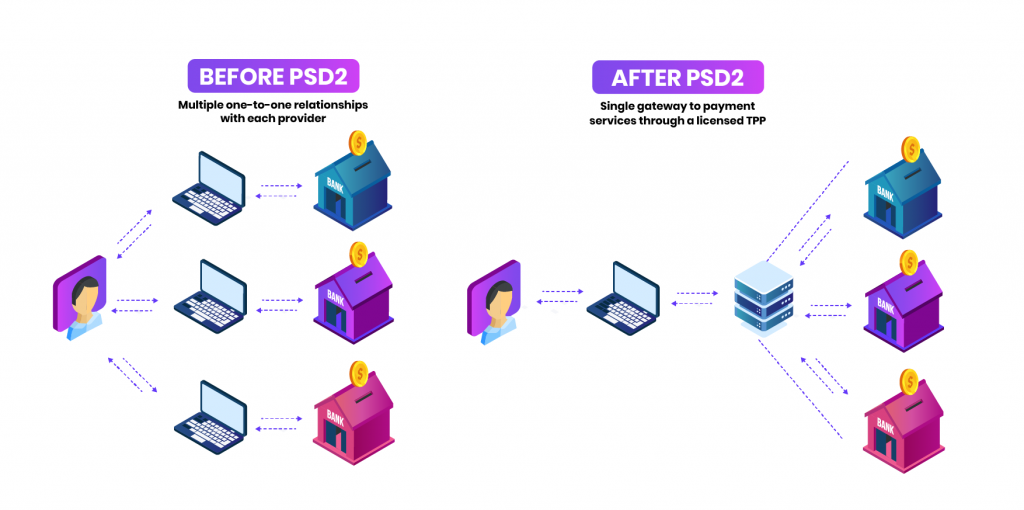

Up until recently, a customer’s personal financial data belonged to their bank, and was off limits to third-parties. PSD2 shifts the ownership of that data from the bank to the customer. With your customer’s permission, you can now access a trove of personal financial data and leverage it to create all kinds of new, customer-centric products and services.

The opportunity

PSD2 represents an opportunity for all players in the financial industry to improve their product offerings and become more data-driven and more customer centric. The latter isn’t a choice but rather a requirement; Millennials and Gen Z consumers are more demanding and want the financial services they use to be tailored to their needs. Open Banking and personal financial data are the best way to achieve this.

Transform your business

Using personal financial data and programatically-driven payments technologies, businesses can automate many of their processes while creating better customer experiences. Services can be made faster, repetitive tasks can be automated, and customers can get what they want with less touchpoints and effort needed on their part. Complying with PSD2 is an opportunity to undertake the digital transformation of the business.