As the consumer world evolves towards more digital solutions, so does the banking world. Financial institutions must adapt to remain relevant and top-of-mind for their customers. Banks, fintechs, and other financial institutions are doing this by offering Personal Financial Management (PFM) applications.

Creating a PFM app helps you give your audience a consolidated view of their finances. It takes the bank-user relationship from a purely transactional one and turns it into a meaningful experience your customers will grow to rely on.

This article will explain what a PFM is and how an EMI can provide the technology needed to create one.

What is a PFM?

A PFM, or Personal Financial Management app, is a digital tool that helps people manage their money. It allows users to see all of their accounts in one place, track spending, set budgets, and achieve their financial goals.

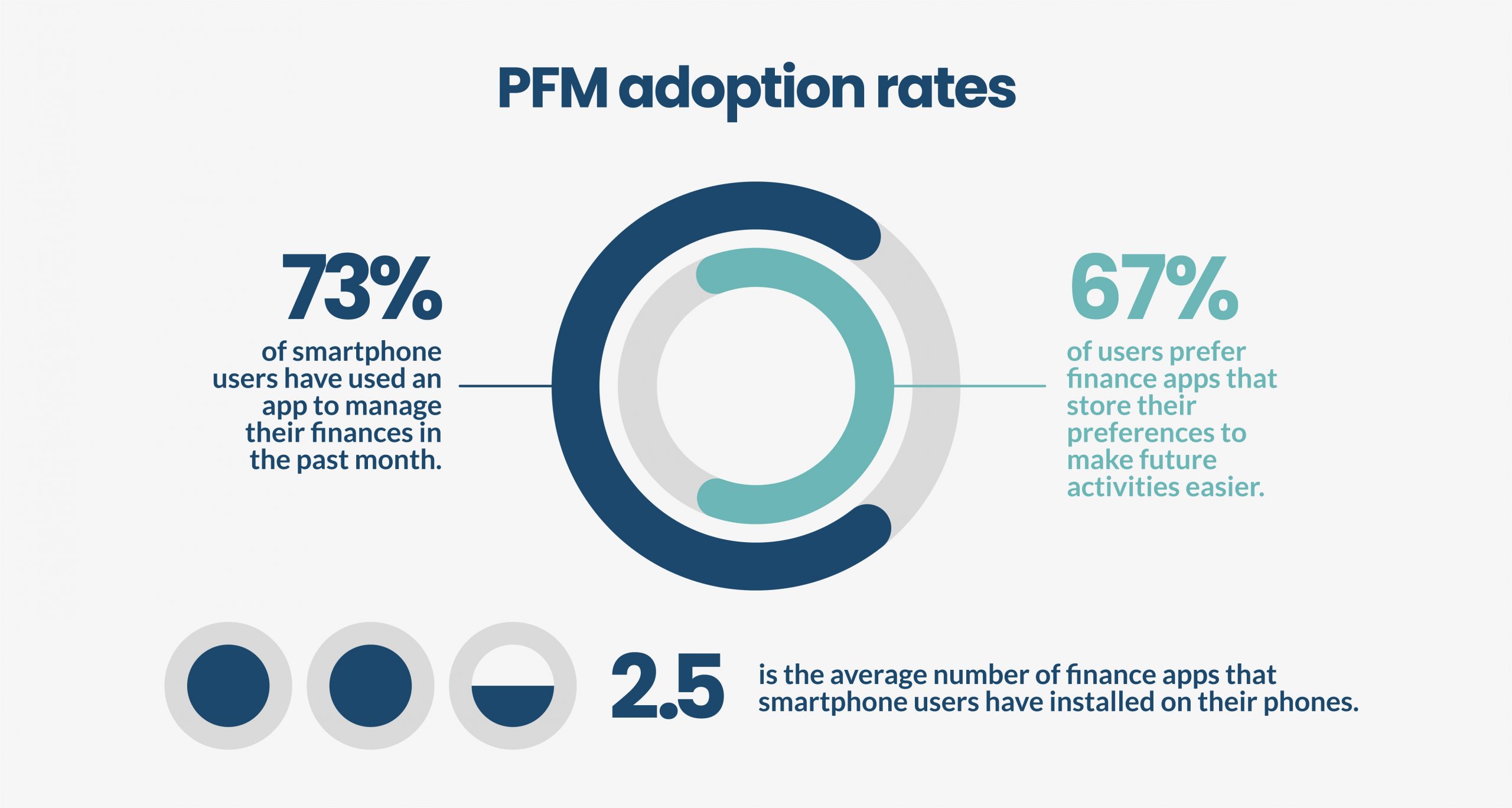

These applications have become popular in recent years because they help people take control of their finances. But what are the real advantages for companies looking to create their own PFM, and what makes a PFM successful?

The benefits of building your own PFM

Building your own PFM gives you unique access to your target audience’s data. That data can then be used to gain insights into the habits and preferences of your users. In turn, those insights can then help you offer ultra-personalized services at the perfect moment, as well as deliver unique experiences to both current customers and new audiences, ultimately enabling you to attract and retain customers.

By offering a PFM tool to users that don’t currently use your services, you open yourself up to new markets, giving you a unique way to get the attention of your competitor’s current customers. Being the business that helps your competitor’s customers manage their money is a great way to differentiate yourself from your potential users’ current financial institution.

Offering a PFM gives you unique access and insights into your competitor’s current customers.

What makes a PFM successful?

A successful PFM must offer several key features to be effective.

Consolidate your user’s accounts

First, a PFM must consolidate all of your users’ financial accounts. Users should have a bird’s-eye view of their entire financial well-being – they need to be able to see all of their financial data in one place, including that from other banks, fintechs, and institutions. PFMs should also include budgeting tools and expense tracking.

Easy to use

Second, it must be easy to use and navigate. Customers should be able to find what they’re looking for quickly and without any hassle. Some companies choose to display information and actionable insights in an attractive and engaging way. You can do this by using graphs, charts, and other visuals to help users understand their finances at a glance.

Safe and secure

Finally, a successful PFM must be reliable. Customers need to know that their data is safe and secure and that the app will work as advertised.

