As embedded banking products have become widespread, businesses in many industries must rethink their account validation processes.

The rise of financial technologies has introduced APIs as a powerful tool for optimizing account verification. API-based account verification is a practical evolution from both PSD2 and manual verification processes, emphasizing efficiency, simplicity, and innovation.

The need for businesses to cross-check proprietary bank accounts is crucial for risk mitigation. Relying on customers’ interactions or manual processes to verify account details for each transaction opens the door to fraud and financial crimes like money laundering.

To address these challenges, Unnax’s account ownership verification solution leverages APIs to create a more seamless and automated validation process. Our solution becomes the pathway for companies to access verified information about individuals or businesses.

Let’s dive into it.

What is Unnax’s account ownership verification solution?

Our account ownership verification allows you to validate your customers’ bank account ownership at all times without requiring direct interactions with the customers themselves.

The journey of account ownership validation has significantly evolved from its origins in manual verification and paper-based processes. Advances in technology and regulatory changes, like PSD2 and Open Banking, have streamlined the sharing of account holder information between organisations, making operations smoother and more efficient.

However, the initial wave of Open Banking technology, while beneficial, still involves a cumbersome 1-to-1 request processing system. This approach necessitates direct customer interactions where customers must give consent and manually retrieve data from their bank accounts, adding complexity to the process.

By leveraging APIs, Unnax addresses these challenges, offering upgrades for both PSD2 and manual verification methods, helping you bring your verification process into the modern era.

Unlike PSD2-based account verification, our solution eliminates the need for customer interaction. All you need is the customer’s IBAN and identification number (DNI/NIE/NIF/CIF). We verify the user information by relying on the services of Iberpay, the entity managing the National Electronic Clearing System in Spain (SNCE). Leveraging the extensive Spanish banking system provides you accurate results and mitigates risks in your onboarding process and guarantees compliance with financial regulations.

Our solution works exclusively with payment operations initiated from our accounts. However, Unnax can validate ownership of any account, regardless of the bank, as long as the provided account has a Spanish IBAN.

Our Account ownership verification offers you features like:

- Validate more than 75 million accounts with Spanish IBANs

- Make individual or batch requests

- Verified personal and businesses accounts

- Do it in real-time, 24/7 availability

- API connections for back office systems (ERP, CRM, TMS, etc.)

- Supporting the fulfillment of your obligations in the customer identification process (KYC).

The uses cases of account ownership verification

The top use cases for Unnax’s account ownership verification solution include:

Financial services:

- Account opening: Open customer accounts with an optimized onboarding process that provides a streamlined experience for customers.

- Loan processing: Process loans with greater efficiency through real-time account validation, speeding up the loan approval or denial process.

- Student loan disbursements: Verifying recipient accounts ensures student loan funds are disbursed correctly and promptly.

- Investment accounts: Enable data-driven decision-making by quickly verifying account data accuracy, along with validating the source account.

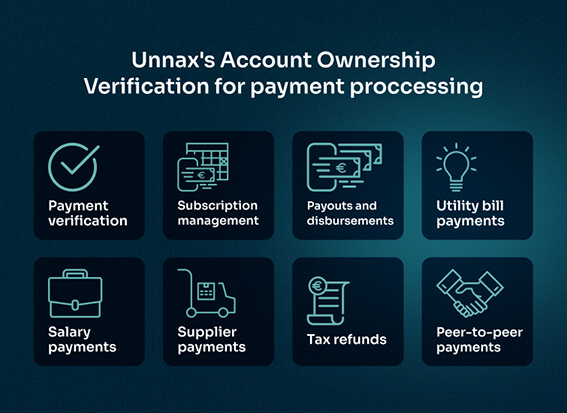

Payment processing:

- Payment verification: Account ownership verification streamlines the payment process by ensuring funds only go to authorized recipients.

- Subscription management: Unnax’s solution offers real-time availability, allowing you to validate the accounts of recurring payments as needed.

- Payouts and disbursements: The real-time availability of Unnax’s account ownership solution ensures payouts and disbursements reach their end destinations without delay.

- Utility bill payments: Like subscriptions, utility companies need a reliable account verification tool that validates customer accounts for recurring bills. Unnax provides API simplicity to keep customer account information up-to-date.

- Salary payments: HR departments benefit from account ownership verification thanks to the ability to verify employee accounts securely when distributing salary payments.

