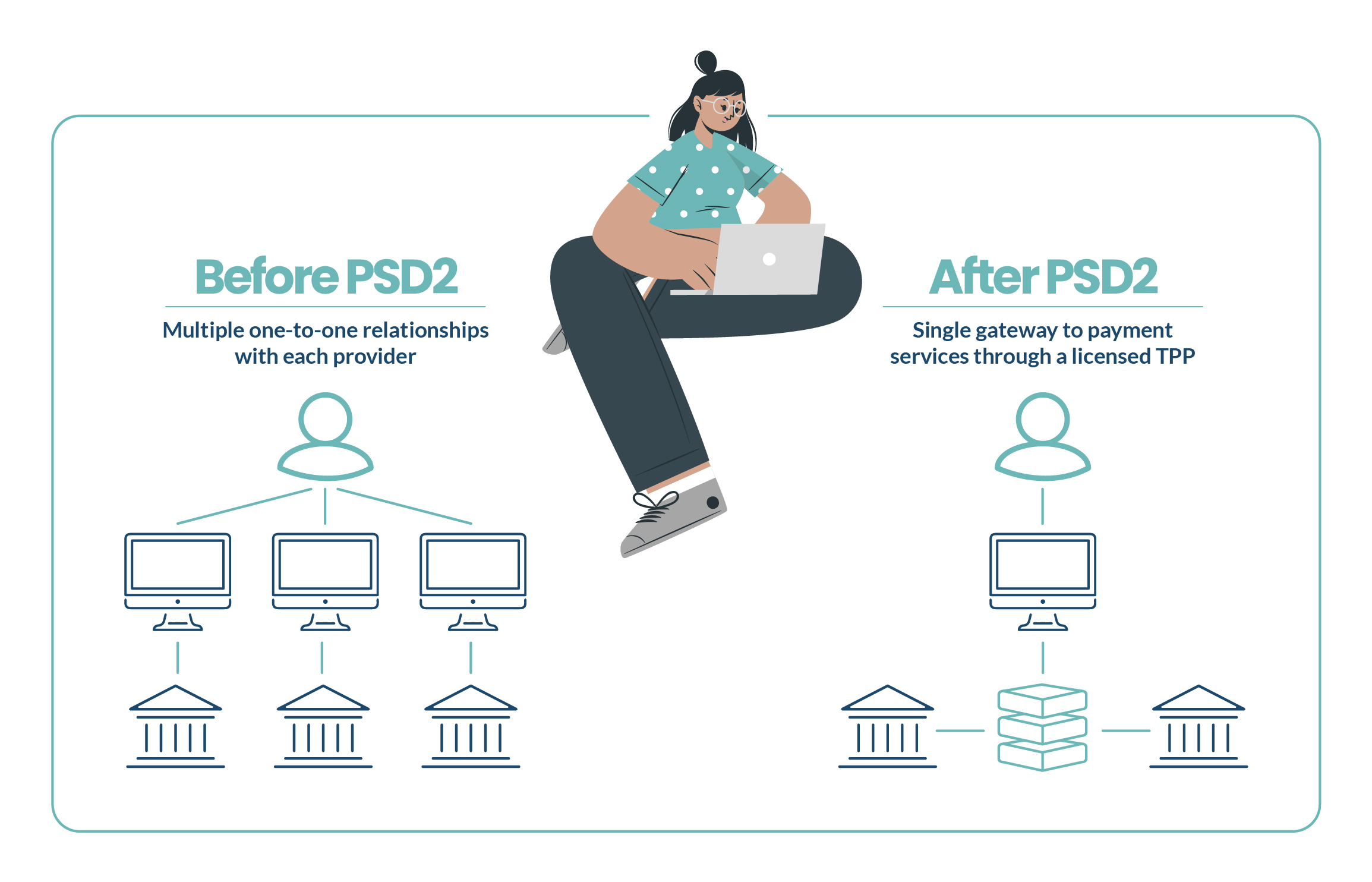

In 2018, PSD2 hit the European markets by force and the impact was felt across the Fintech world. Adoption of this regulation was slow, rocky, and difficult to manage for third-party providers (TPPs) and their financial markets colleagues.

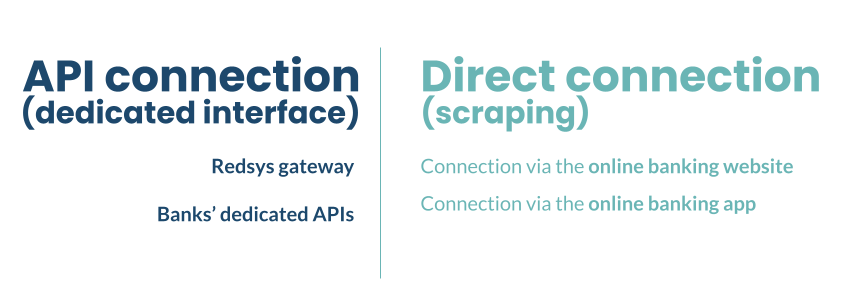

A year before, the European Commission decided PSD2 would include a ban on traditional screen scraping, where TPPs would impersonate a customer. Today, scraping is allowed when the services offered before the regulation came into effect cannot be guaranteed by only connecting to PSD2 APIs. In that case, scraping continues to provide a valid connection. This is considered a fallback mechanism.

Despite this allowance, many account information service providers (AISPs) have stopped enabling screen scraping, leaving their customers without the ability to reach a range of sources and accumulate vital data to further enrich their users’ financial profiles. This article discusses the importance of scraping in Spain and why it’s essential to the businesses we work with.