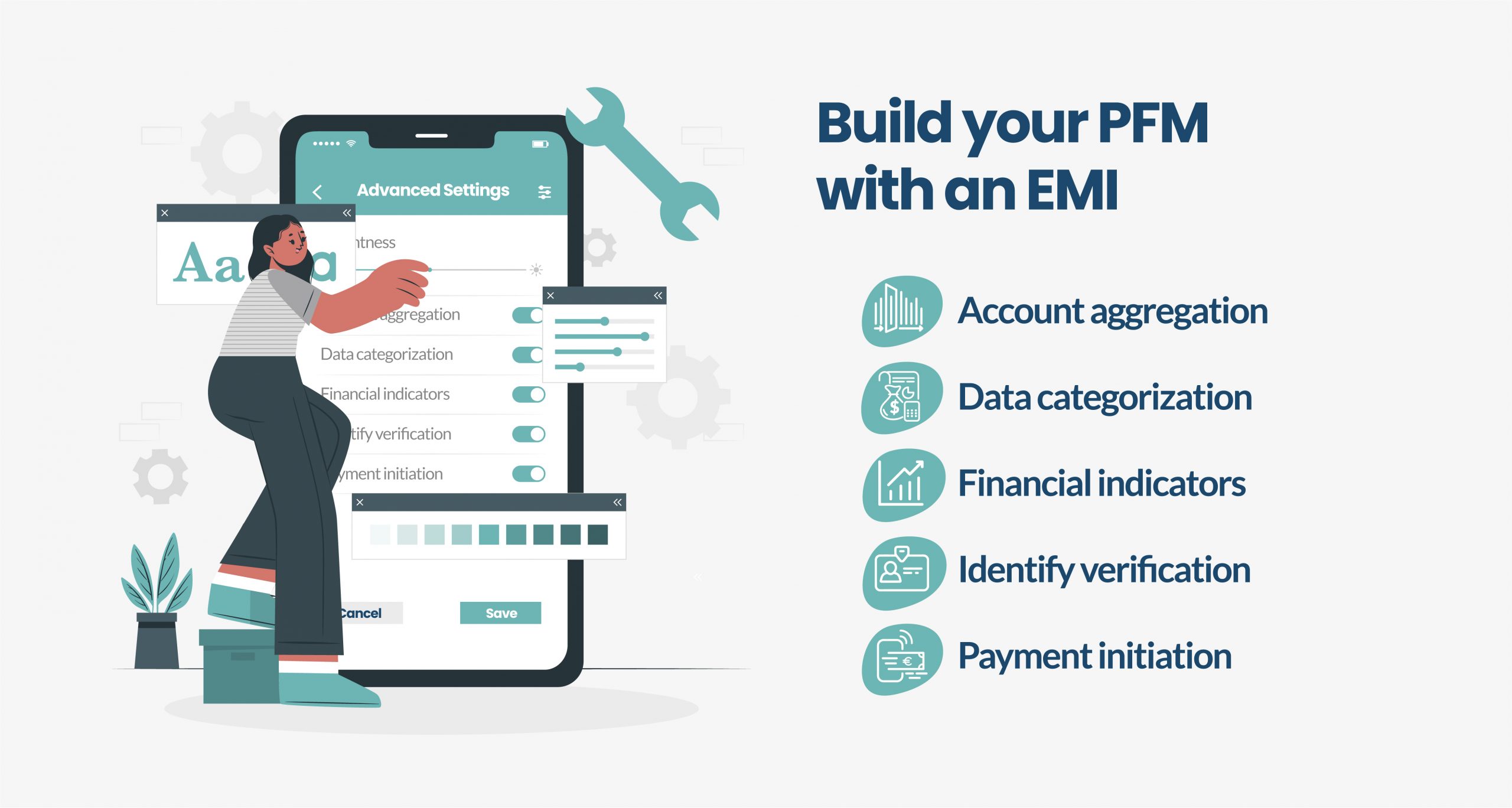

Creating your own PFM is easy when you use an EMI. Unnax provides all the technology you need to build and deploy your own Personal Financial Management app, helping you retain current users, and attract new customers.

Partnering with an EMI for your PFM

However, building a PFM from scratch can be a daunting and costly process for financial institutions. That’s where EMIs, like Unnax, come in.

Unnax is a banking-as-a-service platform that makes it easy to build a PFM. We provide the regulatory-compliant infrastructure and support you need, so you can focus on building an excellent product for your customers.

Account aggregation

Unnax offers APIs that make it easy to connect to multiple bank accounts and retrieve account information. We support a wide variety of banks and financial institutions, so you can be sure that your customers will be able to connect all their accounts.

Data categorization

Another essential part of any PFM is data categorization, or the process of assigning transactions to specific categories, like “groceries” or “restaurants.” This information is then used to generate reports and analytics that give users a clear picture of their spending habits.

Data categorization is a complex task, but Unnax offers an API that makes it easy. We use machine learning to categorize transactions automatically and obtain a complete vision of the user’s incomes and outcomes in real time.

Financial indicators

Our solution provides access to financial indicators. Financial indicators help you gain a deeper understanding of your user’s financial behaviors, enabling you to detect risk factors at an unprecedented speed. You can also turn all that raw data into valuable metrics, helping your business make better decisions.

You can minify all Personally Identifiable Information, which is essential for GDPR compliance. You can see your user’s sources of income and get a better understanding of their payment capacity, and you are able to highlight their overdraft proclivity, gambling inclinations, and any other relevant factors.

Identity verification

We also offer an API for identity verification. This is a critical feature for any financial product, as it helps prevent fraud and ensures that only legitimate users who pass AML and KYC checks can access the app.

Transfers

Users can request transfers from and to any aggregated accounts currently consolidated within your PFM. This means they never have to leave your app.

Bottom Line

As finance and technology evolve side-by-side, companies are looking for new ways to stay ahead of the curve. Building a PFM is a great way to do that, and partnering with an EMI like Unnax makes it easy.

We offer the technology and support you need to build a successful PFM. And our API makes it easy to connect to multiple bank accounts and retrieve information.

Contact us today to learn more about how we can help you build a PFM your customers will love.