- Supplier payments: Unnax’s account ownership solution gives your customers a greater ability to make timely supplier payments to the proper accounts.

- Tax refunds: Issuing IBANs to your customers can enable more efficient tax refund processing times. Providing customers with faster access to tax refunds is essential for ensuring a stable cash flow for other upcoming payments and financial obligations.

- Peer-to-peer payments: Authenticate bank account ownership for peer-to-peer money transfers.

Fraud prevention and compliance:

- Identity verification: Enhance identity verification processes by cross-referencing bank account details through Unnax’s solution, all without having to interact directly with customers.

- Fraud prevention: Unnax gives you the power to verify your sources of information, making it easier to spot potential fraud instances or suspicious customer activity.

- Compliance checks: As a licensed electronic money institute (EMI), Unnax provides a fully compliant infrastructure to conduct due diligence checks during onboarding processes to open new electronic money accounts.

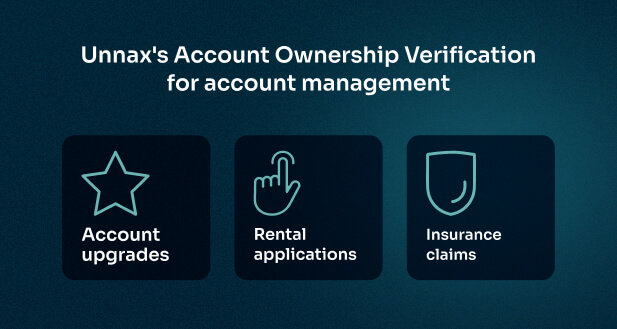

Account management:

- Account upgrades: When a customer upgrades their account (such as signing up for a more expensive subscription tier), Unnax ensures you can verify the account for the upgrade quickly.

- Rental applications: Account ownership verification can be a necessity for rental agencies when processing applications from multiple candidates and properties at once.

- Insurance claims: Insurance companies benefit from the efficiency of account ownership verification by validating customers’ accounts in real-time when claims occur.

Validate accounts instantly with Unnax’s Account Ownership Verification

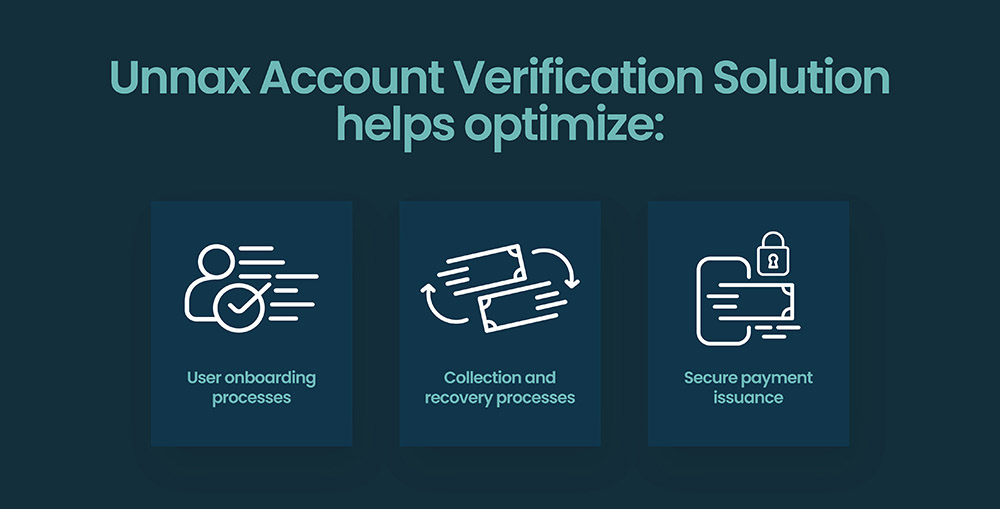

Reinvent your approach to account validation with Unnax’s fully compliant account ownership verification solution. As an upgrade to PSD2 and manual verification methods, Unnax’s API-based solution easily integrates with your back-office system to provide optimal efficiency for you and your customers. With the ability to handle individual or batch requests, Unnax caters to your specific business needs.

-> Learn more about our solution features and benefits

Our solution works exclusively with payment operations initiated from our accounts. However, Unnax can validate ownership of any account, regardless of the bank, so long as the provided account has a Spanish IBAN.

Contact Unnax today to get started.