Read straight through, or jump to the section you want to read:

- What is PSD2?

- What is scraping?

- APIs vs scraping: What’s better for the Spanish market?

- The Unnax way: a hybrid solution designed for the Spanish & European markets

What is PSD2?

PSD2 is the European regulation that governs electronic payment services. It outlines guidelines for banks and Fintechs based in Europe, dictating how platforms can leverage APIs and connect to one another to help aggregate client data. With PSD2 APIs, Account Information Service Providers (AISP) are given an access token, rather than a user’s password, ensuring access can be revoked by the bank or user with ease if necessary.

What is scraping?

Screen scraping is when a user logs into their account and an AISP scans the online banking app or webpage to retrieve financial information. It’s comparable to how Google’s web crawler bots work. They visit a range of pages across the internet, scanning them one by one to create a complete image of the information they contain. Screen scraping works in a similar way, but by scanning online banking platforms. It identifies specific pieces of data, for example, charts, text, buttons, numbers, and more. It then copies the relevant data and makes it available to your business. Scraping makes it possible to capture any relevant data from within an online banking platform, as long as that data isn’t restricted by GDPR. Scraping was traditionally used for financial aggregation, but with the rise in PSD2 APIs, it was pushed to the side as a fallback option.

You may like: How we built an aggregation service that goes beyond PSD2

You may like: How we built an aggregation service that goes beyond PSD2

APIs vs scraping: What’s better for the Spanish market?

PSD2 is a directive that affects all EU Members, although it has not been applied in the same way or at the same pace in all of them.

The United Kingdom and the Nordic countries are the strongest examples of Open Banking adoption today, given the large number of API PSD2 connections, regulatory speed, and customer demand.

The situation is different across southern Europe. Open Banking is starting to be used as a vehicle for digital transformation in domestic payment ecosystems. There is, however, still a long way to go.

The financial data provided by PSD2 APIs is currently not sufficient to get a complete picture of a consumer’s financial behaviour, which is why the connection via scraping is still relevant.

Unfortunately, many account information service providers have stopped offering screen scraping, leaving many businesses without access to previously available banking data. This is what leads us to believe that having a hybrid connection that combines API PSD2 and screen scraping is the best option for conditions like Spain. The primary reasons are:

Improved financial information

While collecting data via PSD2 APIs has its benefits, such as providing a more stable connection, it still offers a reduced view of financial information and doesn’t collect as much data as screen scraping. This poses a challenge for companies who rely on data to understand their customer’s finances and make better decisions – like lending businesses. Screen scraping, while requiring more maintenance, allows these firms to retrieve a wider pool of data. So by leveraging both methods, Spanish institutions can get a more complete view of their users finances and improve their decision making.

Better risk management

It’s no secret that the last two years have been difficult for many, and the full extent of the consequences is yet to be felt. While arrears are an unfortunate thing to talk about, as financial markets professionals they’re something we must prepare for. Consumer finance companies will face a higher percentage of arrears this year, and companies must improve their data collection in preparation. Understanding customers more intricately will play a pivotal role in 2022 and beyond, in particular when making lending decisions during times of economic difficulty. For that reason, again, it’s essential to receive as much data as possible, making a hybrid option the best solution for businesses in Spain.

The Unnax way: a hybrid solution designed for the Spanish & European markets

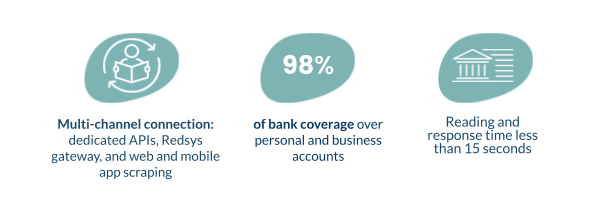

Ensuring your business has access to the wide breadth of data becomes harder every year, but it doesn’t have to be. With Unnax, we worry about the regulatory impacts and ensure you’re empowered with the data you need to make effective, informed decisions at every stage. We provide everything you need to build and operate financial services.

While many technology providers offer only one data collection method, we understand that this simply doesn’t work for the Spanish and southern European markets yet. Leveraging our hybrid solution – which uses both screen scraping and APIs connection – your business receives the data you truly need, gains complete financial profiles of your users and is able to make better decisions. Our solution is able to read, extract, and process:

- Current account owner

- Bank statements

- Account owner personal info

- Cards (credit and debit)

- Loans

- Savings

- Other financial products

Moreover, we don’t just improve your financial data collection. With our categorization technology and advanced financial indicators, we also help you to better understand it by translating data into insights. Our unique algorithm, which has been trained with over 200 million bank statements, processes data quickly and classifies it by specific categories such as how much a user spends on housing, shopping or online services. Based on this, our technology then calculates relevant metrics so you can learn more about your users financial health and behavior. For example, your customer’s debt ratio, what percentage of their salary they spend on expenses, and how many days it takes them to pay off an overdraft. Ultimately, the combination of more data and improved insights enable you to make better decisions.

All of this is achieved while staying compliant with European and Spanish regulations. Using Open Banking, we can build systems that will connect you to bank accounts, helping you streamline your clients’ finances. Whether you’re building a product in Spain, Southern Europe, or beyond, we take the stress out of financial markets.

Still need convincing? Watch this video to hear how we built account aggregation services that went beyond PSD2, or, read more about our account aggregation services here.

Ready to talk to someone on our team? Click here to start your Open Banking journey with Unnax.