First introduced by the European Committee for Banking Standards (ECBS) in 1997, IBANs have helped to standardize bank account identification processes across Europe.

Today, non-financial companies now have the capacity to issue IBANs for themselves and their clients, a capability that has proven pivotal for their development. With the freedom to issue IBANs, non-banking companies can enable effective Embedded Banking and financial services.

The blog post serves as a deep dive into the specifics of IBANs and how they can impact your business.

What is an IBAN & a local IBAN?

An international bank account number, or IBAN for short, is the standard account number for identifying bank accounts across different countries.

IBANs are used primarily in Europe, including the 36 countries within the SEPA (Single Euro Payment Area) region.

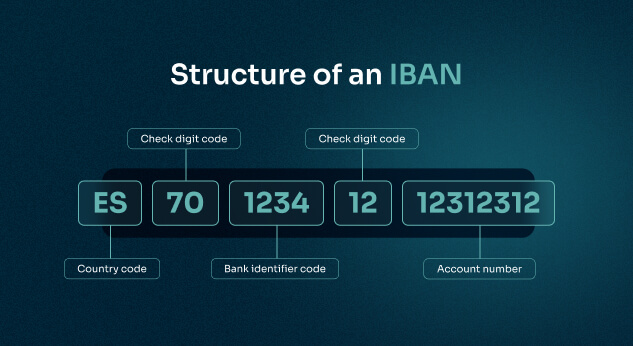

Local IBANs are specific to one particular country. The basic structure of a local IBAN consists of a country code (i.e. in Spain, a local IBAN starts with “ES,” while in France, it’s “FR”), a bank identifier, and an account number.

Although local IBANs offer the benefit of connecting to localized payment systems (such as SEPA payments), this localization can sometimes result in discrimination, as certain companies may only accept payments from IBANs originating in specific regions.

A 2022 Paypers report reveals that France accounts for 41% of all consumer reports of IBAN discrimination, followed by Spain (19%) and Germany (12%). The source of this discrimination often comes down to contradictory regulations and a lack of cross-border standardization.

As your business becomes more global, local IBANs are crucial for meeting the expectations and financial needs of customers around the world. Understanding the complexities of IBAN discrimination is a necessity for adequately serving these customers.

With this in mind, let’s take a closer look at IBAN discrimination.

What is IBAN discrimination?

IBAN discrimination occurs when a payment is refused because the bank account is held in another European country. Not all countries support cross-border financial activities to the same degree, leading to IBAN discrimination, payment disruption, and transactional friction.

Beyond payment refusals, IBAN discrimination can also manifest as:

Higher fees: Some banks or payment processors may impose higher fees or surcharges for transactions involving IBANs from certain countries.

Delays or rejections: Payments or transactions involving IBANs from certain countries may face delays or outright rejection, leading to inconvenience and potential financial losses.

Limited access: Consumers and businesses may face restricted access to financial services or markets based on the country associated with their IBAN.

Not many providers can cover multi-country local IBANs, as it requires a multitude of operational hurdles and complexities. The added complexity of IBAN discrimination can compound the issue, making it difficult to successfully expand into new regions.

As such, it is critical for businesses working to expand internationally to work with vendors that have the capability to issue local IBANs in different countries.

Implementing Local IBANs with Unnax

IBANs are unique identifiers assigned to individual accounts within the SEPA network which enable financial service providers like Unnax to offer secure payment services across Europe. As payments are an integral part of daily life, the ability for non-financial companies to issue IBANs — either for themselves or for their clients — has become crucial for their growth and development.

The foundational pillar of embedded finance is payments accounts, which must be localized to enhance end-customer experiences. Whether you have a financial management app, HR app, or legal app, your French and Spanish customers expect a seamless account opening process tailored to their preferences.

Yet, only a few providers offer multi-country local IBANs due to operational complexities. Businesses looking to expand internationally must partner with vendors capable of issuing local IBANs across various countries.

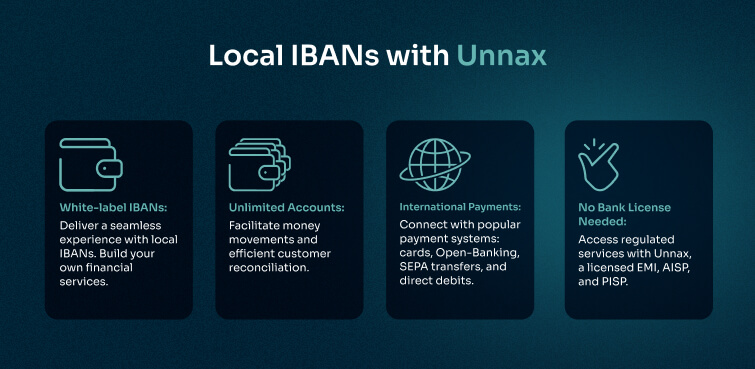

Unnax’s Embedded Banking platform empowers companies to seamlessly provide accounts with Spanish and -soon- French IBANs to their customers. Features of Unnax’s IBAN solution include:

-

- White-label IBANs: deliver a seamless customer experience with white-labeled local IBANs. Our local IBANs also have the full capacity to enable you to build your own financial services.

-

- Unlimited accounts: Facilitate money movements and efficient customer reconciliation within your environment.

-

- International payments: Easily connect with the most popular and secure payment systems, including card payments, Open-Banking payments, ordinary transfers, and direct debits.

-

- No bank license required: Access a comprehensive range of regulated services without having to be regulated yourself. Unnax is a licensed Electronic Money Institution (EMI), Account Information Service Provider (AISP), and Payment Initiation Service Provider (PISP).

Get in touch with Unnax today to get started.