Virtual IBANs empower businesses to efficiently manage payment routing and reconciliation while adapting to specific needs. Unlike traditional accounts, Virtual IBANs are designed solely for collecting payments and act as proxy accounts linked to a single master account. This structure enables streamlined operations by facilitating automatic payment identification and reconciliation.

Using Virtual IBANs, you can simplify invoice payments through credit transfers that assign a unique Virtual IBAN to each payee, reducing manual workloads and minimizing errors.

Unnax currently offers Virtual IBANs to clients in Spain. Let’s explore their top use cases and how they can optimize your operations.

What is a Virtual IBAN and how does it differ from traditional IBANs?

To understand Virtual IBANs, it’s helpful to first understand how traditional IBANs work.

A traditional IBAN functions like a single mailbox—everything arrives there, and sorting through incoming payments requires manual effort. As the volume of payments grows, this process becomes increasingly complex and prone to error.

Virtual IBANs simplify this process by acting as smart mailboxes. They automatically sort and organize incoming payments based on unique identifiers. Each Virtual IBAN is assigned to a specific payee, ensuring that payments are routed correctly and reconciliation is automated.

For example, a rental management company could assign each tenant a unique Virtual IBAN. When tenants send payments, the Virtual IBAN identifies who made the payment and why. This eliminates manual reconciliation, reduces errors, and improves efficiency.

Why businesses need Virtual IBANs:

Rent collection use case

Rent collection is a prime example of how Virtual IBANs can transform financial operations.

When a rental management company collects rent, they often face significant challenges:

- Identifying which tenant made a payment.

- Confirming whether payments were made on time.

- Reconciling payments from multiple accounts or payers (e.g., tenants with shared leases or those who change bank accounts).

Without Virtual IBANs, these tasks require substantial manual effort. Payment errors, such as duplicate payments or disputes, can arise, leading to further delays and complications. Additionally, the collected rent often goes into the management company’s master account, not directly to the landlord, which makes tracking payments even more crucial.

With Virtual IBANs:

- Each tenant is assigned a unique Virtual IBAN.

- Rent payments are automatically identified and tracked, regardless of the payer’s bank account or payment method.

- All payments flow into the management company’s master IBAN, simplifying reconciliation and enabling accurate fund distribution to landlords.

This approach not only streamlines operations but also improves the transparency and accuracy of rent collection.

👉 Read more: Simplifying Bank Reconciliation With Virtual IBANs

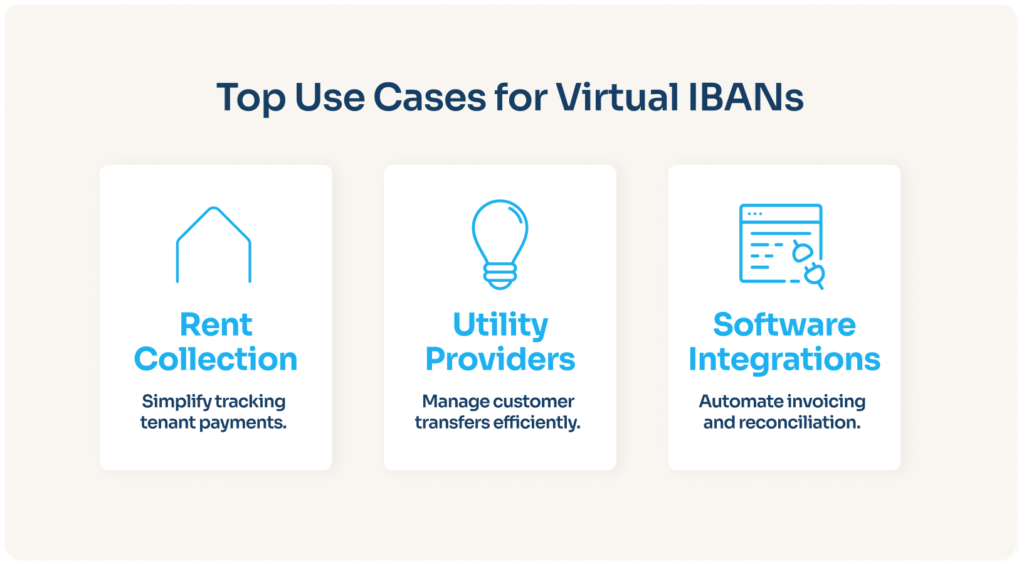

Additional use cases for Virtual IBANs

While rent collection is a prominent example, Virtual IBANs can benefit any business that receives regular wire transfers. Common use cases include:

- Collection of property fees.

- Utility payments (e.g., electricity, phone service).

- Automating invoicing and reconciliation processes for CRMs.

- Internal reconciliation for subsidies or grants.

For utility providers, Virtual IBANs can bridge the gap for customers who prefer wire transfers over Direct Debit. By simplifying payment tracking and reconciliation, Virtual IBANs enable providers to cater to a broader range of customer preferences.

The operational and financial benefits of Virtual IBANs

Virtual IBANs offer several key benefits, such as:

- Automated reconciliation

- Reduced human error

- Decreased manual workloads

- Simple and cost-efficient account creation

Thinking back to the rent collection example, assigning a new Virtual IBAN to a new tenant is quick and simple. Once the account is created, tenants are instructed to use their assigned Virtual IBAN for payments. Funds pass through the Virtual IBAN to the company’s master IBAN, where fees can be deducted before distributing funds to the landlord.

The low startup costs and flexibility of Virtual IBANs make them a cost-effective solution for businesses of all sizes.

👉 Read more: Unibo Leveraged Unnax IBAN Accounts to Achieve 15X Growth in Just One Year

Can Virtual IBANs integrate seamlessly with existing systems?

Integrating Virtual IBANs into your systems is straightforward, especially with Unnax. Our API allows developers to quickly implement Virtual IBANs into their front-end solution or admin console without requiring expertise in banking infrastructure.

To use Virtual IBANs with Unnax, you simply need an existing Unnax IBAN account as the master account. Creating a Virtual IBAN takes just one API call and less than a second to complete. Whether you need one or 1,000 Virtual IBANs, the process remains the same.

Do Virtual IBANs offer cost advantages over traditional accounts?

Virtual IBANs are not designed to replace traditional accounts. Instead, they serve as a tool for collecting payments efficiently. Virtual IBANs act as proxy accounts linked to a single master IBAN account. This structure allows businesses to streamline operations without the need to open separate physical accounts for every payee.

Funds sent via Virtual IBANs are routed directly into the master IBAN, where they can be identified and reconciled. This simplifies financial operations without requiring additional traditional accounts.

Issue Spanish Virtual IBANs with Unnax

Unnax offers our clients the freedom to issue unlimited Spanish IBANs.

With a Unnax Spanish IBAN setup, you can easily create Virtual IBANs that integrate directly with our broader solution.

As a regulated Electronic Money Institution (EMI), Unnax ensures compliance with regional and international standards.

Speak with our team today to discover how Virtual IBANs can transform your business.